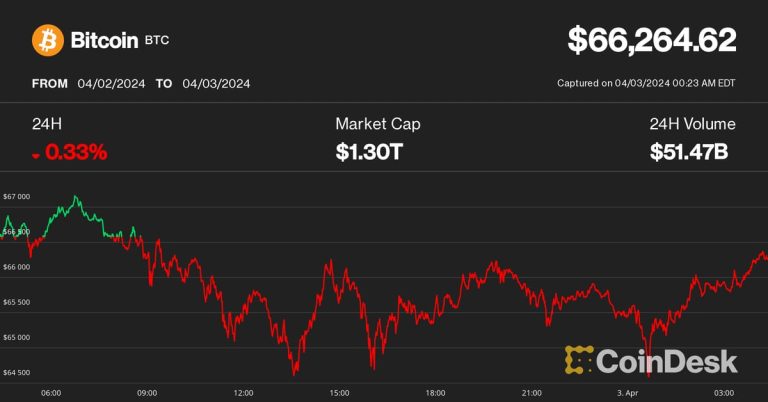

Bitcoin (BTC) maintained losses during Asian trading hours on Tuesday, trading at around $66,000, as traders digested a rebound in Treasury yields and the possibility of the Federal Reserve delaying interest rate cuts until later this year.

At the time of writing, Ethereum (ETH) is trading above $3,300, while CoinDesk 20 (CD20) is down 0.6% to 2,532.

The 10-year Treasury yield hit a two-week high of 4.40% overnight on persistent inflation and unexpectedly strong manufacturing activity. A rise in the so-called risk-free rate usually leads to an outflow of money from risky assets and zero-return investments such as gold. However, the yellow metal remained resilient amid the weak tone of Bitcoin and the tech-heavy Nasdaq on Wall Street.

“Bitcoin fell to $65,000, mostly due to recent macro expectations on interest rates and rising Treasury yields,” Samir Gabelcik, director of capital formation at Pythagoras Investments, said in an email interview. “High interest rate environments typically tend to reduce investors' appetite for risk.”

At Polymarket, bettors ruled out a rate cut by May and were split 50-50 on whether it would happen in June. Most confirmed moneys happen in the fall.

The Fed's CME monitor has a 97% chance that interest rates will remain unchanged after the May meeting.

Coinglass data shows that over $245 million of long positions were liquidated in the past 24 hours, with $60 million of BTC positions re-liquidated.

Jun Young Heo, derivatives trader at Presto in Singapore, added: “Perpetual futures funding rates for most crypto assets have returned to 1 basis point, and global futures open interest fell by 10 percent overnight, indicating the closing of some long positions with significant exposure.” Leverage.

“Given that recent inflows from Bitcoin ETFs have stagnated, and Bitcoin and Ethereum market prices are below the 20-day moving average, some trend followers would have viewed yesterday’s pullback as the end of a two-month rally,” he continued.