Credit to last year's champion Nvidia NVDA,

To give Wall Street its best day yet in a shaky start to 2024. But gloom from Samsung dampens the mood, with stock market futures pointing to a decline.

In the bear camp, Marko Kolanovic, chief global strategist at JPMorgan, says stocks remain overbought and investors are satisfied despite the partial reversal at the beginning of the year. While risk assets are starting to “fully embrace” the idea of central banks easing as inflation falls, resilient growth and continued record profitability could end up being a contradiction for investors.

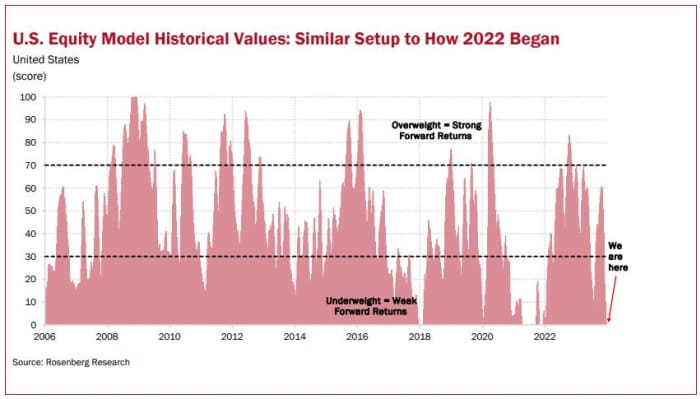

Also on this downside we have Call of the day From David Rosenberg, a veteran strategist who says his firm is now headed for an “extreme” bear on US stocks, citing some troubling recent history.

“The setup for 2024 looks eerily similar to how we entered 2022, with positioning, sentiment and technicals all at extreme readings – matching what we saw in December 2021 (and with worse fundamentals for

“Preface,” the head of Toronto-based Rosenberg Research and his team, which includes Marius Jongstra and Bhawana Chhabra, said in a note.

The S&P 500 SPX ended 2022 with a 19% loss, the largest since 2008.

Here's Rosenberg's chart:

Rosenberg's bearish views last year included an early 2023 call for a 30% stock loss and predictions of a continued recession. But he also predicted in September that the Nasdaq would see a peak in December and January, which could be on track judging by the action this year so far.

So where are you hiding now? The strategist believes that the financials – due to start earnings this week – are the clear best choice for investors and among the cheapest options in terms of valuations. “Historical analysis shows that this group has had strong performance during both Fed standstill and disinflation periods,” he said.

“As recession risks loom in the sector, investors can look toward the big banks (well-capitalized) and insurance companies (stable earnings growth; better valuations) beneath the surface,” Rosenberg said.

Beyond the financials, the strategist says energy, telecommunications and utilities services are all tied for second place.

He also comments on bonds, saying that with markets pricing in about six Fed rate cuts, much of the pivot call is already “in the price.” Other headwinds include a 10% gain for 10-year Treasuries since October. Although it is not a sell recommendation, he says it may be time to “digest the market's movements.”

“With the front treasury bills still being paid [approximately] 5.25%, investors can consider locking in these returns after the rise we have seen so far in the long term.

is reading: Former bond king Bill Gross says 10-year Treasury bonds are 'overvalued'

Rosenberg also said they turned positive on commodities in December, with their model score hitting its highest levels since July 2022. However, energy is not in the mix except for natural gas, where they favor food/agriculture, with wheat, cotton, corn and soybeans. On the top.

The strategist said they had timed gold's bullish turn last fall, but that was fizzling out, citing investor crowding and overbought techniques.

Markets

ES00 stock futures,

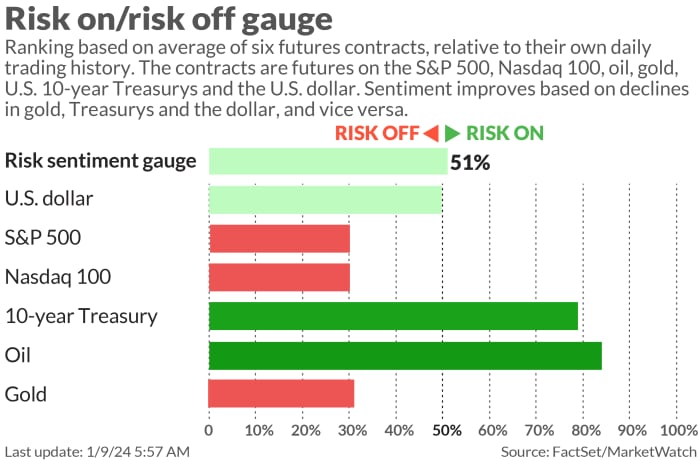

COMP pushes lower, as Treasury yields BX:TMUBMUSD10Y start to rise. Elsewhere, oil CL.1,

Gold GC00 rose nearly 3%,

It also moves up. The Nikkei 225 (JP:NIK) hit a 33-year high, on a mixed day for Asia.

|

Performance of key assets |

last |

5d |

1 m |

YTD |

1y |

|

Standard & Poor's 500 |

4,763.54 |

-0.13% |

3.05% |

-0.13% |

22.39% |

|

Nasdaq Composite |

14843.77 |

-1.12% |

2.85% |

-1.12% |

39.57% |

|

10 year treasury |

4.045 |

10.86 |

-15.89 |

16.37 |

42.39 |

|

gold |

2,037.90 |

-1.64% |

2.02% |

-1.64% |

8.61% |

|

oil |

71.23 |

-0.14% |

-0.24% |

-0.14% |

-4.86% |

|

Data: Market Monitor. The change in Treasury yields expressed in basis points |

|||||

Buzz

Juniper Networks JNPR stock,

rose 22% after the Wall Street Journal reported late Monday that Hewlett Packard Enterprise HPE,

Advanced talks are underway to buy the technology group for $13 billion.

MTCH group match,

Rally on report activist investor Elliott Management wants to make changes.

Samsung Electronics 005930,

Expectations of a decline in fourth-quarter profits

netflix nfl x,

Citigroup cut its shares to hold, and its analysts cited concerns about revenue and spending, but kept the target price at $500. The stock fell 2%.

urban outfitters inventory urbn,

It rose 5% after the retailer reported a 10% increase in year-over-year sales during the holidays.

Deutsche Bank upgraded JPMorgan Chase JPM,

To purchase from Wait and Piece Wells Fargo WFC,

To keep from buying, before bank and other earnings on Friday.

United Airlines UAL,

Loose bolts and “installation issues” were found when some Boeing BA aircraft were inspected,

737 Max 9 aircraft after mid-flight explosion last week. Boeing shares fell slightly in premarket, after falling 8% on Monday.

The trade deficit is scheduled for 8:30 a.m. and Fed Deputy Chairman for Supervision Michael Barr will speak at 12 p.m. Fed Governor Michelle Bowman said she now believes inflation can decline without further rate hikes.

France has appointed its youngest and first openly gay prime minister, Gabriel Attal.

Best of the web

The president of the National Association of Realtors resigns after receiving a “threat” with a “personal” revelation.

South Korea bans the dog meat industry in landmark legislation

The first unicorn in Lithuania: the Vinted phenomenon

Last year, the Earth flirted with globally agreed-upon warming limits

Highest indicators

These were the most searched indicators on MarketWatch as of 6 a.m.:

|

tape |

Security name |

|

TSLA, |

Tesla |

|

ran out, |

Nvidia |

|

Bachelor's, |

Boeing |

|

Camel, |

apple |

|

imc, |

AMC Entertainment |

|

New, |

New |

|

gme, |

GameStop |

|

Mara, |

Digital Marathon |

|

Amzan, |

Amazon.com |

|

AMD, |

Advanced micro devices |

Random readings

Indonesia is returning rare baby monkeys to the wild

Finally, the real reason behind urine turning yellow.

The Need to Know program starts early and is updated until the opening bell, but sign up here to have it delivered all at once to your email inbox. The copy will be emailed at approximately 7:30 a.m. ET.