quick look

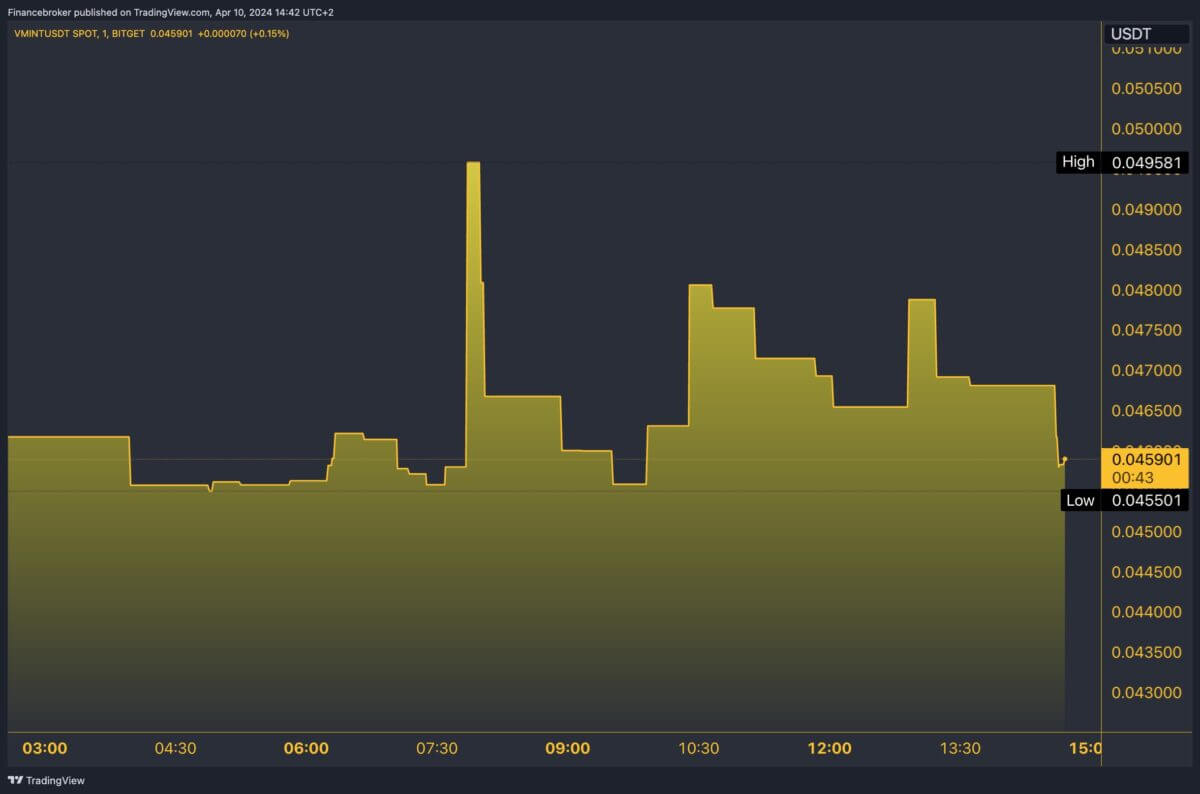

- VMINT's price is now at $0.04597, down 24-hourly by 11.31% and 12.56% over the past week, reflecting significant volatility and decline compared to broader cryptocurrency market trends.

- It is 46.03% below its all-time high on March 25, 2024 at $0.0845, with a market cap of $27.85 million and a 24-hour trading volume of $824,000.

- High volatility is observed with the possibility of further contraction in the short term; Recovery is possible in the medium to long term if positive developments occur.

- Macro factors such as US CPI data and European Central Bank decisions, along with BTC and ETH market movements, can significantly impact VMINT's performance.

As of today, the VMINT token is trading at $0.04597, seeing a massive 24-hour drop of 11.31% in its price. Over the past week, the price has fallen by 12.56%, which is a poor performance compared to broader cryptocurrency market trends. This current pricing puts the token 46.03% below its all-time high of $0.0845, which was reached on March 25, 2024. However, it is still well above its all-time low, indicating extreme volatility in Its short trading history.

the main points

- 24-hour trading volume: $824,065.38

- Market value: $27,855,011

- Circulation/Total/Max. Supply: 610M/1B VMINT

- 24-hour price range: $0.04522 – $0.05218

- Price Volatility: Recent price movements show a high level of volatility.

- 8202% rise from VMINT low profile volatility

VMINT has had a troubled past. Its price has increased by 8201.54% from its all-time low on December 18, 2023 to the current price. Such large rises are often characteristic of new or speculative assets. Therefore, these assets can attract significant interest from traders looking for quick gains. This, in turn, contributes to increased volatility.

Trading volume and market value

VMINT's current market capitalization places it in the moderately speculative category, potentially making it vulnerable to greater price fluctuations on the back of market news or investor sentiment changes. The relatively low but large trading volume also indicates active interest but may lead to price manipulation, since half of the total supply is traded.

Expect high VMINT volatility and short-term risks

Given the high volatility and recent downtrend in VMINT price, a short-term recovery appears uncertain unless supported by a broader market recovery or positive project-specific developments. However, the coin's dramatic rise from all-time lows suggests that interest could rise sharply with the right catalysts.

Future price path

- Short-term: Expect continued volatility with potential downside risks as the market digests recent price declines.

- Medium to long term: Recovery and growth could be on the horizon if the token gains traction through the development of applications or partnerships that meet current market needs.

Bitcoin and Ether prices may influence the fate of VMINT

The prices of major cryptocurrencies such as Bitcoin and Ethereum often set the tone for altcoin performance through market sentiment and investor behavior. Currently, Bitcoin and Ethereum are facing their own pressures. However, it still has bullish expectations from certain segments of the market. Therefore, VMINT may indirectly benefit from any positive shifts in these leading assets.

The expected US CPI data and the European Central Bank's interest rate decision are expected to impact financial markets broadly. This effect is likely to increase risk aversion among investors. As a result, more speculative assets such as VMINT may be negatively affected.

VMINT's bullish sentiment is at odds with creator control

Sentiment around VMINT is currently bullish, according to community feedback. However, concerns about high control from contract creators (who have capabilities such as disrupting sales and minting of digital coins) could prevent new investment. These forces indicate the possibility of sudden significant changes in token supply and market dynamics, which may not always align with investors' interests.

The upcoming Bitcoin halving may benefit VMINT

The upcoming Bitcoin halving and its historically positive impact on the market could lead to renewed interest in cryptocurrencies, including VMINT, especially if broader market sentiment improves after the halving.

Bullish sentiment and high control by creators suggest that although there is upside potential, investors should approach it with caution. Furthermore, they should monitor community channels and developer announcements for any signs of significant changes that may impact their properties.

VMINT shows speculative interest with growth potential

The current and historical market performance of VMINT shows that it is a token with high volatility and speculative interest. The near-term outlook is cautious due to recent price declines and significant control by contract creators. However, the medium to long-term outlook could see improvement, especially with positive macroeconomic signals and a broader cryptocurrency market recovery. Investors should monitor the market closely, particularly with regard to changes in Bitcoin dynamics and macroeconomic indicators that could impact broad investor sentiment.