After more than a year of developments, Sam Bankman Fried has ended up doomed to spend the next 25 years behind bars, but 2024 still holds a number of high-stakes legal dramas related to cryptocurrencies. In this article, find out why the SEC… KuCoin, and Binance could all be important cases to watch in the coming year.

It can be fun to dive into the crypto pool. There are many risks, tricks and tricks, but it is fun and really possible, truly pay off.

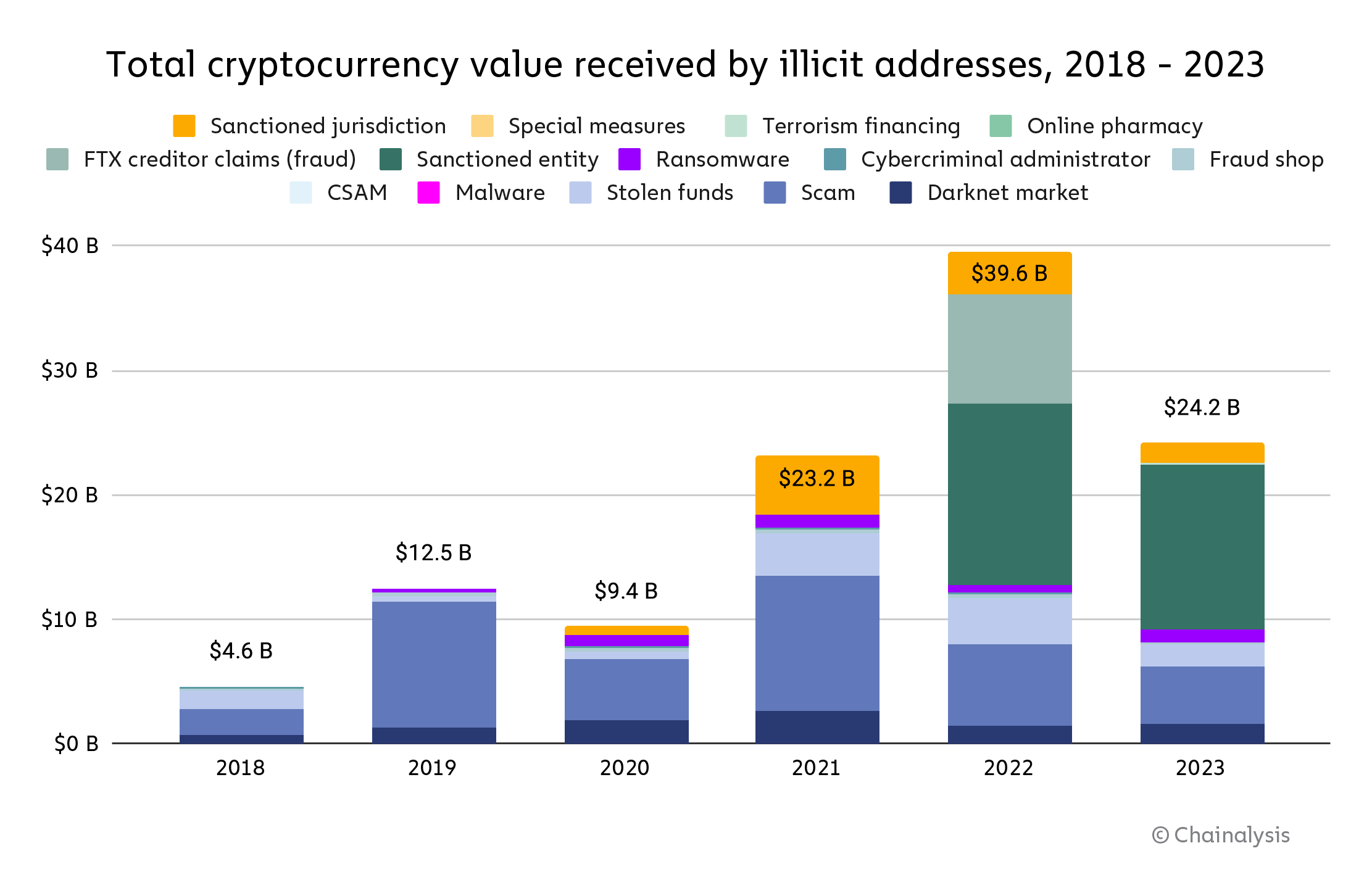

Sometimes, the people behind these cryptocurrency scams do get justice, and the FTX case has proven that law enforcement efforts to seek justice against cryptocurrency crime perpetrators are increasing.

One thing that hasn't changed is the delicate interplay between the legal dramas of high-risk cryptocurrencies and price action, and the ruling against FTX co-founder Sam Bankman-Fried is just the tip of the iceberg.

(string analysis)

With legendary former Binance CEO Changpeng “CZ” Zhao awaiting trial, Do Kwon skipping prison in Montenegro, and several of what we thought were “big” projects, there is a lot of cryptocurrency legal drama in 2024.

Here are the next biggest court cases in the cryptocurrency space.

Major Cryptocurrency Legal Drama #1 – Changpeng Zhao Countdown to CZ Trial

Binance co-founder, Czechoslovakia, faces up to 18 months in prison, with whispers of a maximum sentence of 10 years.

The short version is that Binance failed to report more than 100,000 suspicious transactions by names you might recognize, like ISIS, Hamas, and Al Qaeda. Laundering money for groups designated as terrorist by the United States is illegal.

After pleading guilty to money laundering charges, all eyes are on his sentencing on April 30 in Seattle – and many expect the harsh sentence to send the price of BNB token lower.

But, on the world's largest stock exchange, it's not just Czechoslovakians who are nervous; Binance and its US counterpart settled $4.3 billion over charges, including operating without a license.

And that's without taking into account that the SEC is still pursuing Binance US with allegations of selling unregistered securities.

Cryptocurrency Legal Drama #2 – FTX Trial Fallout and Implications

In the wake of FTX's collapse, its executives face stiff prison sentences. Carolyn Ellison, who led FTX's hedge fund Alameda Research, will serve prison time despite being the key witness in the Sam Bankman-Fried trial.

Caroline had a cult of personality at FTX It goes deep. Alongside Ellison, FTX's Zixiao “Gary” Wang, Nishad Singh, and Carolyn Ellison could also face decades behind bars for their roles in the stock market fraud debacle.

Cryptocurrency Legal Drama #3 – Terraform Labs Founder Dances With Extradition

Do Kwon, the man behind Terraform Labs' seismic collapse after Terra USD was de-pegged, has narrowly dodged extradition to the US from Montenegro – for now.

In another development this afternoon, Montenegro's Supreme Court overturned the decision to extradite Kwon to another jurisdiction – South Korea – although his fate from here lies in the hands of a lower court.

Despite his legal victories in the Balkans, the US and South Korea are keen to extradite him over fraud charges linked to unstable cryptocurrency platform Terra Luna, and prosecutors are expected to continue their pursuit.

Cryptocurrency Legal Drama #4 – SEC v. KuCoin

The SEC is continuing its crackdown on several cryptocurrency companies, including Coinbase, KuCoin, Kraken, Tron, and Gemini — all of which are fighting SEC allegations of selling unregistered securities.

The outcomes of these cases could reshape the regulatory landscape for cryptocurrencies, potentially changing the CEX market beyond recognition.

Bottom line: Don't forget these other little cryptocurrency legal dramas

But while these are the big cases of the coming year, here are four other notable legal cases happening this year:

- Sik Q Coin: The SEC charged KuCoin's founders, Chun “Michael” Gan and Kei “Eric” Tang, for not maintaining an anti-money laundering program and running an unlicensed money transfer business. Both, who are Chinese citizens, could face up to 10 years in prison, but are currently at large.

- Abraham “Avi” Eisenberg: It is cryptocurrency Bernie Madoff whose “highly profitable trading strategy” leveraged $117 million from the DeFi trading platform Mango Markets. He is accused of commodity fraud, among other things.

- Tornado Cash: Tornado Cash developer Roman Storm is gearing up for a trial in September. He is accused of money laundering and other charges. His development partner, Roman Semenov, remains elusive and is believed to be in Russia.

- Celsius and SafeMoon scandals: Celsius' Alex Mashinsky and SafeMoon CEO Braden John Carone face their days in court on charges ranging from fraud to money laundering, with decades of prison at stake.

These cases are not just about individual companies or personalities, although that is a key aspect for many in the cryptocurrency community (as seen in the criticism surrounding the sentencing of Sam Bankman-Fried) they are about setting precedents that could determine the future of cryptocurrencies. Cryptocurrency regulation and innovation. Watch for these cases to appear.

Explores: $5 billion worth of Bitcoin short positions will be liquidated if BTC rises above $75,000

Disclaimer: Cryptocurrencies are a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all your capital.