The following is an excerpt from the latest issue of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain Bitcoin market analysis directly to your inbox, subscribe now.

In Nigeria, home to Africa's largest digital asset economy, a dispute is developing between the government and Binance, a dispute that has culminated in one of the company's executives escaping house arrest and fleeing the country.

The Federal Republic of Nigeria has the sixth largest population in the entire world, enjoys great economic influence on the African continent and a respectable influence in the major global market. Although the potential future of Nigeria's economic development has been the subject of much interest to global financial institutions, a particular point of interest is the country's apparent affinity for Bitcoin; For example, the country tops the list of countries with relevant Google searches like “investing in cryptocurrencies” etc. In addition, due to some classic reasons such as rampant inflation and depreciation of the local currency, Nigeria also has the largest trading volumes in For these reasons, converting Nigeria to Bitcoin will be a huge boon to Bitcoin users around the world, and the country may one day become a hub. Real for this industry.

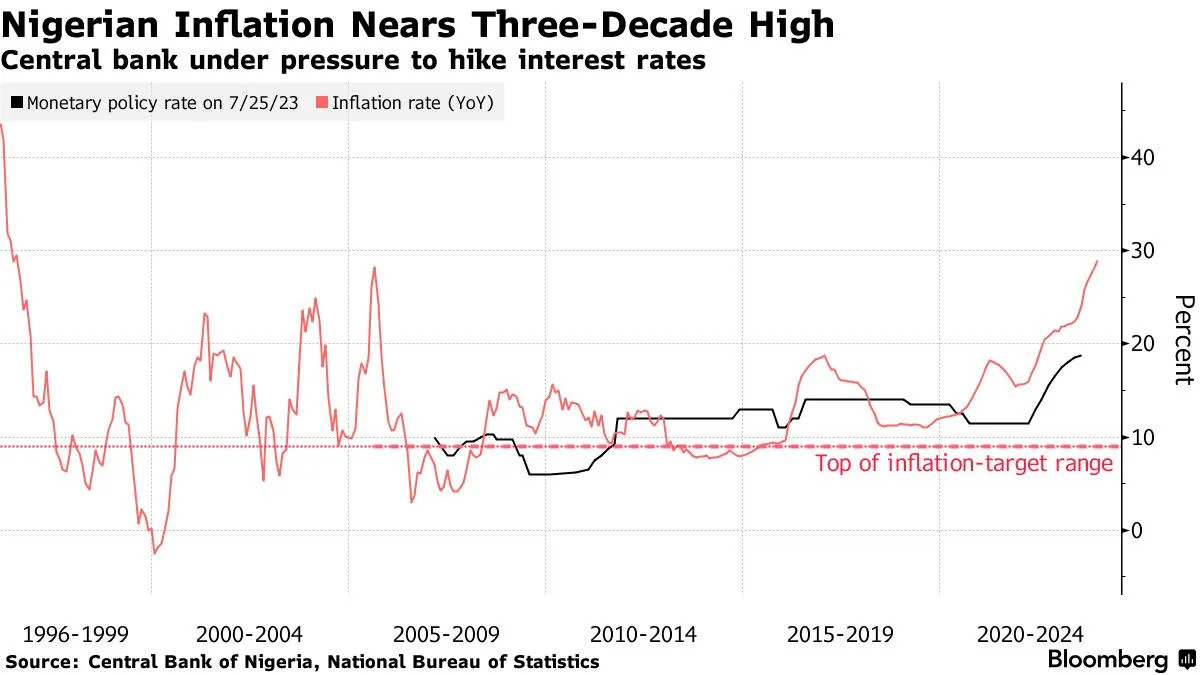

Therefore, Bitcoin users today should certainly be concerned about the evolving dispute centered between Binance and the Nigerian government, paying particular attention to the possibility of a broader crackdown on the industry. The dispute began in earnest in February 2024, when an alleged “glitch” in Binance’s peer-to-peer (P2P) transaction platform led to price drops for users, with government officials formally accusing the company of “blatantly setting a proprietary exchange rate for cryptocurrencies.” Nigeria” and “trying to manipulate our currency to zero.” The Central Bank (CBN) viewed the widespread use of P2P Bitcoin transactions as a potential contributor to the naira’s underperformance, and sought action against Binance. Given that inflation in Nigeria is rising at the fastest rate in decades Over time, this problem seemed particularly worrying to the authorities.

To that end, a series of somewhat confusing events unfolded: Reports circulated in February that the government was blocking services from major exchanges like Binance, Coinbase, and Kraken. For its part, Coinbase claimed that it had no such problems with the Nigerian government at the time. The government went on to clarify its position when the Central Bank of Nigeria pointed to Binance, declaring that about $26 billion in “untraceable” funds had apparently passed through the company’s operations in Nigeria. This amount of cash would represent a large capital outflow for the entire economy. Plus, of course, this large number certainly reflects a relatively high level of interest and adoption across the wider population. After Binance refused to cooperate with allegations that it enabled various financial crimes to be committed on its platform, the government took the aggressive step of detaining two executives – a British citizen and a US citizen.

The move has led to a flurry of activity as the situation between Nigeria and the cryptocurrency economy becomes increasingly muddled. Was the government targeting Binance because of its rebellious stance, or was it just the first step in a planned campaign against the wider Bitcoin world? The government has shut down the country's largest P2P exchange, but is the practice of P2P Bitcoin trading itself the next step? Nigerian regulators have published an updated list of guidelines for foreign exchanges to follow, and in addition, the government has entered into a new partnership to trial the feasibility of rolling out a central bank digital currency (CBDC), eNaira. In the United States, the Chamber of Digital Commerce pressured the White House to intervene in the situation, demanding the release of the US Binance official from custody.

This tense and ambiguous situation came to a head in a very unexpected way when Nadeem Angarwala, a dual British-Kenyan citizen and CEO of Binance, escaped from Nigerian custody with a “smuggler’s passport” and fled the country on March 25. Although his family claimed that Angarwala's exit from the country was completely legal, Nigeria asked Interpol to issue an international arrest warrant for him. Angarwala's guards apparently allowed him to leave house arrest to visit a nearby mosque and attend worship services, where he disappeared. Not only were the guards arrested under investigation, but the government also formally accused Binance of tax evasion. Angarwala's fellow American, Tigran Gambaryan, remains in federal custody and has been named as a defendant in the charges.

This certainly sounds like a bleak omen for the Nigerian Bitcoin space. However, the possibility remains that the government is just trying to strengthen Binance specifically, as the company is already mired in legal issues. In addition to the company's problems in Africa, it has also suffered major setbacks on three separate continents. The most famous of these is the fine imposed by the US Department of Justice: the company must pay $4.3 billion, and CEO Chengpeng Zhao was forced to resign, and is likely to face prison time. Binance.US was created to better accommodate US legal requirements, but even that subsidiary is mired in a series of class action lawsuits and SEC battles that will likely doom it. This wouldn't be the first time, as CommEX, Binance's successor in Russia after a similar exodus, just closed its doors on March 25. The company was also banned in the Philippines on the same day, after the government accused Binance of operating without a license.

In other words, the Nigerian government may now have chosen the right time to strike at an embattled rival, one that has long been a target of the country's securities watchdogs. There are certainly several worrying signs pointing to a potential crackdown on Bitcoin, with a Nigerian court ordering Binance to hand over data on its largest traders, accompanied by rumors that police are targeting street cryptocurrency traders. The investigation into eNaira, a potential central bank digital currency (CBDC) to replace demand for Bitcoin and other digital assets, has certainly not helped matters. However, there is still plenty of reason to see a way forward.

For one thing, Ray Youssef, former CEO of Paxful and current CEO of NoOnes, has been publicly enthusiastic about his company's opportunities in Nigeria. Yusuf suggested that Nigeria should actually raise registration fees for exchanges operating in the country, describing the move as an invitation to the “big boys” like Coinbase or his own company operating in the Nigerian market. Youssef went on to say that the government has an interest in restricting these foreign conglomerates from operating as a major venue for P2P sales for fear of capital flight, and exchanges that have no or limited P2P functionality should be welcomed to operate normally.

Nigerian consumers strongly favor P2P technology as the ideal way to buy and sell Bitcoin, and the prospect of $26 billion flowing from the Binance P2P market to unverified locations has deeply shaken the government. However, the actual practice of P2P Bitcoin sales is still alive and well in the Nigerian market without Binance as an intermediary; For example, International Women's Day 2024 in Nigeria featured large, well-attended seminars focused on educating women from all walks of life about Bitcoin. With a focus on demystifying the world of DeFi and empowering women, these seminars have been sponsored by a wide range of P2P channels, enthusiasts and companies in the Nigerian cryptocurrency scene.

From where we stand, rumors of a widespread crackdown on Bitcoin in Nigeria appear to be greatly exaggerated. Given that the government's dispute with Binance is quickly escalating into an international manhunt, it's easy to imagine that the government would launch similar attacks on other exchanges like Coinbase or even the Bitcoin world altogether if it had any significant interest in doing so. Binance has been seen as running afoul of Nigerian regulations for some time, and simultaneous legal battles in several jurisdictions appear to have presented an opportunity for Nigeria to join in. However, the Bitcoin spirit is still alive and well, and Binance competitors are more than willing to fill their niche in the market. No one can guess how strong Nigeria's Bitcoin industry will be five years from now, as the country's economy as a whole continues to develop. However, one thing seems certain: it will take more than one battle to keep Bitcoin down.