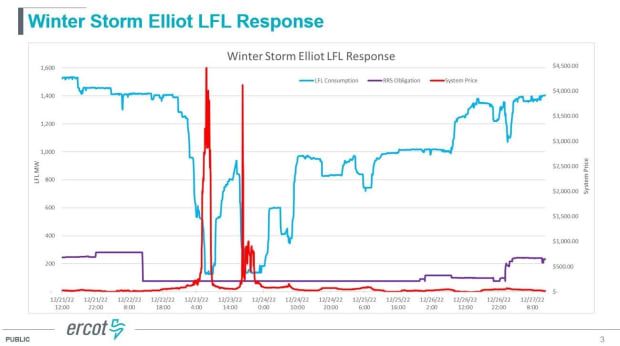

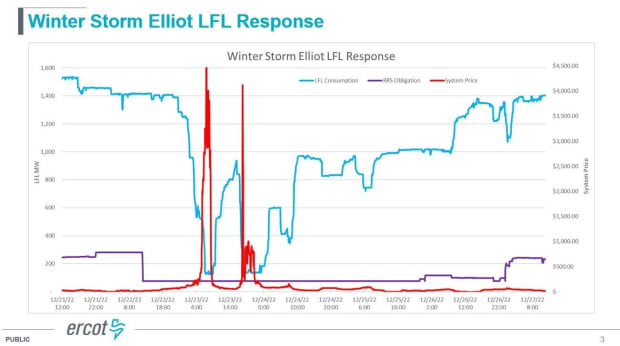

Many headlines recently described a 25% drop in Bitcoin network difficulty during Winter Storm Finn in January. Most attributed the decline to downsizing activity in Texas. While Texas accounts for 17% of the global Bitcoin hash rate, ERCOT data shows that some of the curtailment activity was a combination of high prices and “good network citizenship.” In ERCOT, and to a lesser extent in other ISOs, prices are the best proxy for grid stress. There are other alternative tools such as PRC (Physical Response Capacity) but prices are a better measure for most situations. For this reason, in order to prevent price fluctuations and create more challenging belt conditions, the ideal environment is one in which the price does not fluctuate significantly up and down. However, price volatility is a frequent occurrence in ERCOT, as evidenced by Winter Storm Elliott in December 2022 (see chart below).

Bitcoin miners are economically ideal consumers of electricity. This does not mean that Bitcoin miners will altruistically consume electricity, but rather that Bitcoin miners' margins are uniquely sensitive to the price of energy such that they are economically incentivized to reduce consumption when energy prices exceed the break-even threshold (current break-even). For most miners it is between $100 and $200 per megawatt hour). This means that they will consume electricity when prices are below the break-even price and stop working when prices are higher than that. There are some operational and practical exceptions to this, for example, if miners have data center co-location agreements that stipulate or guarantee uptime.

Texans should want Bitcoin miners to work anytime energy is plentiful because their continued consumption stimulates the building of additional generation. Less counterintuitively, we naturally want Bitcoin miners to scale back when prices are high and the network is under stress.

This brings us to the January 2024 winter event on the week of January 15. The headlines might make you think that the Texas network is under pressure again and that Bitcoin miners are shrinking as a result. The truth is more nuanced. The average settlement price in the ERCOT wholesale power market during the worst three days of the storm was $100.76 per megawatt hour, and prices never exceeded $600 per megawatt hour. For context prices, the maximum is $5,000 per MWh. As wholesale prices indicate, the network has weathered the storm well with ample reserves throughout.

ERCOT did issue a conservation alert, but that was more of a precautionary message to energy consumers who don't monitor the price of energy every second of every day like bitcoin miners do.

We have seen some economic downturn, which means curtailing energy use based on price signals, from miners for long periods, and some shorter periods when prices exceeded 200 MWh. However, this activity was less pronounced than in previous winter events or summer heat waves because generation reserves were more abundant across the grid. It is possible that some Bitcoin miners will scale back their operations for longer periods as a gesture of good “network citizenship,” and to demonstrate their commitment to a stable network, but this cannot be quantified.

All this evidence suggests that last week's difficulty drop warrants a more nuanced explanation. Much of it was a result of curtailment in Texas, but after evaluating ERCOT pricing data, it leads me to believe that a material portion of this curtailment came from other North American ISOs as well. In short, everyone who has an opinion about curtailing Bitcoin mining would do well to keep an eye on ERCOT settlement and LMP prices. Data and economics should form the backbone of all future analyses.

This is a guest post by Lee Bratcher. The opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.