Trammell Venture Partners (TVP), headquartered in Austin, Texas, has revealed its second annual findings from its in-depth research into the thriving venture capital and native Bitcoin startup ecosystem.

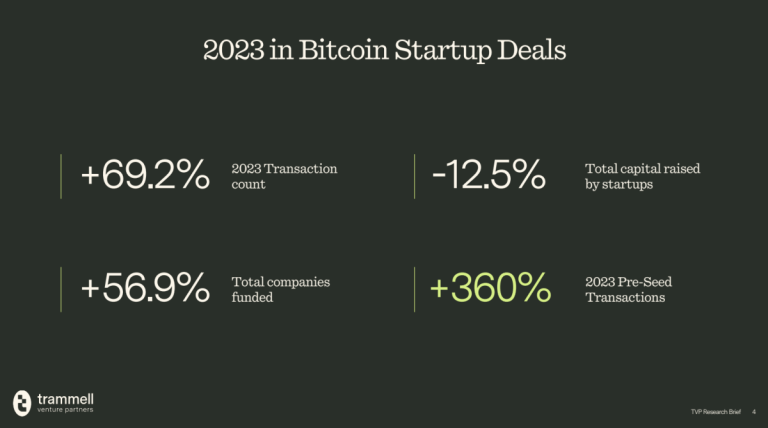

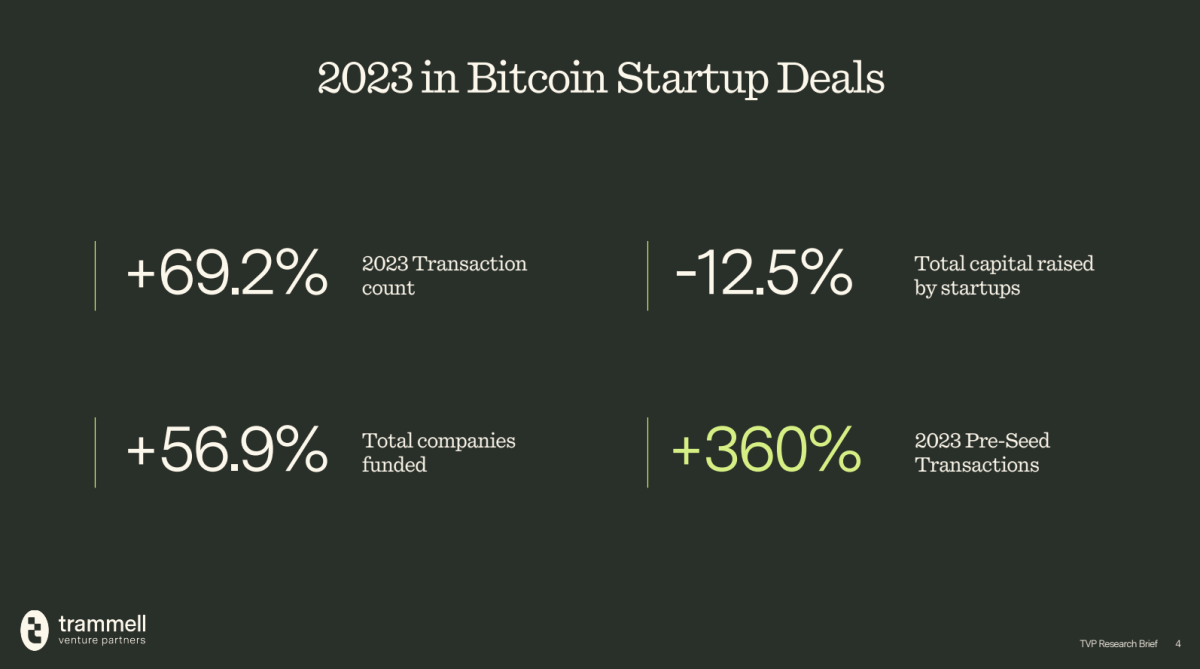

Despite a notable decline in cryptocurrency market investments throughout 2023, TVP research highlights a notable boom in the Bitcoin startup sector, particularly at the pre-seed stage, with a staggering 360% year-on-year rise in the number of transactions.

In contrast to the broader startup landscape that is seeing exit activity decline to a 10-year low in 2023, Bitcoin-based startups have shown resilience and growth, representing a 69.2% year-over-year increase. TVP data revealed that early-stage Bitcoin startups collectively raised nearly $1 billion between 2021 and 2023, demonstrating significant interest and investment in this sector.

Christopher Callicut, Managing Director and Co-Founder of TVP, commented on the results, noting the strong desire among founders to build on Bitcoin. He highlighted the growing supporting infrastructure and technical advancements fueling innovation within the Bitcoin ecosystem.

“Early indications from TVP research are consistent with the expectations we had for the end state of the crypto project: the founders really want to build on Bitcoin specifically,” Callicut said. “With a rapidly growing set of technical enablements fueling the improved scalability and buildability of Bitcoin, the long-standing TVP hypothesis is now a reality supported by evidence and data.”

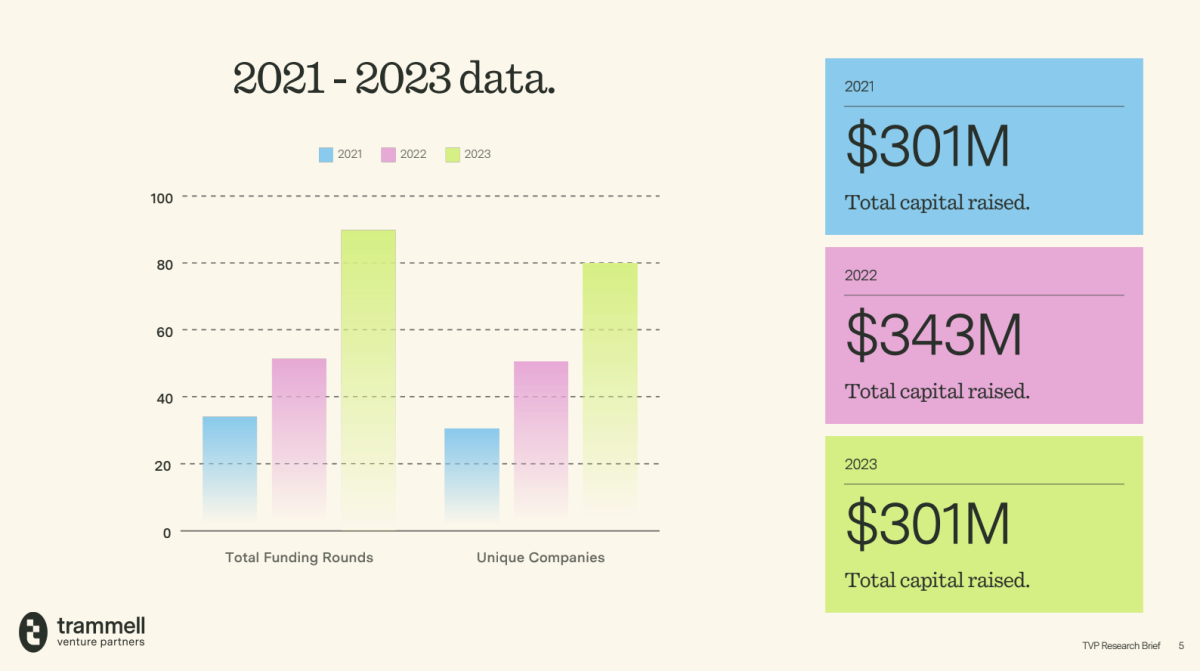

In 2023, the number of original Bitcoin project deals grew significantly, rising by 69.2%, while the number of broader cryptocurrency project deals fell by 35.3%. Despite the increase in Bitcoin startup deals, cryptocurrency venture deals still represent the vast majority of the number of deals and venture funds invested.

“Due to cyclicality and institutional embrace of Bitcoin, its market capitalization dominance is greater than it was at the time of our 2023 report,” Callicut continued. “Despite this, the original venture capital allocation to Bitcoin is still very low, relatively.” We believe Delta will begin to close as more distributors begin to see compounding benefits from the rapidly expanding design space on Bitcoin thanks to early-stage Bitcoin startups. “early.”

TVP's commitment to driving insights and research on the venture capital landscape has led to the launch of the first dedicated fund series focused on the Bitcoin native ecosystem in 2021. This annual edition of TVP's Bitcoin Native Emerging Venture Capital Research Digest aims to deliver valuable data and support to institutional investors Who are looking to explore opportunities within the growing Bitcoin startup sector.

The full TVP Bitcoin startup ecosystem research brief is available for download, providing a comprehensive overview of the evolving landscape and investment opportunities in Bitcoin's native technologies.