San Francisco fintech company Ripple is no longer seeking an initial public offering (IPO) in the United States. Furthermore, the company's CEO said that Ripple is exploring options outside the US due to “hostile” conditions.

On January 16, Ripple CEO Brad Garlinghouse spoke to reporters at the World Economic Forum in Davos, saying that the company has halted any plans to go public for the time being.

Ripple puts its IPO on the backburner

The cryptocurrency executive said the company has explored going public outside the US due to a “hostile” SEC regulator.

The company is currently locked in a three-year legal battle with the US Securities and Exchange Commission, which sued it in 2020 for selling unregistered securities.

Back in 2022, Garlinghouse said the company was exploring a public listing following the lawsuit. Fast forward to 2024, where courtroom controversies are still ongoing, and those plans have been thwarted.

“In the United States, that doesn't seem very interesting to me, when you're trying to advertise to a very hostile regulator that has approved your S-1.”

He mentioned another major cryptocurrency company that went public, Coinbase, whose application was approved. “And now the SEC is suing them for doing things that were identified in the S-1,” he said.

The S-1 SEC document is the initial registration form for a new securities or initial public offering required by the regulator for public companies based in the United States. Rumors of a Ripple IPO surfaced in October after the company posted a job listing for a senior director of shareholder communications.

Read more: How to buy XRP and everything you need to know

The Ripple chief added that the company is keeping “the option of an IPO open” and will evaluate it over time or if regulators change:

“And we will evaluate again, as we have new regulators at the SEC.”

Garlinghouse harshly criticized SEC Chairman Gary Gensler, who considers himself a “crypto cop.”

He told CNBC on January 16 Gensler was a “political liability.”:”

“I think the Chairman of the Securities and Exchange Commission, Gary Gensler, is a political liability in the United States. I think he's not acting in the best interest of the citizens, he's not acting in the interest of long-term economic growth, and I don't understand that.”

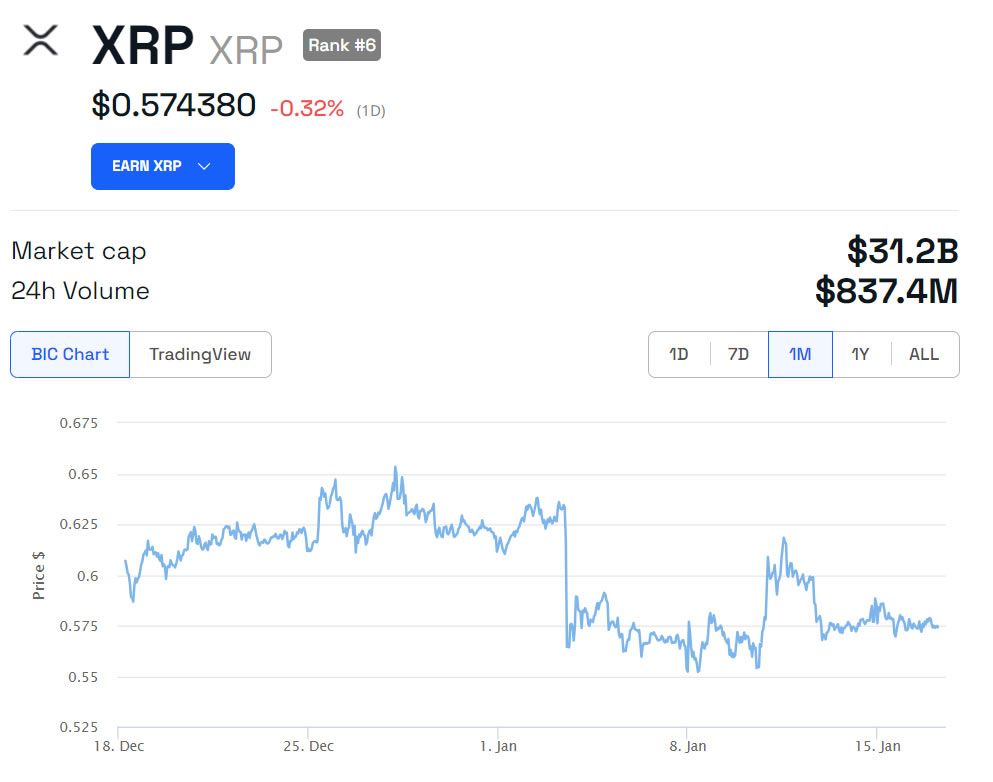

XRP price is moving sideways

The company's native token, XRP, has been lackluster in terms of price action during the recent rally in the cryptocurrency market.

XRP is currently trading flat over the day and last week at $0.574 at press time.

Furthermore, the cross-border token is down 8% since the start of 2024. XRP is still down 83% from its all-time high in 2018 of $3.40.

Even rumors of the existence of a spot XRP ETF were not enough to sway cryptocurrency traders.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased and transparent reporting. This news article aims to provide accurate and timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy and Disclaimer have been updated.