Recap of January 4th

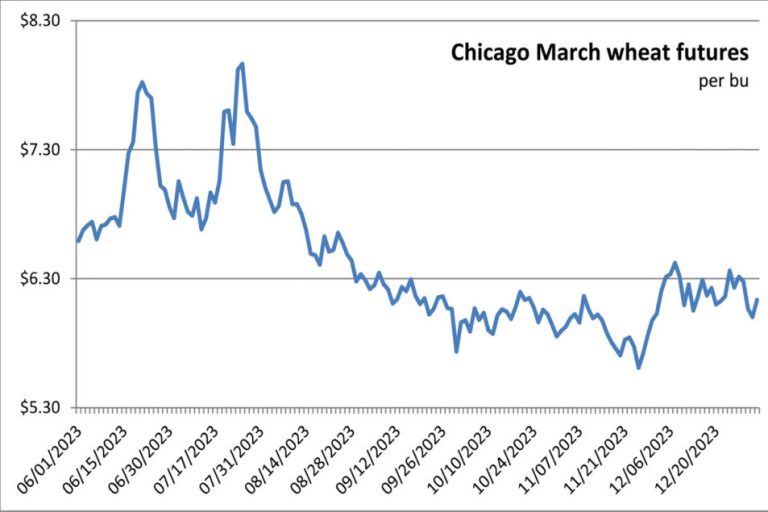

- Wheat futures closed higher on Thursday with Chicago Soft Red Winter Wheat futures leading the way, rebounding from one-month lows on talk that China may seek more US Soft Red Winter Wheat. Soybean futures fell amid rain, providing relief to dry Brazilian fields and concerns about US export sales. Corn futures were slightly higher in market consolidation moves in the near months, and were mixed later. Corn March Futures rose 1¼ cents to close at $4.66 per unit; Subsequent months were unchanged or narrowly mixed. chicago March wheat It jumped 13¼ cents to close at $6.13 per unit. Kansas City March wheat 4¼¢ was added to close at $6.25 per unit. Minneapolis He walks wheat advanced 2¾¢ to close at $7.11 per unit. March soybeans It fell 9½ cents to close at $12.67 per unit. March soybean meal The price of crude fell by $4.20 to close at $376.20 per ton. Soybean oil for March It fell by 0.44 cents to close at 48.16 cents per pound.

- US stock markets were mixed on Thursday. It was the fifth straight day of losses for the Nasdaq, which posted its worst two-day start since 2005. The index came under pressure from Apple and Amazon stocks, among other companies. The Dow Jones Industrial Average posted another gain while the S&P 500 fell. Conagra Foods and Walgreens Boots Alliance were among the stocks that fell. the Dow Jones Industrial Average The stock rose 10.15 points, or 0.03%, to close at 37,440.34 points. the Standard & Poor's 500 The stock fell 16.13 points, or 0.34%, to close at 4,688.68 points. the Nasdaq Composite The stock fell 81.91 points, or 0.56%, to close at 14,510.30 points.

- US crude oil Prices fell on Thursday, with February West Texas Intermediate crude falling 51 cents to close at $72.19 a barrel.

- the US dollar index It broke a four-day high with a decline on Thursday.

- American gold Futures It closed higher on Thursday. The February contract added $7.20 to close at $2,050 an ounce.

Recap of January 3

- The US dollar's rise to a two-month high made US commodity export expectations more expensive, and most wheat futures fell as a result. Improved winter wheat status ratings in Kansas, which features hard red winter wheat production, have added to the pressure. Buoyed by short covering but limited by Brazilian rains and weather forecasts, soybean futures rose on Wednesday from multi-month lows. Corn futures followed Tuesday's sell-off with short covering and technical buying, closing the day virtually unchanged. Corn March Futures rose 1½ cents to close at $4.65 per unit; Subsequent months were narrowly mixed but mostly higher. chicago March wheat It fell 6½ cents to close at $6.00 per unit. Kansas City March wheat fell 7½ cents to close at $6.21 per unit; Contracts deferred to 2025 were slightly higher. Minneapolis He walks wheat It lost 6½™ to close at $7.08 per unit. March soybeans 3½¢ was added to close at $12.77 per unit. March soybean meal It rose 90 cents to close at $380.40 a ton. Soybean oil for March It rose 0.31 cents to close at 48.60 cents per pound.

- US stock markets fell on Wednesday. Some investors attributed the declines to a natural follow-on to the rises in stocks and bonds in late 2023. The weakness at the beginning of the year came even as new economic data pointed to a gradual slowdown in the US economy. The Institute for Supply Management said manufacturing activity fell slightly in December compared with the previous month, although less than economists expected. The US Department of Labor said there were 8.8 million job openings in November, down from the recent peak of 12 million in March 2022. Dow Jones Industrial Average The stock fell 284.85 points, or 0.76%, to close at 37,430.19 points. the Standard & Poor's 500 The stock fell 38.02 points, or 0.8%, to close at 4,704.81 points. the Nasdaq Composite The index fell 173.73 points, or 1.18%, to close at 14,592.21 points.

- the US crude oil The downward price trend stopped on Wednesday. February West Texas Intermediate crude futures rose $2.32 to close at $72.70 per barrel.

- the US dollar index Its rise continued on Wednesday for the fourth consecutive day of trading.

- American gold Futures Oil prices on Wednesday returned to their bearish stance recorded at the end of 2023. The February contract fell $30.60 to close at $2,042.80 an ounce.

Recap of January 2nd

- A stronger dollar helped push most agricultural commodity futures lower Tuesday on the opening trading day of 2024. Traders monitoring Black Sea supply risks sold futures contracts, sending European wheat prices lower. Soybean futures fell as rain in northern Brazil helped improve moisture and crop conditions, with more rain expected this week. This offsets StoneX lowering its estimate for Brazil's crop to 152.8 million tons from 161.9 million. Brazil's soaking sent US corn futures to record lows. Corn March Futures fell 7½ cents to close at $4.63 per unit. chicago March wheat It fell 21¼ cents to close at $6.06 per unit. Kansas City March wheat It shed 13 cents to close at $6.29 per unit. Minneapolis He walks wheat It lost 8½™ to close at $7.15 per unit. March soybeans It fell 19½ cents to close at $12.74 per unit. March soybean meal The price of crude fell by $7.10 to close at $378.90 per ton. Soybean oil for March It fell 0.05 cents to close at 47.79 cents per pound, although all subsequent months were higher.

- US stock markets were mixed on Tuesday, with the Dow Jones Industrial Average hitting another record closing high, while big tech stocks like Apple and Nvidia pushed the Nasdaq lower. The S&P 500 closed lower as declines in technology and communications stocks offset gains in energy stocks, health care, utilities and consumer staples companies. the Dow Jones Industrial Average It rose 25.5 points, or 0.07%, to close at 37,715.04 points. the Standard & Poor's 500 The stock fell 27 points, or 0.57%, to close at 4,742.83 points. the Nasdaq Composite The stock fell 245.41 points, or 1.63%, to close at 14,765.94 points.

- US crude oil Prices continued to decline at the dawn of 2024. February WTI fell $1.27 to close at $70.38 per barrel.

- the US dollar index Its rise continued on Tuesday with the resumption of trading.

- American gold Futures It reversed course at the end of the year and closed higher on Tuesday. The February contract added $1.60 to close at $2,073.40 an ounce.

Recap of December 29th

- Wheat futures recorded limited and mixed changes on Friday ahead of the New Year holiday but rose during the week as concerns about export demand were offset by growing conflict in the Russia-Ukraine war. Corn and soybean futures fell for the day and for the week due to improved weather forecasts for Brazil's corn and soybean crops. Over the course of the year, corn futures were down about 30% from the previous year, Chicago wheat futures were down about 20%, and soybean futures were down 15%. Corn March Futures fell 3 cents to close at $4.71 per unit. chicago March wheat fell 3½ cents to close at $6.28 per unit; Subsequent months were narrowly mixed. Kansas City March wheat It fell 1¾¢ to close at $6.42 per unit; Subsequent months were narrowly mixed. Minneapolis He walks wheat It lost 2 cents to close at $7.23 a half per unit. March soybeans It fell 14 cents to close at $12.98 per unit. March soybean meal It fell $4.70 to close at $386 per ton. Soybean oil for March It rose 0.20 cents to close at 48.18 cents per pound.

- US stock indexes closed with small to modest losses on Friday, mainly due to profit taking, but posted double-digit growth for the year and were near record levels as traders expected monetary policy easing and interest rates to fall in 2024. Dow Jones Industrial Average The stock lost 20.56 points, or 0.05%, to close at 37,689.54 points. the Standard & Poor's 500 The stock fell 13.52 points, or 0.28%, to close at 4,769.83 points. the Nasdaq Composite The stock fell 83.78 points, or 0.56%, to close at 15,011.35 points.

- US crude oil Prices fell on Friday. February sweet crude futures fell 0.12 cents to $71.65 a barrel.

- the US dollar index Apply again on Friday.

- American gold Futures It ended the last trading session of 2023 on a decline. The February contract lost $11.70 to close at $2,071.80 an ounce.

Recap of December 28th

- Wheat futures rose on Thursday after a second accident this week in the Black Sea raised concerns about safe exports of the grain from Ukraine. The accident related to the collision of a ship flying the Panama flag, heading to load grain at a port on the Danube River, with a Russian mine. Corn and soybean futures were lower due to beneficial rains in Brazil. Corn March Futures fell 2¼ cents to close at $4.74 per unit. chicago March wheat 8½¢ was added to close at $6.31 per unit. Kansas City March wheat It rose 8¾¢ to close at $6.43 per unit. Minneapolis He walks wheat It rose 3¾¢ to close at $7.25 per unit. March soybeans It fell 8½ cents to close at $13.12 per unit. March soybean meal It fell $3.10 to close at $390.70 per ton. Soybean oil for March It lost 0.68 cents to close at 47.98 cents per pound.

- US stock indices closed mixed on Thursday. The S&P 500 continued to approach its all-time high, and all three indexes were on track to conclude a ninth straight week of gains. The unemployment claims report released earlier today provided further evidence that the economy was effectively slowing, indicating 218,000 layoffs occurred last week, slightly higher than economists expected but not enough to calm the optimism bubble that fueled the recent rally in stocks. the Dow Jones Industrial Average It rose 53.58 points, or 0.14%, to close at 37,710.10 points. the Standard & Poor's 500 The stock rose 1.77 points, or 0.04%, to close at 4,783.35 points. the Nasdaq Composite The index fell 4.04 points, or 0.03%, to close at 15,095.14 points.

- US crude oil Prices were lower on Thursday. February sweet crude futures fell 2.34 cents to $71.77 a barrel.

- the US dollar index Advanced Thursday.

- American gold Futures Dropped Thursday. The February contract lost $9.60 to close at $2,083.50 an ounce.

Component markets

| new ideas. Served daily. Sign up for Food Business News' free newsletters to stay up to date on the latest food and drink news. |

Participate |