One cryptocurrency trader shared why he believes Grayscale Bitcoin Trust is experiencing a mass sell-off.

Grayscale Bitcoin Trust (GBTC) has been observed selling its Bitcoin (BTC) holdings, with recent reports indicating that the company recently moved $1.3 billion worth of Bitcoin to Coinbase. A cryptocurrency trader with the pseudonym Ash Crypto explained that he believes market forces are the sole reason behind this liquidation on January 18. mail.

Historically, GBTC has been an important holder of Bitcoin. This accumulation was primarily due to their practice of redeeming shares by paying investors in US dollars rather than selling the underlying Bitcoin. This approach changed after the approval of Bitcoin exchange-traded funds (ETFs).

According to Ash Crypto, there are two primary drivers for investors withdrawing their funds from GBTC. First, Grayscale charges an annual management fee of 1.5%, which is much higher than what ETF issuers charge. This disparity in fees has made other ETFs more attractive to investors.

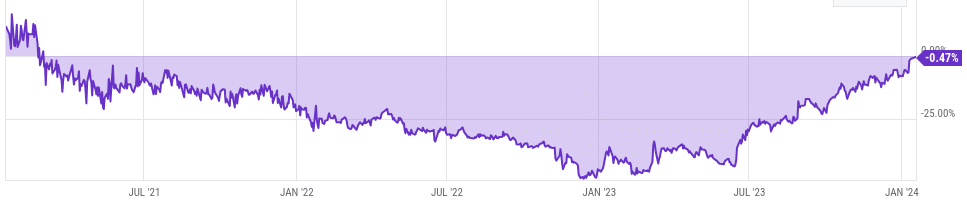

Second, the shift in market sentiment is partly due to the pricing structure of GBTC shares. Many investors bought into GBTC at a significant discount, as high as 49% in January 2023. However, with the discount now eliminated – which stands at 0.47% as of press time – these investors are choosing to exit their positions, in search of greater profitability or stability. Opportunities elsewhere.

These factors have led to a situation where GBTC is forced to sell its BTC holdings to meet the redemption requirements of departing investors. Ash Crypto notes that this sell-off may have short-term impacts on Bitcoin market performance, potentially leading to a sideways movement or decline in the value of BTC over the coming weeks.

The long-term outlook suggested by Ash Crypto sees investors reallocating their funds from GBTC to other ETFs that offer lower management fees. The analyst warns that rash reactions and a lack of patience could lead to investors losing out in the volatile cryptocurrency market, especially in light of the influence of major players such as Wall Street.