introduction

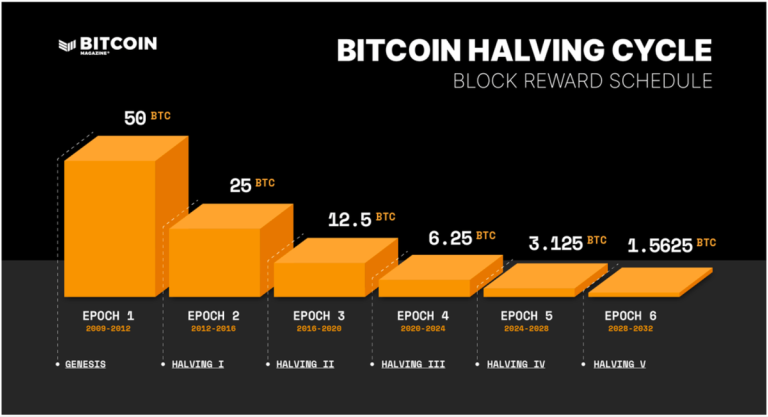

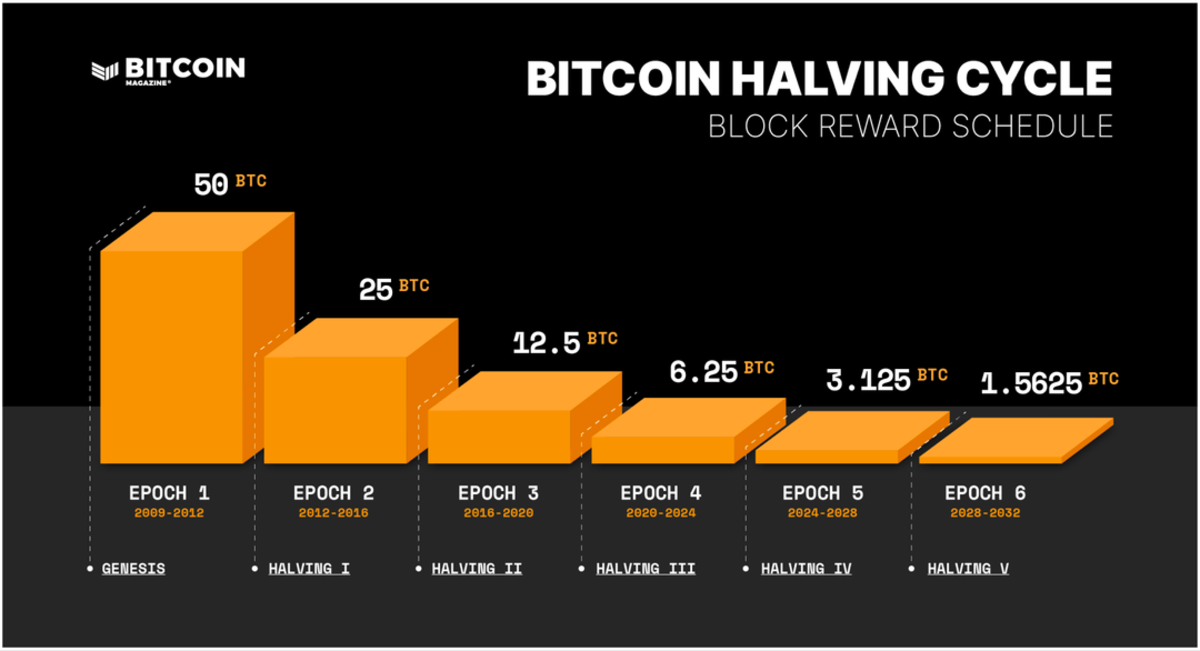

As we approach the end of the third era, the countdown to the next Bitcoin halving is steadily underway. Halving (also known as “halving”) is one of Bitcoin's most important and innovative features. Every 10 minutes, the Bitcoin network issues a new bitcoin, and roughly every four years (every 210,000 blocks, to be exact) the amount issued (“block support”) is halved. Block support is the reward that miners receive for validating and recording new transactions on the blockchain.

Halving the block support is a crucial factor in the eventual maximum Bitcoin supply of 21 million bitcoins. In addition, miners also collect transaction fees that users attach to their transactions to encourage miners to include them in the next block. Therefore, miners often earn more bitcoins for mining a block than just from subsidies. .

When will Bitcoin price fall to the next halving?

The next Bitcoin halving is expected to take place on or around April 20, 2024, reducing the block reward from 6.25 to 3.125 BTC. This halving period – or epoch – will increase the supply by 164,250 BTC (from 19,687,500 to 20,671,875), which is just 328,124 BTC out of a maximum supply of 21 million.

Calculates the next half date

- Determine the block interval: While Bitcoin's block time (the time between each block) is around 10 minutes, the time can vary slightly due to hash rate and network adjustments.

- Find the current block height: You need to know the current block height, which you can find on many blockchain explorer sites or directly from your Bitcoin node if you're running one.

- Calculate the remaining blocks until the next halving: Bitcoin halving occurs every 210,000 blocks. Subtract the current block height from the block height by the next half.

- Calculate the estimated time remaining: Multiply the number of remaining blocks by the approximate block interval (in seconds) to estimate the time remaining until the next half.

- Convert time to date: Convert the remaining estimated time to date format to see when the next half hour is expected.

Current block height: can be found here.

Blocking time: can be found here.

Current date: xx/xx/xxxx

Blocks per epoch: 210,000

Next half block height: 210,000 times Next half number

Calculation:

(((Block height to next half – current block height)*10)/60)/24 = days remaining

Hash rate and difficulty adjustment are two variables that constantly shape the processing speed of blocks and thus the time intervals between blocks. The next halving date could vary as a result, so it's important to keep calculating.

Bitcoin halving date

As of March 2024, there have been three Bitcoin halvings:

- On November 28, 2012, Bitcoin's block support decreased from 50 Bitcoin per block to 25 Bitcoin per block.

- On July 9, 2016, the second Bitcoin halving reduced the block support from 25 BTC per block to 12.5 BTC per block.

- On May 20, 2020, the third Bitcoin halving reduced the block support from 12.5 BTC per block to 6.25 BTC per block.

Bitcoin halving 2012

The halving in 2012 was the first halving for Bitcoin.

Half:

Date: November 28, 2012

Half number: 01

Block height: 210,000

Block reward: 25

Mined Supply: 10,500,000 (amount of Bitcoin already issued when the halving occurs)

age:

Support: 5,250,000

Extracted width percentage: 25%

Bitcoin halving in 2016

The 2016 halving was Bitcoin's second halving.

Half:

Date: July 9, 2016

Half number: 01

Block height: 420,000

Block reward: 12.5

Mined Supply: 15,750,000 (amount of Bitcoin already issued when the halving occurs)

age:

Support: 2,625,000

Extracted supply percentage: 12.5%

Bitcoin halving 2020

The 2020 halving was the third halving for Bitcoin.

Half:

Date: May 20, 2020

Half number: 03

Block height: 630,000

Block reward: 6.25

Mined Supply: 18,375,000 (amount of Bitcoin already issued when the halving occurs)

age:

Support: 1,312,500

Extracted supply percentage: 6.25%

Bitcoin halving 2024

The halving in 2024 will be the third halving for Bitcoin.

Half:

Date: April 20, 2024 (estimated)

Half number: 04

Block height: 840,000

Block reward: 3.125

Mined Supply: 19,687,500 (amount of Bitcoin issued when the halving occurs)

age:

Support: 656,250

Extracted supply percentage: 3.125%

Bitcoin future halving

The ban time variable will introduce some variation in estimated halving dates, but approximate dates can be expected until universal support ends in 2140. Below, we provide a brief overview of expected halving dates from 2024 to 2060, and provide valuable insights into these upcoming milestones.

| Era number | Block height | Half a year | Estimated half date |

|---|---|---|---|

|

04 (of 32) |

840,000 |

2024 |

April 20, 2024 |

|

05 (of 32) |

1,050,000 |

2028 |

2028 |

|

06 (of 32) |

1,260,000 |

2032 |

2032 |

|

07 (of 32) |

1,470,000 |

2036 |

2036 |

|

08 (of 32) |

1,680,000 |

2040 |

2040 |

|

09 (of 32) |

1,890,000 |

2044 |

2044 |

|

10 (of 32) |

2,100,000 |

2048 |

2048 |

|

11 (of 32) |

2,310,000 |

2052 |

2052 |

|

12 (of 32) |

2,520,000 |

2056 |

2056 |

|

(continued…) |

Historical implications of the Bitcoin halving

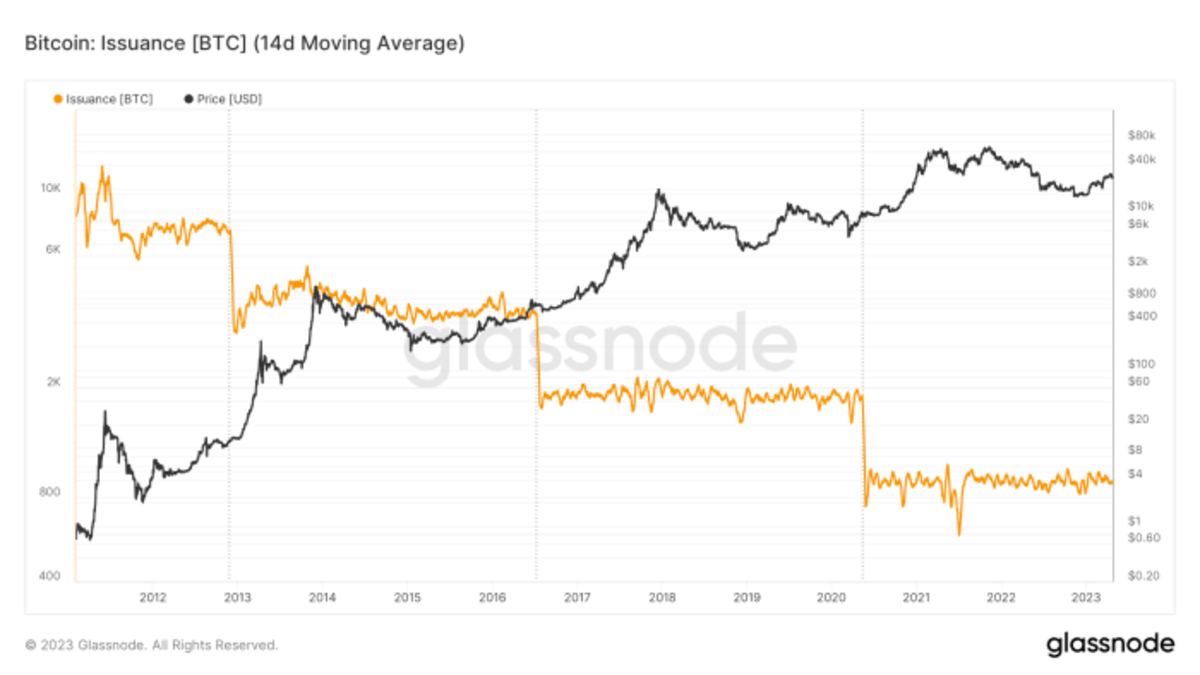

Halving events have consistently been preceded by significant increases in the price of Bitcoin, making them a focal point for market analysts.

Price estimate

Historically, the price of Bitcoin has seen significant spikes following halving events due to a combination of decreased supply and increased demand. These events significantly affect the overall supply of Bitcoin, and therefore its price. However, it is necessary to recognize that price dynamics are affected by many factors beyond halving events.

- After the halving in 2012, Bitcoin's price rose almost 9,000% to $1,162.

- After the halving in 2016, the price of Bitcoin rose approximately 4,200% to $19,800.

- After the 2020 halving, the price of Bitcoin rose approximately 683% to $69,000.

The Bitcoin issuance rate is halved approximately every four years.

Challenges facing miners

Halving events can pose challenges for miners, as their income drops when block rewards are halved. To remain competitive, miners must operate efficiently, which may lead to the development and adoption of more energy-efficient mining technology. It is very common for miners to go bankrupt, which often affects the network's hash rate, the supply of Bitcoin available for sale, and ultimately the price of Bitcoin. Through disruptions, adjusting the difficulty eventually restores balance and the Bitcoin network and ecosystem continue to move forward.

common questions:

Will Bitcoin rise at the halving?

Bitcoin's historical performance after the halving event showed a notable upward trajectory. A declining rate of new supply is Bitcoin's path to absolute scarcity. This event often arouses increased interest and demand. However, it is necessary to be careful and not view halvings as guaranteed paths to quick profits. A wise approach is to understand the long-term potential of Bitcoin and view it as a store of value rather than trying to time the market by buying and selling.

Is Bitcoin Halving Bullish?

The Bitcoin halving is undoubtedly a bullish event, as it changes the supply dynamics in favor of higher prices. While the halving is generally viewed as a bullish event, it is wise to remember that Bitcoin's price is affected by several factors. Caution is advised.

How many days after the Bitcoin halving did it peak?

A look at the past three halving events shows that a spike in prices usually begins within a few months of the halving event. Also, before the halving event, the price of Bitcoin tends to rise as investors expect the price to rise after the halving. After the halving, it usually takes more than 12 months for the price to reach its peak.

Should you buy Bitcoin before the halving?

Instead of trying to understand when to buy and sell Bitcoin, it is recommended to understand the value of the asset. However, a pattern has emerged in the past where buying 6 to 12 months before the halving and selling 12 to 18 months after the halving results in a significant profit. Past performance and behavior is no guarantee of future performance. Our best advice for those who are not experienced traders is to buy and hold for several cycles.