Another tough day for Wall Street, after Chinese growth numbers disappointed, hurting oil and a host of US-listed Chinese stocks.

This brings us to what we have Call of the dayas market watchers say China-related problems continue to escalate for Tesla (TSLA),

and Apple AAPL,

and its investors.

In a note to clients, Mike O'Rourke, chief technical strategist at JonesTrading, noted how Magnificent Seven shares have come under pressure to support the S&P 500 SPX in a challenging 2024.

“Key leaders at Apple and Tesla continue to be bombarded with daily negative headlines related to their core businesses. While it doesn't draw a lot of attention, it doesn't help that they are the two most vulnerable companies in China,” the strategist says.

Apple and Tesla lost 4% and 11% respectively this year, the worst performance among the seven companies.

Is China then the common denominator among the problems the husband suffers from?

Apple recently reduced phone prices in China as it competes with rivals like Huawei. Tesla also reduced the prices of electric vehicles in the country where Berkshire Hathaway owns BYD 002594.

rules. Wednesday brought news of Tesla's price cuts in Germany, where it faces production disruptions due to attacks on ships in the Red Sea.

China represents 19% of Apple's revenue in 2023, and about 22% for Tesla in the first nine months of last year.

For Apple and Tesla, “it's much more about the competitive environment that could hurt them rather than their core markets,” Jenny Hardy, portfolio manager at the GP Bullhound Global Technology Fund, tells MarketWatch. She points out that in China's bleak market, electric cars and smartphones were strong until the end of 2023.

Hardy notes that a number of new launches in China have been competing with Tesla at the higher end, such as Huawei's luxury Aito M9 model, which is rumored to have achieved weekly sales of more than 20,000. “At least for Tesla, this means a war,” she says. The aggressive prices you are facing in China continue.”

Huawei has also taken a “significant stake” in relation to Apple. It indicates that this company owned 16% of the share of smartphones in China, but it fell to about 2% by 2022 after the American blacklist.

“For us in the portfolio, we still have exposure to Chinese electric vehicles through semiconductor component companies that supply the Chinese market (Infineon IFX,

and nxpnxpi,

) – who are less vulnerable to pricing pressures from OEMs. We remain cautious about exposure to broader consumer electronics, as the recovery in Chinese demand remains uncertain.

More food for thought comes from Peter Navarro, a former White House trade adviser under President Donald Trump, whose recent op-ed titled “On the Eve of Apple and Tesla's Destruction in China” is making the rounds. It should be noted that Navarro is scheduled to be sentenced later this month after being found guilty of contempt of Congress for not cooperating with the investigation into the US Capitol attack two years ago.

“Like General Electric before them, Apple and Tesla now face this grim business reality,” he writes. “As Mr. Cook and Mr. Musk have directed the bulk of Apple and Tesla’s production to be moved to China, the companies are at the mercy of a ruthless dictator in Xi Jinping.” “.

“Arrogance and arrogance are common threads running through Mr. Immelt [Jeffrey, former CEO] “In the 2000s through Mr. Cook and Mr. Musk today,” Navarro said, adding that the companies' products face a “xenophobic ban” in the country.

Food for thought kicker from Navarro? “Whether you're a large hedge fund manager or a small retail investor, you have to wonder whether Apple or Tesla are still safe investments — at least on the long side, if you get my drift.”

Markets

ES00 stock futures,

YM00,

Weak, led technology NQ00,

With Treasury bond yields BX:TMUBMUSD10Y and BX:TMUBMUSD02Y mixed. Oil prices fell 2%, due to disappointment in Chinese growth, which knocked 3.7% off the Hang Seng Index (HK:HSI)..

|

Performance of key assets |

last |

5d |

1 m |

YTD |

1y |

|

Standard & Poor's 500 |

4,765.98 |

0.05% |

0.54% |

-0.08% |

19.18% |

|

Nasdaq Composite |

14,944.35 |

0.68% |

0.26% |

-0.45% |

34.89% |

|

10 year treasury |

4.076 |

4.21 |

22.78 |

19.52 |

70.27 |

|

gold |

2,024.10 |

-0.49% |

-0.84% |

-2.30% |

5.26% |

|

oil |

71.74 |

1.16% |

-1.58% |

0.57% |

-10.39% |

|

Data: Market Monitor. The change in Treasury yields expressed in basis points |

|||||

Buzz

charles Schwab SCHW,

Citizens Finance CFG,

and US Bancorp USB,

He will report before the opening.

The Chinese economy grew by 5.2% in 2023, but data showed an uneven recovery and some analysts expected growth of 5.3%.

Scheduled for release at 8:30 a.m. alongside import prices, retail sales are expected to rise to 0.4% in December from 0.3%. Industrial production arrives at 9:15 AM, and the Home Builders Confidence Index is released at 10 AM

Fed Vice Chairman for Supervision Michael Barr and Fed Governor Michelle Bowman will speak at 9 a.m., and the Fed's beige economic conditions book is scheduled for 2 p.m.

is reading: Government Shutdown: Congress has four days to act. Here's what's at risk.

Best of the web

The Japanese market is coming back to life, with old-timers leading the way

The downside to a longer life: spending more time being sick

Former Australian Prime Minister rejects Chinese peak narrative

Chart

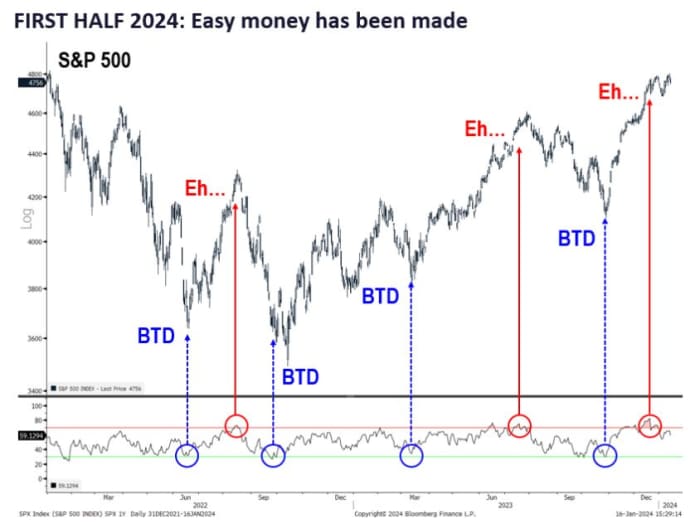

The rocky start to 2024 is a sign of “easy money” and a challenging year ahead, says Tom Lee, president of Fundstrat.

“But the reason we're seeing 'easy money' being made is because we're now overbought. So, even with potential new highs at the end of January, this is not a risk-filled market,” says Lee, who adds that the bulk of Gains will be achieved in the second half.

Bloomberg/Fundstrat. (BTD – buy the dip)

Highest indicators

These were the most searched indicators on MarketWatch as of 6 a.m.:

|

tape |

Security name |

|

TSLA, |

Tesla |

|

ran out, |

Nvidia |

|

New, |

New |

|

imc, |

AMC Entertainment |

|

AMD, |

Advanced micro devices |

|

Camel, |

apple |

|

gme, |

GameStop |

|

MSFT, |

Microsoft |

|

Mara, |

Digital Marathon |

|

Baba, |

Ali Baba |

Random readings

Mocking the British Space Minister after confusing the sun with Mars

A 524.7-pound bluefin tuna sold for $789,000 in Tokyo.

The Need to Know program starts early and is updated until the opening bell, but sign up here to have it delivered all at once to your email inbox. The copy will be emailed at approximately 7:30 a.m. ET.