Drum roll, please.

For the past three years, around this time, I've been telling you what the world's top fund managers own and what investments they're avoiding. Each time, I'd throw in the rogue idea that a portfolio consisting entirely of the latter — the things they hate — would likely crush the market over the next 12 months.

And every time it turns out to be true. And then some.

This portfolio of Wall Street's most hated assets, which I call “Pariah Capital,” returned an impressive 26% in 2023.

A “balanced” global portfolio, consisting of 60% global stocks VT and 40% global bonds BNDW? A full 10 points less, or 16%. (U.S. equivalent only for a “balanced” portfolio, consisting of 60% S&P 500 SPY and 40% U.S. AGG bonds,

He got 17%.)

Meanwhile, a portfolio consisting of the fund managers' favorite investments? Only 5%. depressed. More than 20 points lower than Pariah Capital, more than 10 points lower than the balanced index.

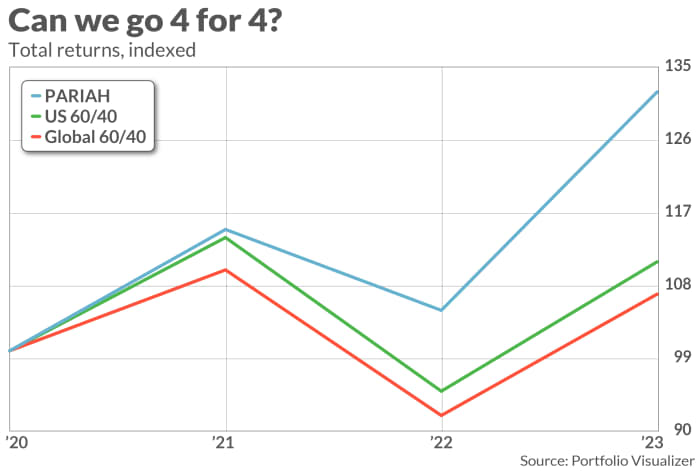

This is not a one-off. This Pariah Capital strategy outperformed the global index by a clear seven points in 2022 and five points in 2021 (when we first started reporting on it annually).

In other words, over the past three years, Pariah Capital has generated a total return of 32%. This is more than four times the total return of 7% achieved by the global balanced portfolio, and three times the 11% return achieved by the US-only balanced portfolio.

(Though I'll give credit where credit is due — in the 2022 bear market, their top picks outperformed both the outcasts and the indexes, posting a 5% gain.)

There is a method to this madness. Every month, BofA Securities, formerly known as Merrill Lynch, surveys the world's top money managers: pension fund managers, mutual fund managers, endowment managers, etc. He usually speaks to more than 200 big money people around the world, dealing in total assets worth about $600 billion.

It tells what they are thinking and what they have of their money.

The problem for these people is twofold. First, because they all go to the same business schools, get the same training and certifications, and because they all have enormous professional incentives to get along, they usually think and act alike. Second, if they are investing heavily in a particular asset, they – and all other like-minded money managers – will have already bid up the price, which will reflect their bullish outlook.

Or to put it another way: the assets that fund managers love already exist the seller Market (with suitable prices). Meanwhile the assets they hate are in the buyer Market (as above).

Paria Capital pays absolutely no attention – absolutely nothing – to what these people have to say about the markets, the global economy or the future. He only looks at what they have.

Last year, among other things, these people did not invest in technology stocks (the Technology Select Sector SPDR ETF XLK is up a whopping 56% over 2023), communications services (Fidelity MSCI Communication Services ETF FCOM is up 45%) and stocks Discretionary of consumers (consumers). The optional sector SPDR ETF XLY is up 40%. Among global markets, their least favorite was the US, which then outperformed, with the Vanguard Total Stock Market ETF VTI rising 26%.

Meanwhile, among their preferred assets, the only bet that performed well was their bet on Europe – with the SPDR euro Stoxx 50 ETF FEZ up 27%.

So, what does the future hold for 2024?

First remember that this is a tongue-in-cheek exercise. Proceed at your own risk. Also, after three consecutive years of success, Pariah Capital should do just that certainly It may be due to a year of poor performance. Buyer Beware: Buyer beware.

However, BofA Securities' 2024 Global Fund Managers Survey has just dropped. It lists the top picks and pans for this year's big-money crowd.

As always, the most interesting part is what they avoid: what they don't have. The survey lists eight assets in which fund managers are, overall, significantly underweight in absolute terms. By far, the biggest underweight is in UK stocks. The others are utility stocks, banks, insurance stocks, eurozone stocks, energy stocks, real estate, and consumer discretionary stocks.

This raises a number of issues.

First, it's all stocks, no cash or bonds. OK. This increases the risks. Even if you decide to gamble on this portfolio, adjust to your mood and circumstances. One major caveat is that while these fund managers are underweight these specific markets and sectors, they are overweight overall — reason enough to be nervous. Anyone who manages this type of portfolio at the hedge fund level can combine it with a put option on the global stock market. The rest of us might collect it with cash.

Second, some of these investments require some finesse. For example, to bet on London's main stock market index, you can invest in the low-cost Franklin Templeton FTSE United Kingdom ETF FLGB..

It charges just 0.08% fees and invests in the top 100 or so stocks. But the London stock market is really weird. It is dominated by a small number of huge multinational companies, such as energy giants Shell and SHEL,

And BBB,

Pharmaceutical giants AstraZeneca AZN,

and Glaxo GSK,

and HSBC Bank HSBC,

This is mostly what you get: The 10 largest companies make up nearly half of the portfolio. The problem is that this is not a real bet on the UK economy or on “British” stocks in anything but name. Rio Tinto is headquartered in London, but it is a global mining company. And so on and so on. So there's a reason the UK bet is split into two funds: half in FLGB and the other half in the iShares MSCI United Kingdom Small-Cap ETF EWUS,

Which is spread more widely across about 250 medium-sized and small-sized companies. The latter, unfortunately, charges a fee of 0.59%.

Third, while fund managers mistrust both banks and insurance, the ETF space for both is difficult due to the complexity of the sectors. Some “insurance” ETFs do not include Warren Buffett's Berkshire Hathaway BRK.B,

For example. Some “bank” ETFs only include regional banks, and exclude the giant Wall Street banks. Many ETFs in this area charge exorbitant fees. There is no perfect solution. The Fidelity MSCI Financials FNCL Index charges just 0.8%. That's 16% insurance companies (mostly Berkshire) and 84% everything else.

But, with all those caveats, here's Pariah Capital's 2024 portfolio.

It consists of 12.5% or one eighth of each Vanguard Utilities VPU,

SPDR S&P Insurance ETF KIE,

SPDR Euro Stoxx 50 ETF Vis,

Power Select Sector SPDR XLE Box,

Invesco KBW Bank ETF KBWB,

Vanguard Real Estate VNQ) and the XLY Consumer Select Sector SPDR Fund,

Plus also 12.5% at FLGB or (my preferred option here) 6.25% all In FLGB and EWUS.

Meanwhile, the latest survey shows that money managers are investing heavily in the following eight assets: healthcare, technology, industrial and consumer stocks, US, Japanese and emerging market indices, and cash. So the ensuing portfolio – which we can call “the best of the best (with honors!)” with a shout-out to Will Smith in “Men In Black” – would contain equal amounts of 12.5% of sponsorship capital Health Select Sector SPDR XLV Fund,

Vanguard IT ETF VGT,

SPDR XLI Industrial Sector Fund,

Consumer Goods Select Sector SPDR XLP Fund,

Vanguard Total US Stock Market VTI,

Franklin FTSE Japan ETF FLGB,

Vanguard FTSE Emerging Markets ETF VWO,

and Goldman Sachs Access to the 0-1 Year Treasury ETF GBIL.

By the way, for this exercise, for all sector ETFs, I have deliberately chosen those that focus only on the US market. Readers tend to prefer a strong US focus, and in these cases the fees are lower. But a hawk would instead bet on sector ETFs that invest globally: iShares Global Energy IXC instead of XLE, for example. But that's another story.

Let the record show that emerging market indices are now largely betting on whether China will invade Taiwan: stocks in both countries make up 50% of the index. Russia used to dominate index funds in Eastern Europe, with disastrous results in 2022. If you want to bet on emerging markets on a large scale and… Avoids This issue, I would look at alternatives. This is also another story.

How will the outcast perform in 2024? Stay tuned. As I said before, outcast He should Because of a bad year. And even I, despite my cynicism, can't imagine that betting against the big money crowd would cause the indices to weaken every year. It can't be that easy, surely?