Recap of December 28th

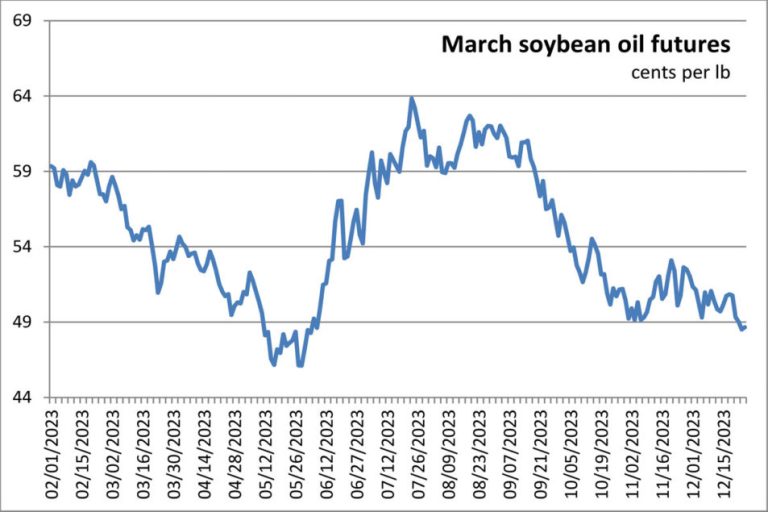

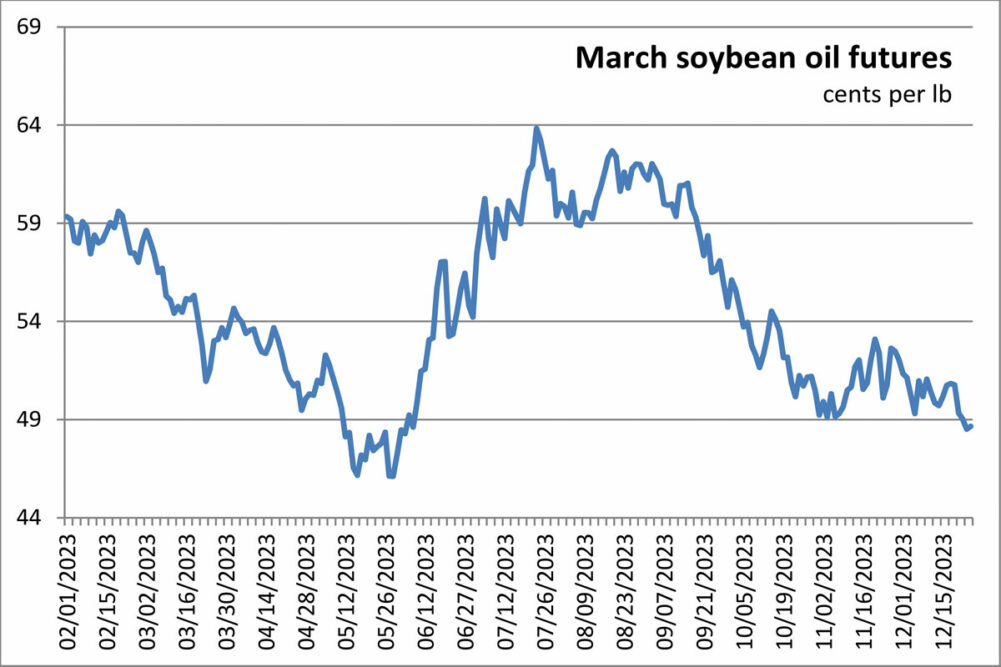

- Wheat futures rose on Thursday after a second accident this week in the Black Sea raised concerns about safe exports of the grain from Ukraine. The accident related to the collision of a ship flying the Panama flag, heading to load grain at a port on the Danube River, with a Russian mine. Corn and soybean futures were lower due to beneficial rains in Brazil. Corn March Futures fell 2¼ cents to close at $4.74 per unit. chicago March wheat 8½¢ was added to close at $6.31 per unit. Kansas City March wheat It rose 8¾¢ to close at $6.43 per unit. Minneapolis He walks wheat It rose 3¾¢ to close at $7.25 per unit. March soybeans It fell 8½ cents to close at $13.12 per unit. March soybean meal It fell $3.10 to close at $390.70 per ton. Soybean oil for March It lost 0.68 cents to close at 47.98 cents per pound.

- US stock indices closed mixed on Thursday. The S&P 500 continued to approach its all-time high, and all three indexes were on track to conclude a ninth straight week of gains. The unemployment claims report released earlier today provided further evidence that the economy was effectively slowing, indicating 218,000 layoffs occurred last week, slightly higher than economists expected but not enough to calm the optimism bubble that fueled the recent rally in stocks. the Dow Jones Industrial Average It rose 53.58 points, or 0.14%, to close at 37,710.10 points. the Standard & Poor's 500 The stock rose 1.77 points, or 0.04%, to close at 4,783.35 points. the Nasdaq Composite The index fell 4.04 points, or 0.03%, to close at 15,095.14 points.

- US crude oil Prices were lower on Thursday. February sweet crude futures fell 2.34 cents to $71.77 a barrel.

- the US dollar index Advanced Thursday.

- American gold Futures Dropped Thursday. The February contract lost $9.60 to close at $2,083.50 an ounce.

Recap for December 27th

- Wheat futures fell Wednesday on continued shortfall in U.S. wheat export demand, mostly offsetting a rise in futures prices on Tuesday due to heightened tension in the Russia-Ukraine war. There was also a lack of new demand for US corn and soybean exports, with markets moved mostly by weather events and forecasts in Brazil. Corn March Futures lost 3 ¾¢ to close at $4.76 per unit. chicago March wheat It fell 13¼ cents to close at $6.23 per unit. Kansas City March wheat It fell 7¾¢ to close at $6.35 per unit. Minneapolis He walks wheat It returned 7½¢ to close at $7.21 apiece. March soybeans It rose 1½ cents to close at $13.20 per unit, but subsequent months were narrowly mixed. March soybean meal The price of gold fell by $2.10 to close at $393.80 per ton. Soybean oil for March It rose 0.15 cents to close at 48.66 cents per pound, but subsequent months were mixed.

- US stock indices on Wednesday continued their closing streak higher this week. The S&P 500 is close to its all-time high. the Dow Jones Industrial Average The stock increased 111.19 points, or 0.30%, to close at 37,656.52 points. the Standard & Poor's 500 The stock rose 6.83 points, or 0.14%, to close at 4,781.58 points. the Nasdaq Composite The stock gained 24.60 points, or 0.16%, to close at 15,099.18 points.

- US crude oil Prices fell as ships continued to pass through the Suez Canal despite the recent terrorist attacks. February sweet crude futures fell 1.46 cents to close at $74.11 a barrel.

- the US dollar index It dropped again on Wednesday.

- American gold Futures It was sharply higher on Wednesday. The February contract jumped $23.30 to close at $2,093.10 an ounce.

Recap of December 22nd

- Wheat futures jumped on Tuesday amid fresh concerns about safe shipping in the Black Sea after Ukrainian missiles hit a Russian warship in Crimea, with short covering also present. Rising crude oil prices (fueled by turmoil in the Middle East and thoughts of US economic strength) have given a boost to corn and soybean futures. Market movements are often more extreme amid thin trading during the holidays. Corn March Futures added 7¼ cents to close at $4.80 per unit. chicago March wheat It jumped 20 cents to close at $6.36 per unit. Kansas City March wheat Added 19¾¢ to close at $6.42 per unit. Minneapolis He walks wheat It rose 15 cents to close at $7.29 per unit. Soybeans for January It rose 13½ cents to close at $13.13 per unit. January soybean meal It rose $3.60 to close at $403.20 per ton. Soybean oil for January It lost 0.62 cents to close at 47.91 cents per pound.

- US stock indexes started the final week of the year with higher closes on Tuesday mainly on thoughts the Federal Reserve will start cutting interest rates in March 2024. Trading volume was light between the weekends. The “Santa Claus” effect at the end of the year seemed to outweigh fears that the market was overbought. the Dow Jones Industrial Average It rose 159.36 points, or 0.43%, to close at 37,545.33 points. the Standard & Poor's 500 The stock rose 20.12 points, or 0.42%, to close at 4,774.75 points. the Nasdaq Composite The stock gained 81.60 points, or 0.54%, to close at 15,074.57 points.

- US crude oil Prices rose on Tuesday amid rising tensions in the Middle East. February sweet crude futures rose 2.01 cents to close at $75.57 a barrel.

- the US dollar index It dropped on Tuesday.

- American gold Futures It was higher on Tuesday. The February contract added 70 cents to close at $2,069.80 an ounce.

Recap of December 21st

- A weak dollar provided support for grains on Thursday, helping soft red winter futures in Chicago edge higher in a technical bounce. But Kansas City and Minneapolis futures were mostly lower, with the latter hitting their lowest levels since Dec. 14, after France-based consulting firm Strategy Greens said in its first forecast for 2024-2025 that global wheat production is expected to rebound. Corn futures also rose on a technical rebound, which consolidated after hitting contract lows in the previous session amid concerns about possible disruptions to US exports due to the closure of US-Mexico border rail crossings by the US government due to migrant crossings. Wet forecasts for dry Brazil weighed on US soybean futures. Corn March Futures added 2¾¢ to close at $4.72 per unit. chicago March wheat It rose 2½ cents to close at $6.12 per unit. Kansas City March wheat Added 1¾¢ to close at $6.26 per unit; The July contract onwards was narrowly lower. Minneapolis He walks wheat It fell 3¾¢ to close at $7.14 per unit. Soybeans for January It fell 11 cents to close at $12.97 per unit. January soybean meal The price of crude fell by $4.50 to close at $395.40 per ton. Soybean oil for January It fell 1.52 cents to close at 49.04 cents per pound.

- US stock indexes resumed their rally on Thursday, with the S&P 500 back on track for an eighth weekly gain, after the US central bank's favored inflation index rose 2% in the third quarter, below previous estimates. It was the latest sign that the US economy is gradually slowing, as policymakers had hoped. the Dow Jones Industrial Average It rose 322.35 points, or 0.87%, to close at 37,404.35 points. the Standard & Poor's 500 The stock rose 48.40 points, or 1.03%, to close at 4,746.75 points. the Nasdaq Composite The stock jumped 185.92 points, or 1.26%, to close at 14,963.87 points.

- US crude oil Prices closed lower on Thursday after advancing for three days. February West Texas Intermediate Light crude fell 33 cents to close at $73.89 a barrel.

- the US dollar index It returned to the downtrend on Thursday where it had lived for most of the previous seven trading days.

- American gold Futures It was higher on Thursday. The February contract rose $3.60 to close at $2,051.30 an ounce.

Recap on December 20th

- Squaring trades ahead of the Christmas weekend sent wheat futures lower on Wednesday. Further pressure on wheat came from double increases in wheat yield estimates in the Black Sea region after SovEcon raised its Russian wheat crop forecast to 91.3 million tonnes from 89.8 million, while APK-Inform raised its Ukraine grain crop forecast to 56.3 million tonnes from 54.7 million tons. . Corn futures closed lower, the previous two months at contract lows, two days after the US government closed the Eagle Pass Bridge and the El Paso rail bridge to Mexico in order to “redirect staff” to process migrants crossing the border. The National Grain and Feed Association said in a Dec. 20 letter to Homeland Security Secretary Alejandro Mayorkas that the impact is already being felt. Soybean futures fell on Wednesday, as market participants continued to monitor the weather forecast in drought-hit Brazil and adjusted their positions ahead of the holidays. Corn March Futures fell 3 cents to close at $4.69 per unit. chicago March wheat fell 12¾ cents to close at $6.10 per unit; Contracts deferred to 2025 rose higher. Kansas City March wheat It fell 16½ cents to close at $6.25 per unit. Minneapolis He walks wheat It fell 10¼ cents to close at $7.18 per unit. Soybeans for January It fell 4¼ cents to close at $13.08 per unit. January soybean meal It fell $3.30 to close at $399.90 per ton. Soybean oil for January It fell by 0.17 cents to close at 50.56 cents per pound.

- US stock markets closed lower midweek, pausing a remarkable rally that pushed the Dow Jones Industrial Average to several record highs last week. It was the largest single-day percentage decline since September for the S&P 500 and the worst day since October for the Dow Jones Industrial Average and Nasdaq. the Dow Jones Industrial Average The stock fell 475.92 points, or 1.27%, to close at 37,082 points. the Standard & Poor's 500 The stock fell 70.02 points, or 1.47%, to close at 4,698.35 points. the Nasdaq Composite The stock fell 225.28 points, or 1.5%, to close at 14,777.94 points.

- US crude oil Prices rose again on Wednesday. The price of West Texas Intermediate Light crude for February rose 28 cents to close at $74.22 a barrel.

- the US dollar index The price flipped to the higher side on Wednesday, rising for only the second time in seven sessions.

- American gold Futures It was lower on Wednesday. The February contract fell $3.90 to close at $2,034.50 an ounce.

Component markets

| new ideas. Served daily. Sign up for Food Business News' free newsletters to stay up to date on the latest food and drink news. |

Participate |