-

Bitcoin rose to the $70,000 level after a 10-day cooling off period.

-

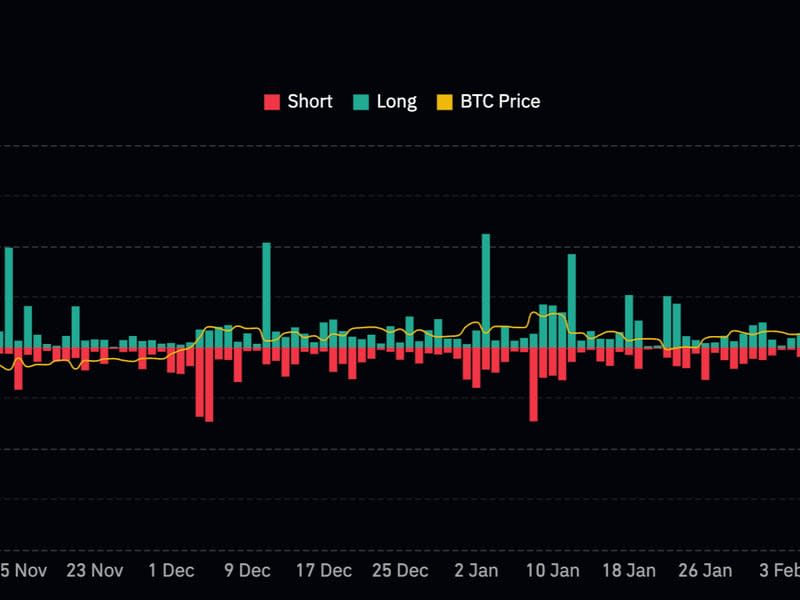

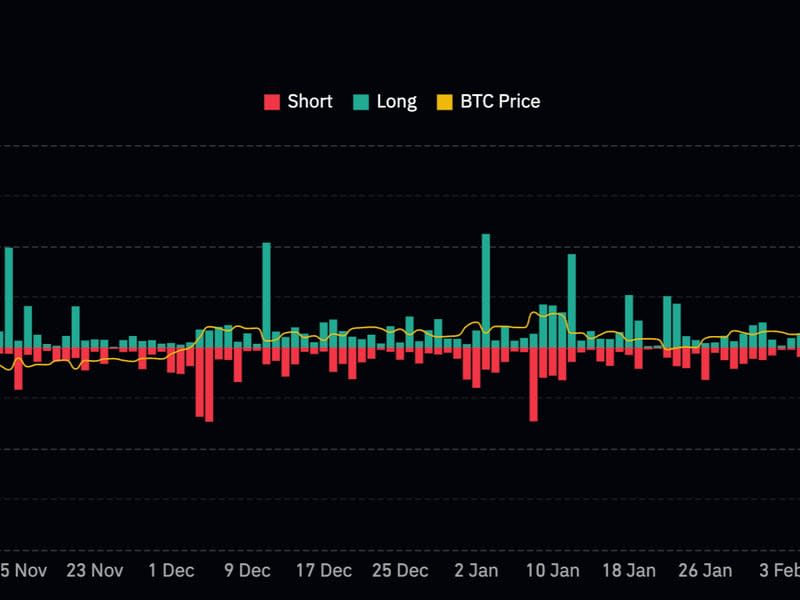

The rally did not trigger mass short liquidations, indicating that there were not many market participants using leverage to bet that prices would fall.

-

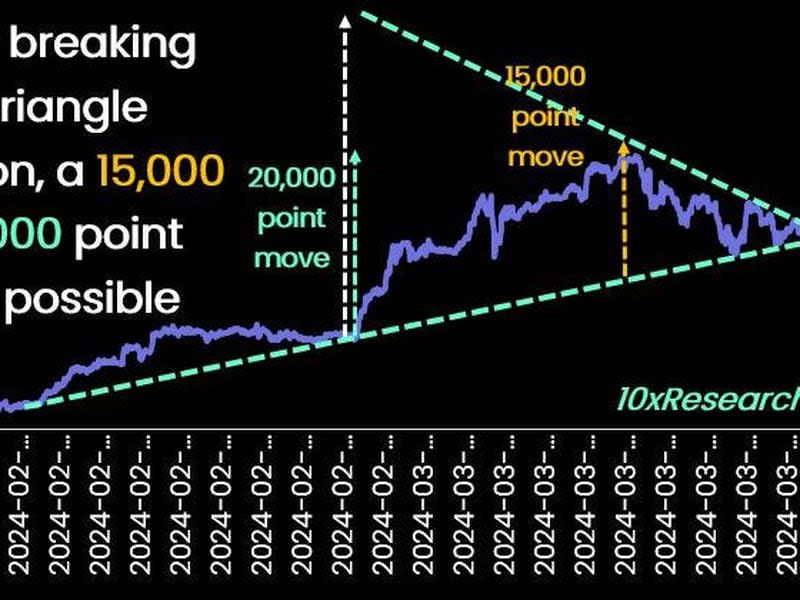

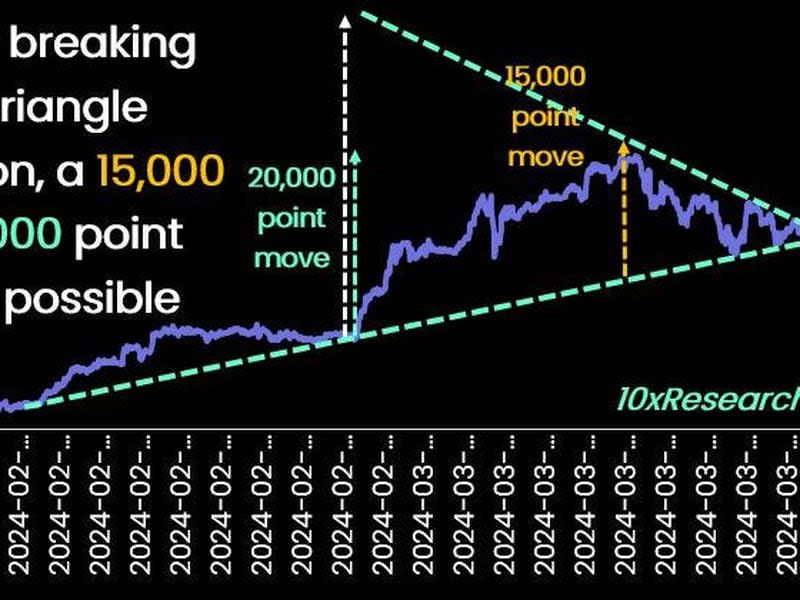

Bitcoin could reach $83,000 after a bullish breakout from a consolidation pattern, 10x Research said.

Cryptocurrencies started the week with a strong rally, rebounding from recent losses as Bitcoin {{BTC}} traded back above its 2021 peak.

Bitcoin {{BTC}} rose above $70,000 on Monday during US trading hours, surpassing the level for the first time in 10 days and gaining more than 7% over the past 24 hours. Ethereum Ethereum {{ETH}} rose 6% over the same period, while major layer-one blockchain tokens Solana {{SOL}} and Avalanche {{AVAX}} advanced more than 10%.

The rally extended to almost all digital assets, as all components of the broad-based CoinDesk 20 (CD20) index were in the green and the gauge rose 6.1% for the day.

The spike led to the liquidation of $195 million in leveraged derivatives positions across all crypto assets, about $129 million of which were short positions seeking to profit from lower prices, CoinGlass data showed. Bitcoin short liquidations reached $53 million, below the average daily figure for the last period.

The relatively modest amount of short liquidations despite rising prices suggests that there are not many market participants using leverage to bet on continued weakness.

Bitcoin is targeting $83,000 and above after breaking out of the consolidation pattern

Monday's surge signaled a potential end to the recent correction in cryptocurrency markets, which saw BTC fall below $61,000 last week from record prices of more than $73,000, coupled with tepid inflows into new U.S.-listed spot bitcoin ETFs and increased fund selling. Grayscale's GBTC.

Bitcoin could target all-time highs after a bullish breakout from a consolidation pattern, analytics firm 10x Research said in a report on Monday. Based on the formation of a symmetrical triangle, a chart pattern in technical analysis, the breakout could herald a rise in Bitcoin price ranging from $15,000 to $20,000 for the next move from around $63,000, the report said. This would push BTC as high as $83,000.

Markus Thelen, founder of 10x, said another critical level that Bitcoin crossed today is the 2021 peak at $68,000, given that when “the highs of the previous market cycle were retested and broken again, Bitcoin tended to make significant rallies.”

The report said that the upward trend is supported by several central banks leaning towards dovish stances, which would benefit Bitcoin.

“The Fed has signaled that it is willing to accept higher inflation for a longer period and is keen to slow quantitative tightening,” Thelen said. “The Bank of Japan and the Swiss National Bank also surprised on the dovish side.”

The report highlighted that Bitcoin tends to perform well during US election years – and 2024 is one of them – historically advancing 100% to 200%, which also supports the case for a price rally later this year.

“Our upside targets of $83,000 and $102,000 could slowly come into play,” Thielen said.

Updated (15:45 UTC, 03/25/24): The price of the notes exceeds 70 thousand dollars.