After the collapse of FTX, Carolyn Ellison's approach to stop losses was widely derided by critics. “I don't think it's an effective risk management tool,” she infamously told an audience during FTX's heyday. But did she have a point?

Entering the crypto asset management space presents a unique set of challenges that differ significantly from the realm of traditional funds. In this introductory article, we will delve into the obstacles that aspiring fund managers face when launching a Bitcoin sector fund and examine the key differences that exist when you step out of the world of traditional asset management.

Volatility and risk management

One of the most important challenges that Bitcoin sector funds face is the extreme volatility present in the cryptocurrency market. The price of Bitcoin has seen strong upward surges, sparking excitement among investors. However, it has also seen strong bearish declines, resulting in significant losses for those unprepared for such price fluctuations. Managing risk in such a dynamic environment requires sophisticated strategies, rigorous risk frameworks and assessments, and a deep understanding of market trends.

Unlike most traditional and mainstream blue-chip assets, which often experience relatively stable price movements, the price of Bitcoin can change materially within hours. Hence, Bitcoin sector fund managers must be well-equipped to deal with sudden price fluctuations to protect investors' capital. Traditional stop loss structures may not work to the extent expected, as a market close order may be executed at well below the predetermined strike price due to order book slippage and rapid price movements, the proverbial “catch a falling knife”. Using tight stop losses as your primary risk management mechanism can be your enemy. For example, in a flash crash scenario, positions may be automatically sold at a loss even though the market has returned a few minutes (or seconds) later.

While stop losses are an alternative, it is not an option option! Options are contracts that you can buy that give you the right to buy or sell a specific asset at a predetermined price (i.e. strike price) at a certain time (i.e. expiration date). An option to buy an asset is a call option and an option to sell it is a put option. Buying an out-of-the-money trade (i.e. well below the current price) can serve as a floor on your potential losses if the price collapses. Think of it as a premium paid to secure your position.

Sometimes, to defend against binary outcome events or particularly high volatility time frames, you just have to settle your positions, take no risks, and live to fight another day in the Bitcoin market. Think for example of major protocol update dates, regulatory decisions, or the next Bitcoin halving; However, note that the market moves before these events, so you may have to take action beforehand.

Creating an effective risk management plan for a Bitcoin sector fund may include the use of various hedging techniques, diversification of products and instruments (possibly across asset classes), trading venue risk and risk-adjusted allocations, dynamic trade size, dynamic leverage settings, and aggressive hiring. Analytical tools to monitor market sentiment and potential market and operational risks.

Guarding and security

Sponsorship of Bitcoin and other cryptocurrencies is an important aspect that distinguishes Bitcoin sector funds from their traditional counterparts. One key difference is that unlike traditional exchanges that only match orders, Bitcoin exchanges do order matching, margining, settlement, and asset custody. The exchange itself becomes a clearing house, concentrating counterparty risks rather than mitigating them. Decentralized exchanges come with a unique set of risks as well, from fending off value extraction from miners to preparing to move assets in the event of a protocol or bridge hack.

For these reasons, protecting digital assets from theft or hacking requires robust security measures, including but not limited to multi-signature protocols, cold storage solutions, and risk monitoring tools. Responsibility for securely managing private keys and selecting and monitoring trusted trading venues rests entirely with the fund manager. The burden of monitoring market infrastructure itself introduces a level of technical complexity absent in traditional fund management where custody and settlement systems are standardized and independent.

Custodial solutions for Bitcoin sector funds must be carefully selected, ensuring that assets are protected against cyber attacks and insider threats. With the history of high-profile cryptocurrency exchange hacks, investors are particularly concerned about the safety of their assets; Any breach of security may lead to significant financial losses and damage to the Fund's reputation.

Conclusion

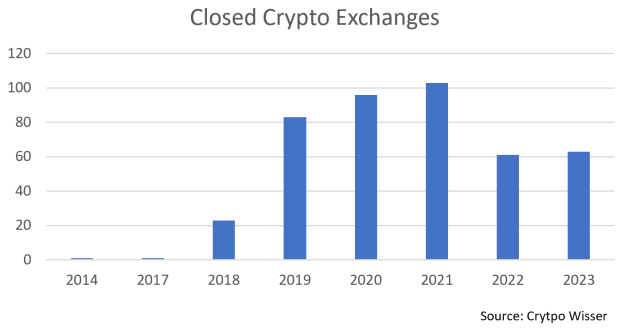

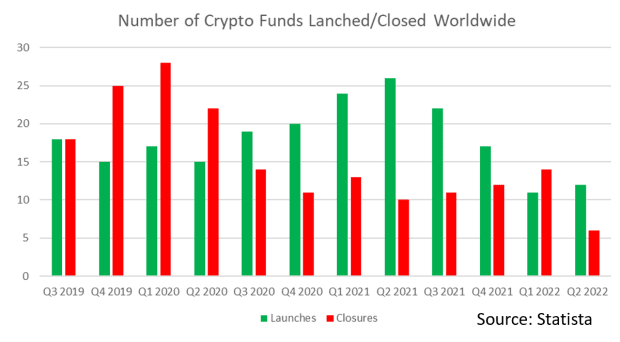

The launch of a Bitcoin Sector Fund is an exciting endeavor that provides unprecedented opportunities for investors looking for exposure to the fast-growing cryptocurrency market. However, it is important to understand that launching a fund is not easy, as the risks exceed the success of the trading strategy. Not surprisingly, quarterly fund closings are in the same range as fund launches.

Those entering the Bitcoin sector funds space should approach it with a pioneering spirit, stay informed, and embrace the dynamic nature of this exciting emerging market. Although the road may be difficult, the potential rewards for successful Bitcoin sector fund managers can be astronomical.

If you're ready to start your fund building journey, already on your way, or just want to learn more, reach out to us at advisory@satoshi.capital.

This is a guest post by Daniel Truk. The opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.