New data shows that youth debt in South Korea is on the rise, as cryptocurrency investments lead many desperate young people to bankruptcy courts.

Per Hankyoreh, on April 5, the Seoul Rehabilitation Court released a report on debt-related issues for fiscal year 2023.

The report's authors noted a 31% increase in “personal rehabilitation” requests in fiscal year 2023.

The authors noted that “investment in cryptocurrencies” and “stock market purchases” led to higher case numbers for people between the ages of 20 and 29.

South Korean Youth: Are Cryptocurrency Investments Going Wrong?

The Seoul Bankruptcy Court prepares an annual statistical survey report on personal rehabilitation and bankruptcy cases.

This year's report showed that 19,379 individuals filed for rehabilitation or bankruptcy in fiscal year 2022, up from 14,826 in fiscal year 2022.

In South Korea, the rehabilitation system allows individuals who cannot repay their debts to avoid legal bankruptcy if they agree to adhere to debt repayment plans set by the court.

If they fail to adhere to these plans, the courts process bankruptcy protocols.

The Seoul Bankruptcy Court noted that applications for personal rehabilitation by people in their 20s have “increased steadily” over the past few years.

In the first half of 2021, 10.3% of rehabilitation applicants were between 20 and 29 years old. This number rose to 11% in the second half of 2021, then to 13.8% in the first half of 2022.

In the second half of 2022, the number rose to 16.6%, then increased to 16.8% in the first half of 2023, and reaches 17% in the second half of 2023.

According to the court's analysis, this rise is “a result of the expansion of economic activities of people in their 20s, including cryptocurrencies and stocks.”

The court concluded that more young people are turning to cryptocurrencies

The same court made similar observations in October 2023, when it claimed:

“Growing up in [insolvency] Among young people, it seems that they have been influenced by the growth of economic activities such as cryptocurrencies and investment in the stock market.

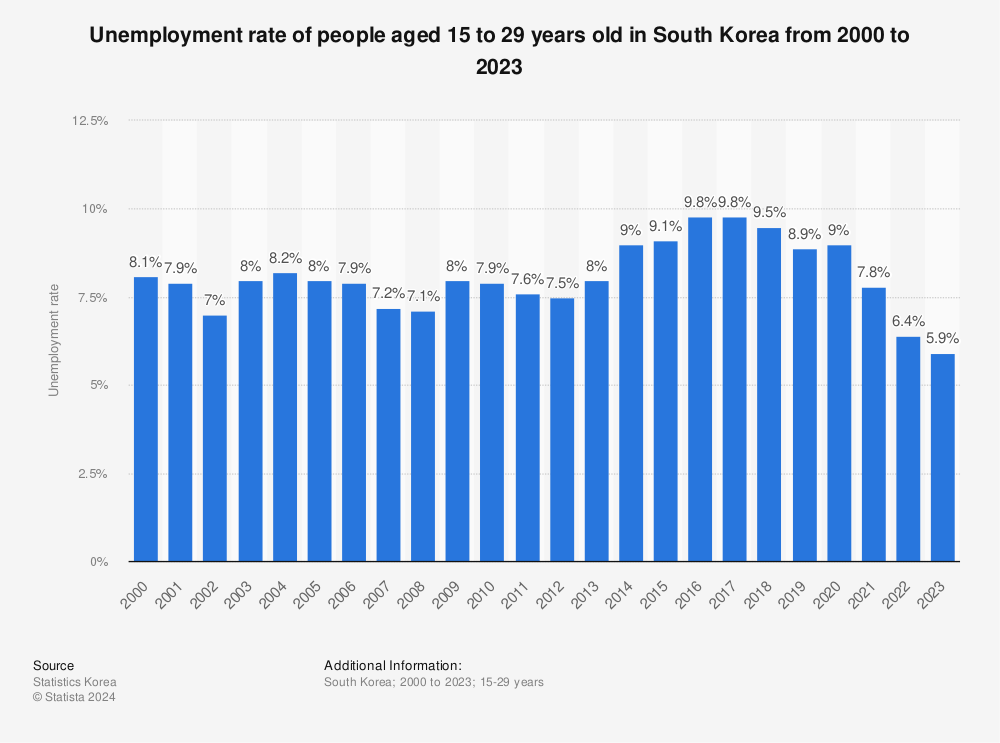

Many have blamed rising property prices and high unemployment rates for growing disillusionment among South Korea's youth.

Home prices strength 1.74 million. Residents have been leaving Seoul since 2014 https://t.co/BoK79xR85q

— Korea Times (@koreatimescokr) February 6, 2024

Some say their only financial hopes lie in cryptocurrencies and offshore stock markets. Meanwhile, many financial advisors say purchasing cryptocurrencies is “no longer optional” for young South Koreans.

Earlier this year, Judge Lee Seok-jun of the Seoul Bankruptcy Court published a paper calling for greater regulation of cryptocurrencies.

Lee claimed that cryptocurrency investors need more protection. He concluded that the courts are often unable to provide this due to legislative oversight.