- BlackRock CEO Larry Fink said a spot ETF is still a possibility if the SEC deems it a security.

- The SEC is said to be intent on bringing the second-largest cryptocurrency under its jurisdiction.

- Fink said he's bullish on BlackRock's spot Bitcoin ETF, which has quickly become the fastest-growing ETF ever.

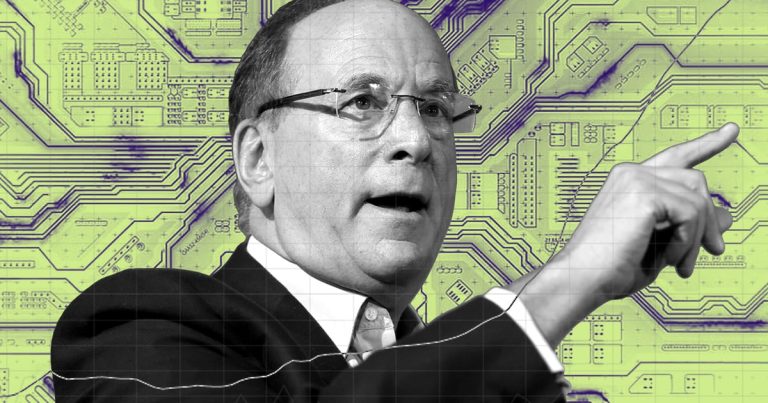

BlackRock CEO Larry Fink said on Wednesday that his company would likely create an Ethereum exchange-traded spot fund, even if the U.S. Securities and Exchange Commission classifies Ethereum as a security.

BlackRock is one of several ETF providers that have applied to the SEC for an Ether ETF, but some have expressed doubts that the agency will approve ETFs by the May deadline.

Fink said Fox BusinessCharlie Gasparino wasn't able to discuss much when Gasparino asked whether the SEC might define ether as a security.

“But I don’t think the designation would be too harmful,” Fink said, noting that a potential security designation would not prevent the creation of Ethereum ETFs.

Stay ahead of the game with our weekly newsletters

last week, luck The SEC subpoenaed three companies regarding information about the Ethereum Foundation, a Swiss-based non-profit organization that contributes to the growth and development of the Ethereum blockchain, the magazine reported. The article highlighted the agency's potential goal of classifying Ethereum as a security, rather than Bitcoin, which is classified as a commodity.

Cryptocurrency lawyer Gabriel Shapiro said that if the SEC classifies ether as a security, it could use the classification as an excuse to delay or reject an ether ETF. DL News “That's probably their biggest goal,” Shapiro said earlier this month.

Bitcoin ETFs

on Fox BusinessFink said he is “very optimistic about Bitcoin's long-term viability.” BlackRock's iShares Bitcoin Trust ETF has amassed $17 billion in assets under management since the ETF was approved on January 10, becoming the fastest-growing ETF ever.

“I'm pleasantly surprised, and I didn't expect it before we introduced it, that we would see this kind of retail demand,” Fink said.

Join the community to get our latest stories and updates

Tyler Pearson is a markets reporter at DL News. It is based in Alberta, Canada. Got a tip? Contact us on ty@dlnews.com.