King Ferdinand of Spain, Christopher Columbus's patron, had only one order for the conquistadors: “Get the gold!” Humanely, if possible, but with all the risks!”

500 years later, that feeling still seems to be the same, with the addition of new dangers. Gold advocates and Bitcoin advocates share the common belief that the fiat currency system is on the verge of collapse, while constantly degrading itself in order to survive. the solution? A commodity-based alternative that ensures that accumulated value is preserved, immune to degradation.

With the upcoming fourth reduction in block support from 6.25 to 3.125 BTC in April 2024, the inflation rate (annual growth rate of total supply) of Bitcoin will be 0.9%. In addition to its high portability and divisibility compared to traditional gold, the inflation rate of “digital gold” will be lower than the inflation rate of gold (~1.7%) and will continue to fall to lower rates in the future.

But when asked about their choice of value store, many investors say things like:

“I would choose gold. Not Bitcoin, because of the environment!” truly?!

Contrary to this perception, research tells us that Bitcoin mining can promote the expansion of renewable energy (Bastian-Pinto 2021, Rudd 2023; Ibañez 2023; Lal 2023) and stimulate methane emissions reductions (Rudd 2023, Neumüller 2023) while achieving half the carbon footprint. (70 million tons of CO2 equivalent) from gold mining (126 million tons of CO2 equivalent).

When people think of gold, they think of a pure, clean material. But the reality of gold production looks completely different. As I watched environmentalists develop water pollutants, I learned that gold mining is one of the most polluting industries in the world. Further delving into the topic leads to the following facts.

Gold mining ranks second after coal mining (7,200 km2) in terms of land coverage. Gold mining sites (4600 km2) cover more than the following three mineral sites combined (copper: 1700 km2, iron: 1300 km2 and aluminum: 470 km2).

As many highly productive gold mines have been exhausted, chemical processes, such as cyanide leaching or amalgamation, are used, with extensive use of toxic chemicals today. Polluted water from gold mining called acid mine drainage is a toxic cocktail for aquatic life and makes its way into the food chain.

Colorado's Animas River turned yellow after 3 million gallons of toxic wastewater spilled at the Gold King mine in August 2015. From:

In the United States, only 90% of cyanide is used to recover gold, which is difficult to extract. Toxic substances, their production and transportation have a direct relationship to the gold market. It is estimated that gold mines use more than 100,000 tons of cyanide each year. This means producing and transporting large quantities of a compound with a lethal dose to humans of a few milligrams.

In 2000, a tailings dam collapsed at a gold mine in Romania, sending 100,000 cubic meters of cyanide-contaminated water into the Danube River watershed. The spill caused a mass die-off of aquatic life in the river's ecosystem and contaminated the drinking water of 2.5 million streams. Mines in Brazil and China widely use the historical amalgamation method that produces mercury waste. Approximately 1 kg of mercury is emitted for 1 kg of gold mined.

Gold production from artisanal and small-scale mines, mostly in the Global South, accounts for 38% of global mercury emissions.

Thousands of tons have been discharged into the environment in Latin America since 1980. 15 million small-scale miners were exposed to mercury vapor, and residents of downstream communities ate fish heavily contaminated with methylmercury.

Mercury poisoning among this population causes severe neurological problems, such as loss of vision and hearing, seizures, and memory problems. Likewise, in the townships of Johannesburg in South Africa, poor communities are paying the price for the country's rich gold mining in the past.

Recognizing the risks, Western mining companies have increasingly moved into developing countries in reaction to stricter environmental and labor regulations at home. Surprisingly, only 7% of the gold mined is used for physical property purposes in industry (for example, in electronics). The remainder is processed into jewelry (46%) or purchased directly as a store of value through retail or central banks (47%). For this reason, periods of high monetary reduction boost the price of gold. Last year central banks bought 1,000 tonnes of bullion, the most ever recorded, while gold hovered near its all-time nominal high (status: December 2023).

The last time the demand for gold increased its price significantly was due to the monetary decline following the global financial crisis of 2008. During that period, gold mining in Peru's western Amazon increased by 400%, while the average annual rate of forest loss doubled. three times.

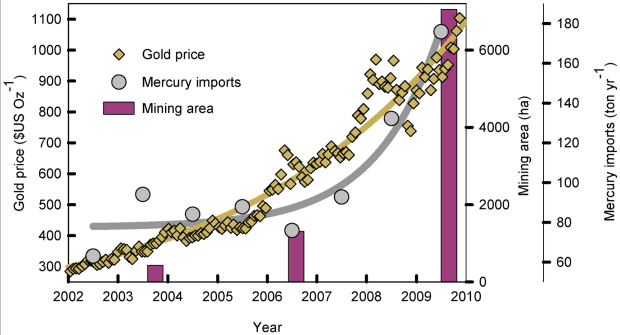

Since almost all of Peru's mercury imports are used in gold mining, the price of gold corresponds to a huge increase in Peru's mercury imports.

As a result of artisanal handling of mercury, large amounts of mercury are released into the atmosphere, sediments and waterways.

Massive exposure to mercury can be detected in birds in Central America. An area that supports more than half of the world's species.

Figure 1: Gold price and mercury imports in Peru and mining region, from “Gold Mining in the Peruvian Amazon: World Prices, Deforestation and Mercury Imports.” 2011, PLoS One 6(4): e18875.

Other natural areas with gold deposits, such as the Magadan region in northeastern Russia, have been experiencing similar expanded mining activity over recent years, including environmental destruction in response to rising gold prices.

Gold mining, driven largely by demand for a store of value, causes widespread environmental and social damage around the world. Coal is a means of storing value.

At least half of today's gold mining could be prevented by using a different store of value – a digital commodity with greater portability, divisibility, and scarcity.

So, the next time a green investor argues for gold versus Bitcoin, tell them:

The store of value in the twenty-first century should not depend on huge fields of destruction and toxic hazards, but on electricity from non-competitive energy sources, supporting the expansion of renewable energy.

This is a guest post by Weezel. The opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.