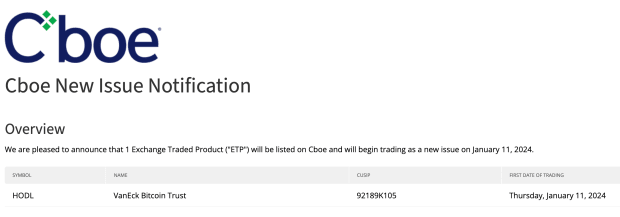

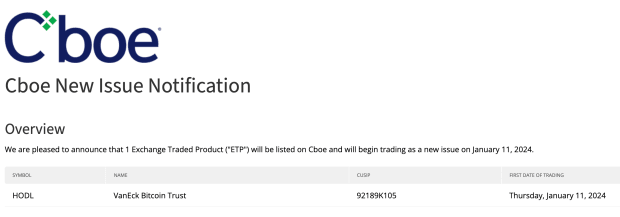

The Chicago Options Exchange (CBOE) announced on its website that the VanEck, Fidelity, and ARK 21Shares Spot Bitcoin Exchange-Trade Funds (ETFs) will officially begin trading starting tomorrow, pending regulatory approval and effectiveness.

The CBOE announcement represents a milestone in the pursuit of regulated, direct exposure to Bitcoin through ETFs, offering institutional and retail investors a path to exposure to Bitcoin.

This development follows careful regulatory assessments and market preparations, putting spot Bitcoin ETFs in place for their long-awaited debut on the trading floor. The CBOE confirmation reinforces the growing acceptance and recognition of Bitcoin as a legitimate and regulated investment asset class.

The imminent start of trading on Spot Bitcoin ETFs underscores a historic moment poised to reshape the investment landscape, providing broader access to Bitcoin within traditional financial markets. However, it is important to note that at the time of writing, the SEC has not officially approved ETFs for trading, and approvals are expected later today.