Just days before potentially pivotal results from Nvidia Corp., Goldman Sachs raised its year-end S&P 500 target to 5,200, but with much of that hinging on Big Tech's ability to continue posting strong earnings.

“Our updated 2024 EPS forecast of $241 (8% growth) is above the average top-down strategy forecast of $235 (6% growth) and reflects our expectations for stronger economic growth and higher profits for the IT sectors.” and communications services, which a team led by David Kostin, chief U.S. equity strategist, said in a note late Friday: “contains 5 of the 7 great stocks.”

With his new target, Goldman is in line with some of Wall Street's most bullish forecasters — Oppenheimer's John Stoltzfus and Fundstrat's Tom Lee who also expect a 5,200 finish after each accurately called it the 2023 high. Ed Yardeni of Yardeni Research is at the top, with a 5,400 target.

This is the second time that Goldman has raised its target for the S&P 500 index, after rising to 5,100 points from 4,700 points in late December. Earlier this year, RBC Capital raised its forecast for the S&P 500 to 5,150 from 5,000 and UBS raised its own target to 5,150 from 4,850.

Behind these new forecasts is a more optimistic economic outlook – economists at Goldman recently raised their forecast for US real GDP growth for Q4 and Q4 2024 to 2.4% due to strong consumer spending and residential investment. This is because they expect a forward P/E multiple for the S&P 500 of 19.5 times, just under the current 20 times.

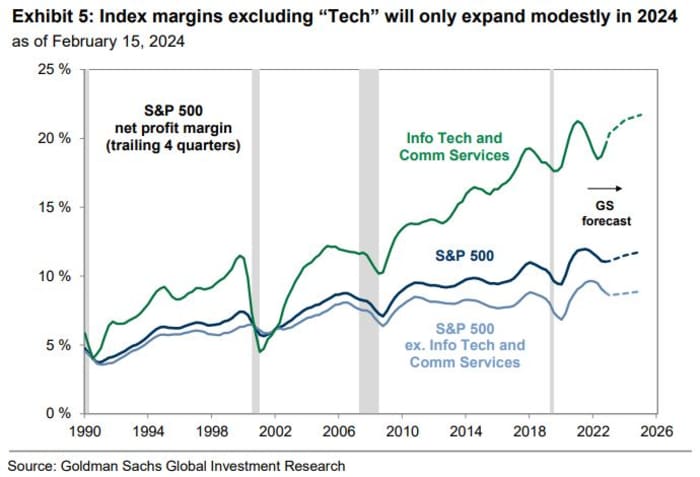

“The almost-concluded fourth-quarter earnings season has highlighted the ability of companies to maintain profit margins despite slowing inflation,” said Kostin and his team.

But the bank's more optimistic outlook depends on the ability of big technology companies to continue to perform. Kostin and his team noted how the fourth quarter “highlighted the continued fundamental strength” of Magnificent 7 – Meta Platforms META shares,

microsoft MSFT,

apple apple,

google alphabet,

tesla TSLA,

netflix nflx,

And NVDA,

Analysts have warned that Nvidia's earnings, due Wednesday, could represent a “make or break” moment for the stock, with earnings per share expected at $4.59, up more than 700% from the same quarter last year.

is reading: Bullish bets on Nvidia and other 'Magnificent Seven' members near their busiest levels of last year

As Jim Reid, a strategist at Deutsche Bank, told clients on Monday, “It's a reflection of the world we live in that the most important event of the week may be Nvidia's earnings on Wednesday. It's now the fourth-largest company in the world and the best-performing S&P 500.” So far this year (+46.6% YTD), so this will be very important for sentiment.”

Addressing Nvidia's earnings directly, strategists at Goldman said that if the chipmaker reports consistent estimates, Magnificent 7 would deliver sales growth of 15% annually and lift margins by 582 basis points annually, leading to earnings growth of 58%. . “.

The bank expects ICT Services, which contains five of the seven major companies – Meta, Microsoft, Apple, Alphabet and Nvidia – to record the strongest earnings growth among the S&P 500 sectors this year. They said the rest of the index would see some minor improvements, but “to a much lesser extent.”

Goldman added that strength in big tech companies has also led to higher expectations among peers, with Magnificent 7's earnings estimates revised up 7% in the past three months and margins forecast 86 basis points higher. This is versus 3% and 30 basis points downward revisions to earnings and margin forecasts for the remaining 493 stocks.

The bank said stronger-than-expected US growth or continued upward surprises from major companies could pose upside risks to their outlook.

“Similarly, disappointing growth in the overall economy or from the largest stocks would create downside risks to the S&P 500 earnings outlook. In addition, accelerating input cost inflation would dampen expectations of an emerging profit margin recovery, and thus growth.” Corporate profits are widespread.