The following is an excerpt from the latest issue of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain Bitcoin market analysis directly to your inbox, subscribe now.

As the next Bitcoin halving approaches this month, miners are using record profits to adapt their business models to disruptive opportunities.

Half of us are almost here. While the entire Bitcoin world anxiously awaits the halving of mining rewards, the prospect of a new revenue stream has us wondering how the space will react to new market conditions. Halvings in the past have generally been associated with a Bitcoin boom, but they have also been known to shake up previously held assumptions in a big way. We are already seeing some examples of these changes in the market; To name a few, major miners have updated their equipment to ensure maximum hardware efficiency. This has led to old equipment from these companies being sold at bargain prices, with several thousand mining rigs finding their way to aspiring miners in Africa and Latin America. Cheap hydropower from Ethiopia has already attracted international capital to become a new mining hub, and a large portion of those rigs go there for pennies on the dollar.

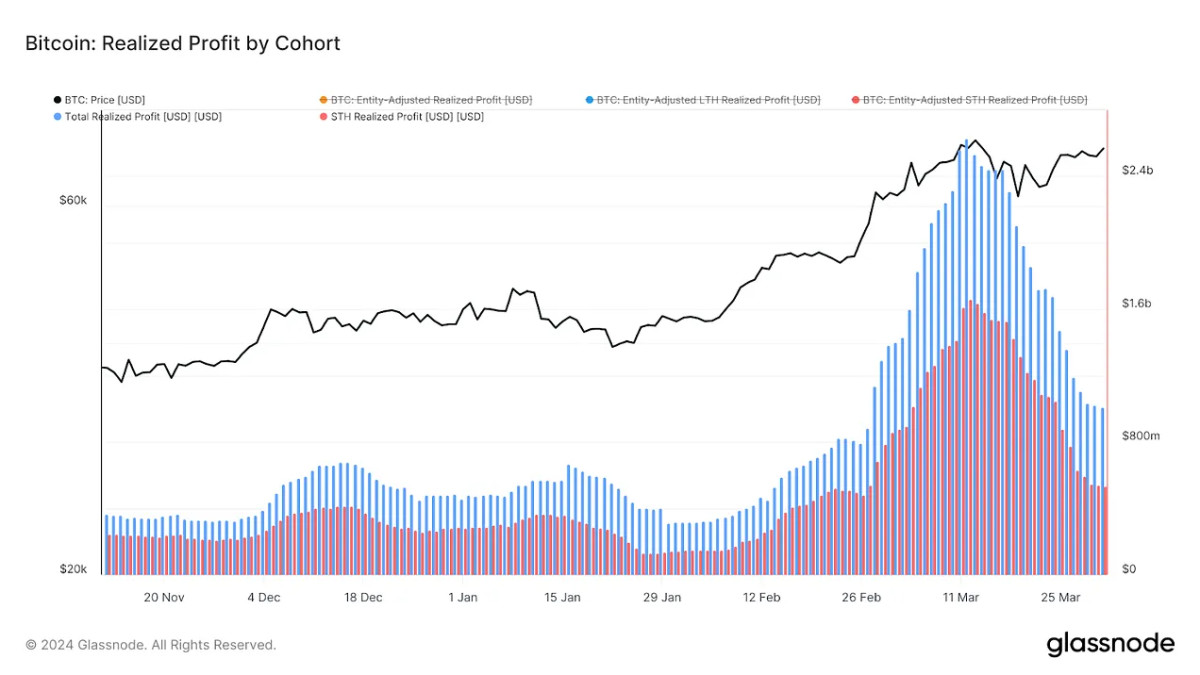

In other words, miners expect to see less production in the near future, but this has nonetheless stimulated the creation of new mining companies around the world and net growth of the industry. This is just one example of the types of unexpected opportunities that will invade the digital asset space, and it is up to Bitcoin users to seize them. For miners as a whole, the opportunities are certainly plentiful. March 2024 saw the highest monthly revenues ever for the collective mining industry, exceeding just $2 billion. This is particularly noteworthy because less than half of this revenue came from transaction fees, a far cry from the situation in December where transaction fees exceeded mining rewards.

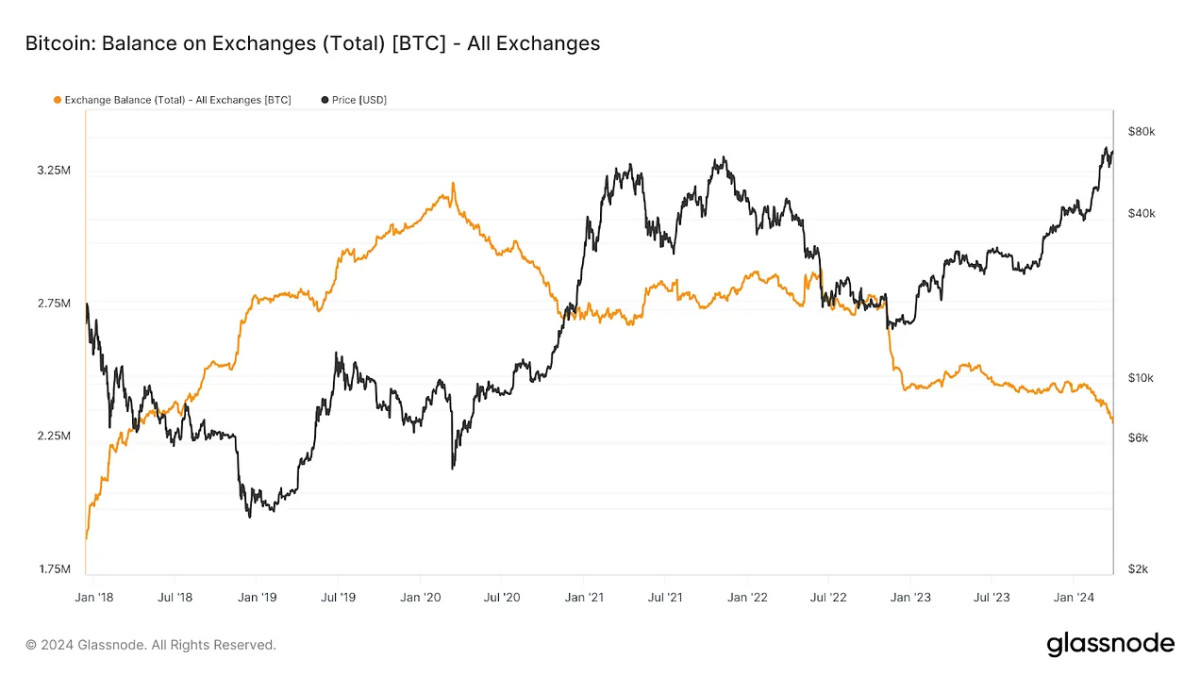

In December, the price of Bitcoin was much lower, and the blockchain was experiencing congestion. This congestion not only suppressed demand for purchasing Bitcoin, but also increased demand for miners to process the blockchain. Resolving transactions on already mined Bitcoin accounts for a larger share of profits than mining and selling new coins, and this project has become a lifeline for many small businesses. However, now it seems that money is flowing everywhere. Bitcoin ETFs are gobbling up Bitcoin at extreme rates – more than 6 times the actual output of miners. This wealth even brought venture capital interest back into direct focus, adding to the frenzy. In the first three months of 2024, major exchanges collectively saw their Bitcoin reserves drop by nearly $10 billion, revealing the massive demand for newly mined coins. With market conditions like these, it's no wonder miners' profits have reached an all-time record high.

However, although this period of intense sales has certainly created opportunity for miners, there are also risks associated with the halving. These companies are in a mad dash to secure as much revenue as possible before the halving, and the race is extremely desperate for one simple reason: trend lines may provide encouraging data, but there is no real guarantee that the price of Bitcoin will rise accordingly after its supply declines. Finish it. The halving of hype and the massive success of ETFs pushed Bitcoin's price to record highs, but this record was followed by volatility. Bitcoin has been hovering around its major benchmark since passing it without continuing to rise in a massive surge. If the price of Bitcoin continues to behave in unpredictable ways, it will eventually wreak havoc on small businesses and promote industry consolidation.

In addition, a particularly interesting development has emerged in Bitcoin secondary markets. As greedy demand by ETF issuers and other financial institutions has completely outstripped supply, some holders of long-term funds (LTHs) have woken up to fears of a general liquidity crisis. Whales who were previously content to hold Bitcoin for many years have changed their behavior and have clearly decided that it is time to finally make huge profits. March 2024 saw long-term holders begin selling their assets at unprecedented rates, making a disproportionate amount of profits compared to other Bitcoin sellers. Obviously a resource like this can't last forever, but it's an important reminder for some miners: just because you're having trouble making ends meet after the halving, doesn't mean the industry is either. Adapt, or the space will find new ways to leave you behind.

However, large and small mining companies have not faced the challenge of halving. These runaway profits have enabled companies to invest in a wide range of onboarding strategies, and sometimes even radically change their business models. For example, the US company Arkon Energy previously operated as an infrastructure company, viewing itself as a provider to a customer base of independent miners. When it announced a major purchase of modern mining equipment on April 2, it joined an industry-wide trend of preparing to cut in half with the most efficient machines. Instead of offering this equipment to its previous customers, Arkon announced its intention to focus on simply mining Bitcoin. This simple shift represents a radical change in their overall business model, and they plan to follow through with “the goal of making Arkon one of the most efficient miners in the world.”

Leading mining company Hut 8, on the other hand, has started its own pivot business model, but in a slightly different direction. A first-quarter earnings call in late March saw CEO Asher Genoot admit that 70% of the company's revenue came from asset mining, but those plans were expected to change somewhat as the halving approached. Hut 8 is still focused on upgrading its equipment and exploiting energy resources in new locations, like many other mining companies, but it is also investing in a new direction. This new trend is not in different assets, whose mining operations are focused on Bitcoin, but in the development of high-performance computing and artificial intelligence processes. These new operations were “below scale today…but we are excited about this business because we see it as foundational to the ability to grow,” Ginot claimed. “You will see us continue to be creative in the way we do things,” he added. Maximizing the value of each machine,” he said, stressing the need to maintain a careful and disciplined attitude towards current mining operations.

These are just a few of the different new strategies miners are taking to anticipate the halving. Businesses have been preparing for months, and there is still time to make additional new plans. At the time of writing, the halving is in less than three weeks, and the countdown to the event reveals the optimistic and celebratory attitude of Bitcoin users everywhere. No matter what happens when the long-awaited day arrives, some constants seem very reliable. There will be tremendous demand for the world's leading digital assets, and the Bitcoin community will have the same spirit of innovation as always. Whether Bitcoin jumps right away or acts unexpectedly, someone is sure to end up a big winner. For us Bitcoin users, this means there is a lot to look forward to.