Eleven approved bitcoin exchange-traded funds have painted the leading cryptocurrency with a new layer of legitimacy. By obtaining the official blessing of the Securities and Exchange Commission (SEC), the barrier to institutional investment has been lifted.

With this barrier gone, financial advisors, mutual funds, pension funds, insurance companies and individual investors can now gain exposure to Bitcoin without the hassle of direct custody. Most importantly, the flaw has been removed from Bitcoin, which was previously likened to “tulipomania,” “rat poison,” or a “money laundering indicator.”

After an unprecedented domino of cryptocurrency bankruptcy throughout 2022, Bitcoin's price returned to the November 2020 level of $15.7K by the end of that year. After depleting its large FUD reservoir, Bitcoin slowly recovered throughout 2023 and entered 2024 at the $45K level, first visited in February 2021.

With Bitcoin's fourth halving in April, and ETFs setting new market dynamics, what should Bitcoin investors expect next? To determine this, one must understand how Bitcoin ETFs have increased Bitcoin trading volume, effectively stabilizing Bitcoin price fluctuations.

Understanding Bitcoin ETFs and market dynamics

Bitcoin itself represents the democratization of money. Not beholden to a central authority like the Federal Reserve, Bitcoin's decentralized network of miners and algorithmically determined monetary policy ensure that its limited supply of 21 million coins is not tampered with.

For Bitcoin investors, this means they can have exposure to assets that do not follow an inherent path of devaluation, which is in stark contrast to all fiat currencies in the world. This is the basis for realizing the value of Bitcoin.

Exchange-traded funds (ETFs) represent another path to democratization. The purpose of ETFs is to track the price of an asset, represented by stocks, and enable trading throughout the day unlike actively managed mutual funds. Passive price tracking of ETFs ensures lower fees, making them an accessible investment tool.

Naturally, it will be up to Bitcoin custodians like Coinbase to implement sufficient cloud security to instill investor confidence.

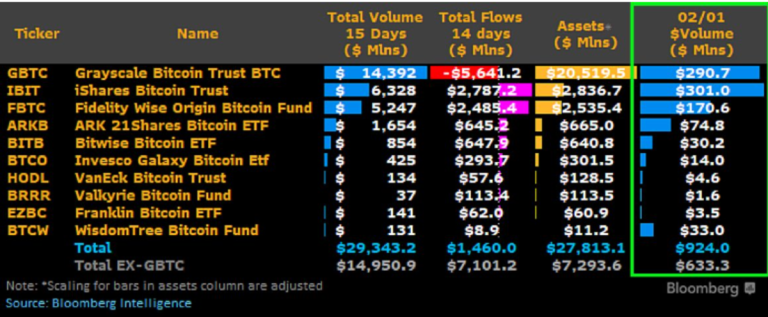

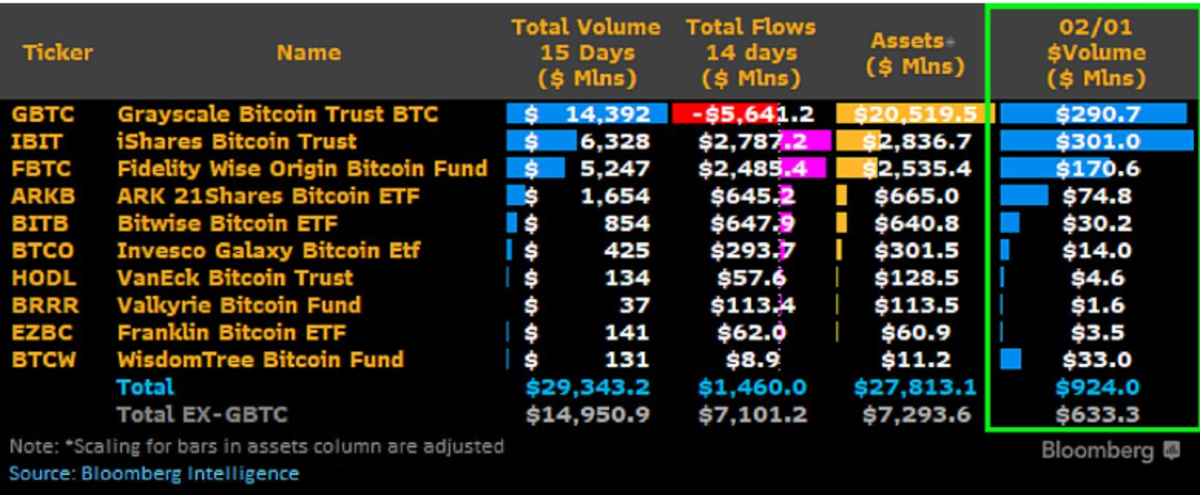

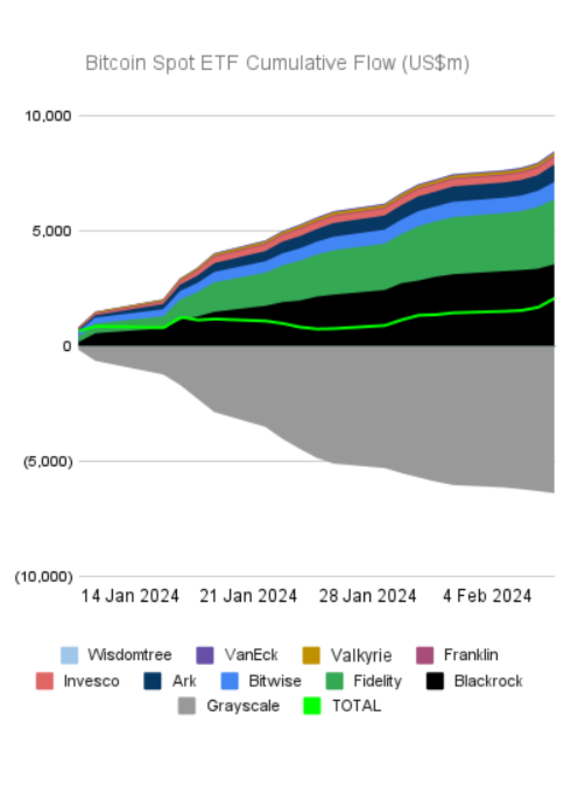

In the world of ETFs, Bitcoin ETFs have shown high demand for decentralized assets resistant to central dilution. Overall in the last 15 days, this resulted in $29.3 billion in trading volume versus a $14.9 billion squeeze from Grayscale Bitcoin Trust BTC (GBTC).

This is not surprising. With the price of Bitcoin rising due to the hype of Bitcoin ETFs, 88% of all Bitcoin holders entered the profit zone in December 2023, eventually reaching 90% in February. In turn, GBTC investors were cashing out, putting $5.6 billion worth of downward pressure on Bitcoin's price.

Furthermore, GBTC investors benefited from lower fees from newly approved Bitcoin ETFs, shifting funds from GBTC's relatively high 1.50% fee. At the end of the day, BlackRock's iShares Bitcoin Trust (IBIT) won volume with a fee of 0.12%, which will rise to 0.25% after a 12-month winding down period.

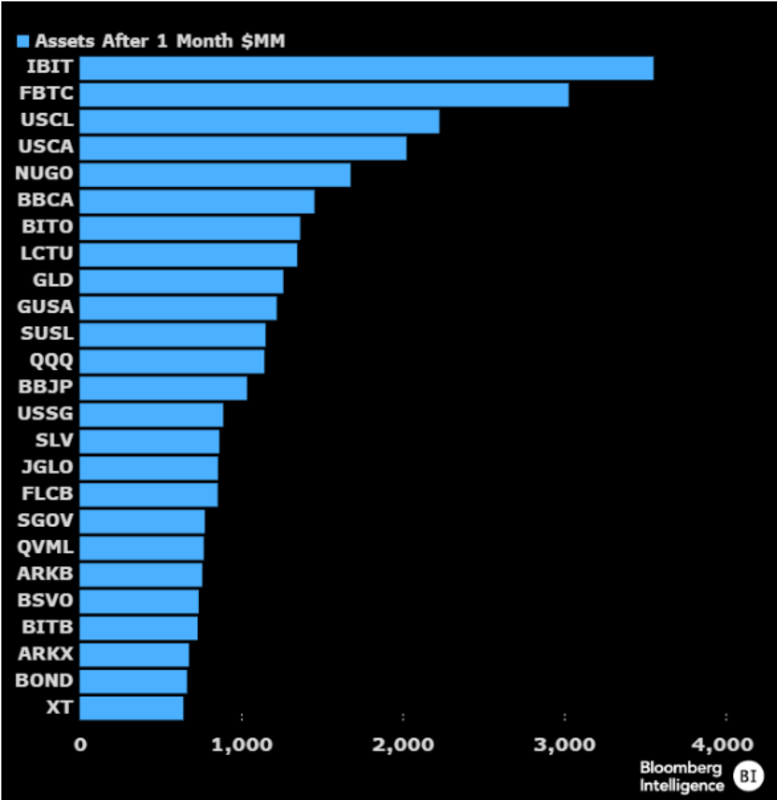

To put this in context with the broader ETF universe, IBIT and FBTC were able to outperform the iShares Climate Conscious & Transition MSCI USA ETF (USCL), which launched in June 2023, within a month of trading.

This particularly shows that Bitcoin's history is one of attacks coming from the direction of sustainability. It should be noted that the price of Bitcoin fell by 12% in May 2021, shortly after Elon Musk tweeted Tesla is no longer accepting BTC payments specifically due to environmental concerns.

During January, IBIT and FBTC found themselves in eighth and 10th place, respectively, as ETFs with the largest net asset inflows, led by the iShares Core S&P 500 ETF (IVV), according to the Morning Star report. With around 10,000 BTC per day flowing into ETFs, this represents a highly unbalanced demand of over 900 BTC mined daily.

From now on, with the decline of GBTC outflow pressure and the increase of the outflow trend, the continuous flow of funds into Bitcoin ETFs is poised to stabilize the price of BTC.

Stabilization mechanism

With 90% of Bitcoin holders entering the profit zone, the highest percentage since October 2021, selling pressure could come from many sources, institutional, mining, and retail. The high flow trend in Bitcoin ETFs is the bulwark against it, especially heading into another hype event – the Bitcoin 4th halving.

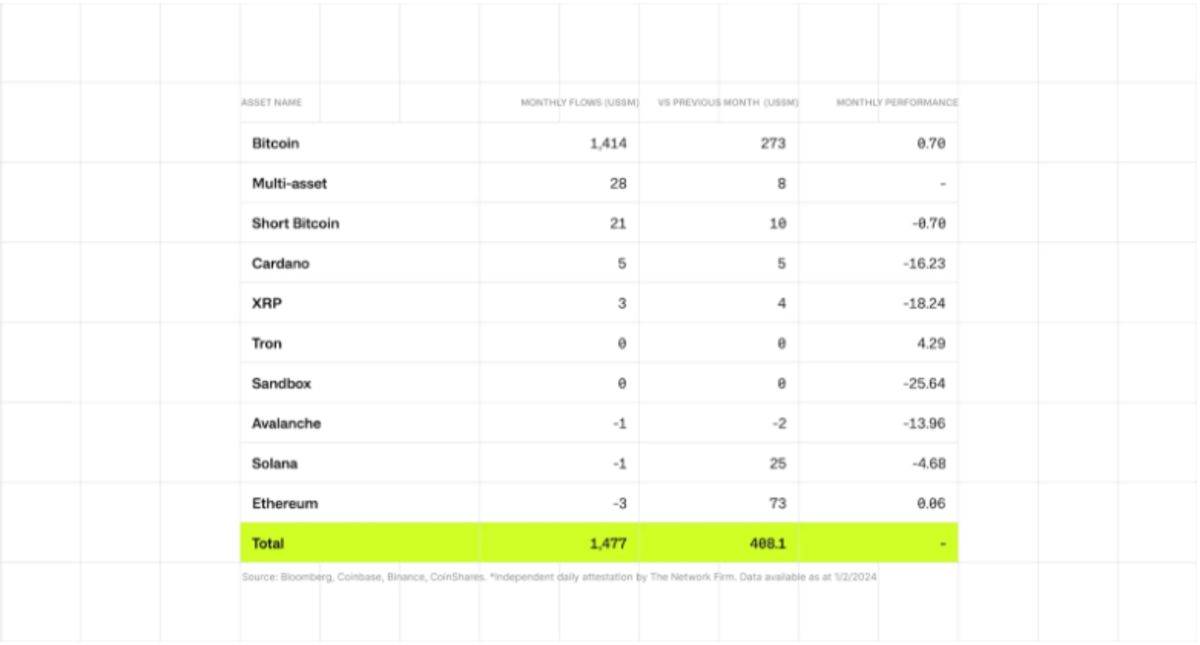

Higher trading volumes generate higher liquidity, which facilitates price movements. This is because large volumes between buyers and sellers absorb temporary imbalances. During January, a CoinShares report showed inflows of $1.4 billion from Bitcoin, along with $7.2 billion from newly issued funds in the US, versus GBTC outflows of $5.6 billion.

On the other hand, large financial institutions are setting new liquidity baselines. As of February 6th, Fidelity Canada has a 1% allocation to Bitcoin within its portfolio ETF. Given the “conservative” moniker, this suggests a larger percentage allocation in non-conservative funds in the future.

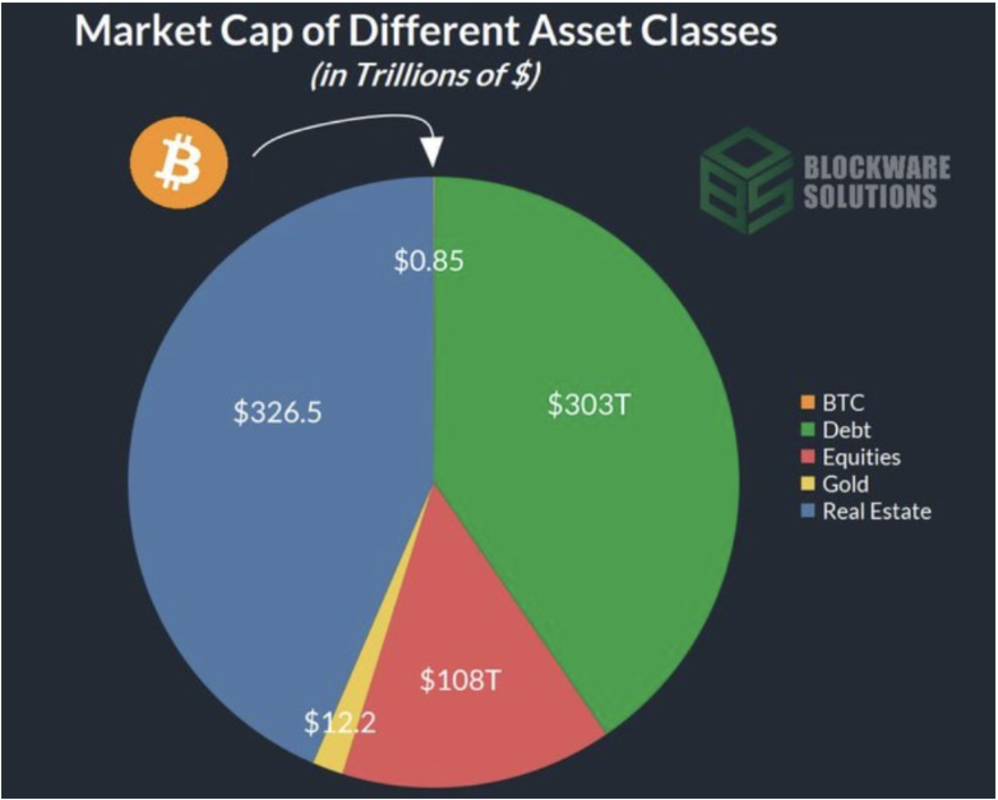

Ultimately, if Bitcoin taps 1% of the $749.2 trillion market pool across various asset classes, Bitcoin's market capitalization could grow to $7.4 trillion, pushing Bitcoin's price to $400,000.

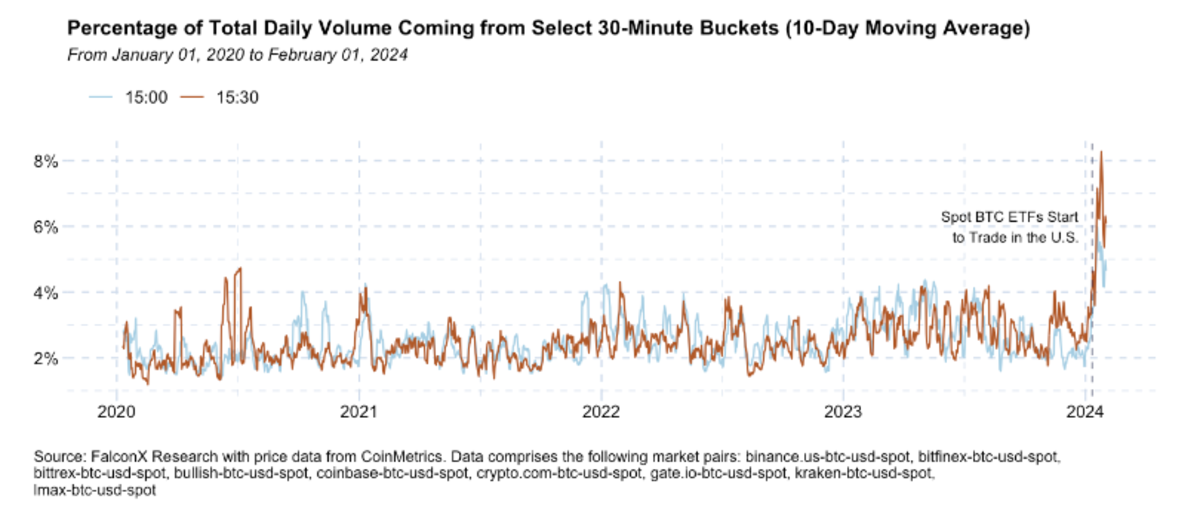

Given that Bitcoin ETFs provide a consistent and transparent reference point for the market price, large block trades reduce the market impact of potential sell-offs coming from miners. This is shown by FalconX research, which shows a significant rise in daily total volumes, previously from an average of 5% heading into the 10 – 13% range.

In other words, the new market order brought about by Bitcoin ETFs reduces overall market volatility. Until now, Bitcoin miners have been the main driver of price suppression on the other side of the liquidity equation. In Bitfinex's latest weekly on-chain report, mining wallets were responsible for 10,200 BTC worth of outflows.

This matches the roughly 10,000 BTC of the above inflows into Bitcoin ETFs, resulting in relatively stable price levels. As miners reinvest and upgrade mining rigs before the fourth halving, another stabilization mechanism could play a role – options.

Although the SEC has not yet approved options related to BTC ETFs, this development will increase the liquidity of ETFs. After all, the greater range of investment strategies that revolve around hedging increases liquidity on both sides of the trade.

As a forward-looking measure, implied volatility in options trading measures market sentiment. But the greater market maturity we will inevitably see following the introduction of BTC ETFs, we will likely see more stable pricing for options and derivatives contracts in general.

Analysis of inflows and market sentiment

As of February 9, the Grayscale Bitcoin Trust ETF (GBTC) owns 468,786 BTC. Over the past week, the price of Bitcoin rose by 8.6% to reach $46.2 thousand. In conjunction with previous forecasts, this means that Bitcoin dumping is likely to be widespread before the fourth halving and beyond.

According to the latest figures provided by Farside Investors, as of February 8, Bitcoin ETFs had inflows of $403 million, for a total of $2.1 billion. Total outflows from GBTC reached $6.3 billion.

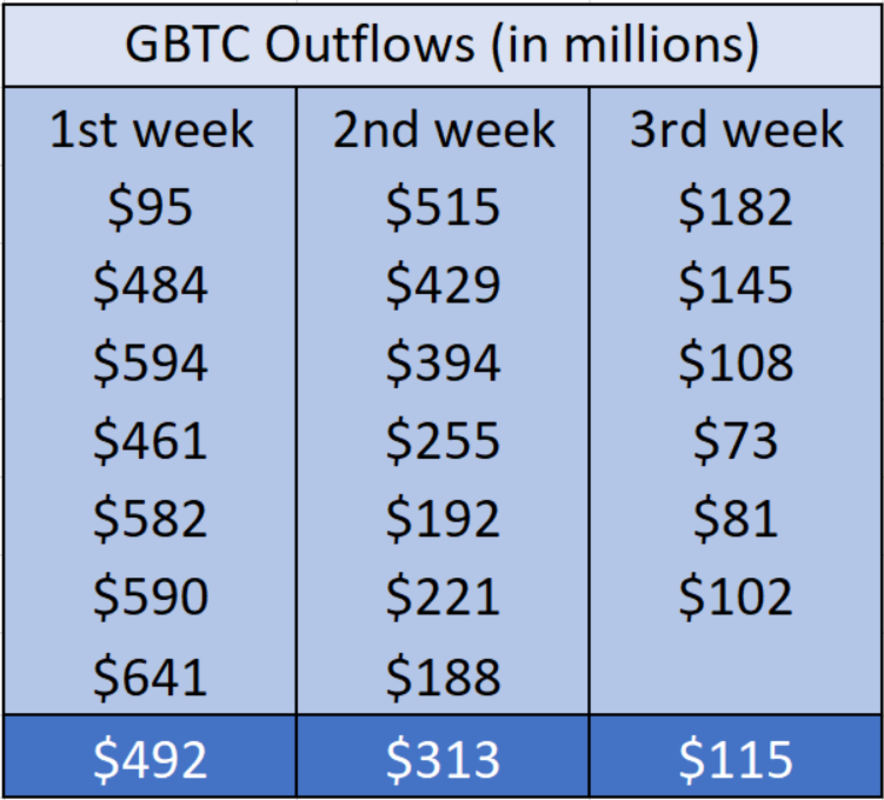

From January 11 to February 8, GBTC outflows steadily declined. During the first week, it averaged $492 million. In the second week, GBTC outflows averaged $313 million, ending with an average of $115 million during the third week.

On a weekly basis, this represents a 36% decrease in selling pressure from week one to two, and a 63% decrease from week two to three.

With the appearance of GBTC FUD until February 9, the Cryptocurrency Fear and Greed Index rose to “Greed” at 72 points. This marks a return to January 12, at 71 points, just a few days after the Bitcoin ETF was approved.

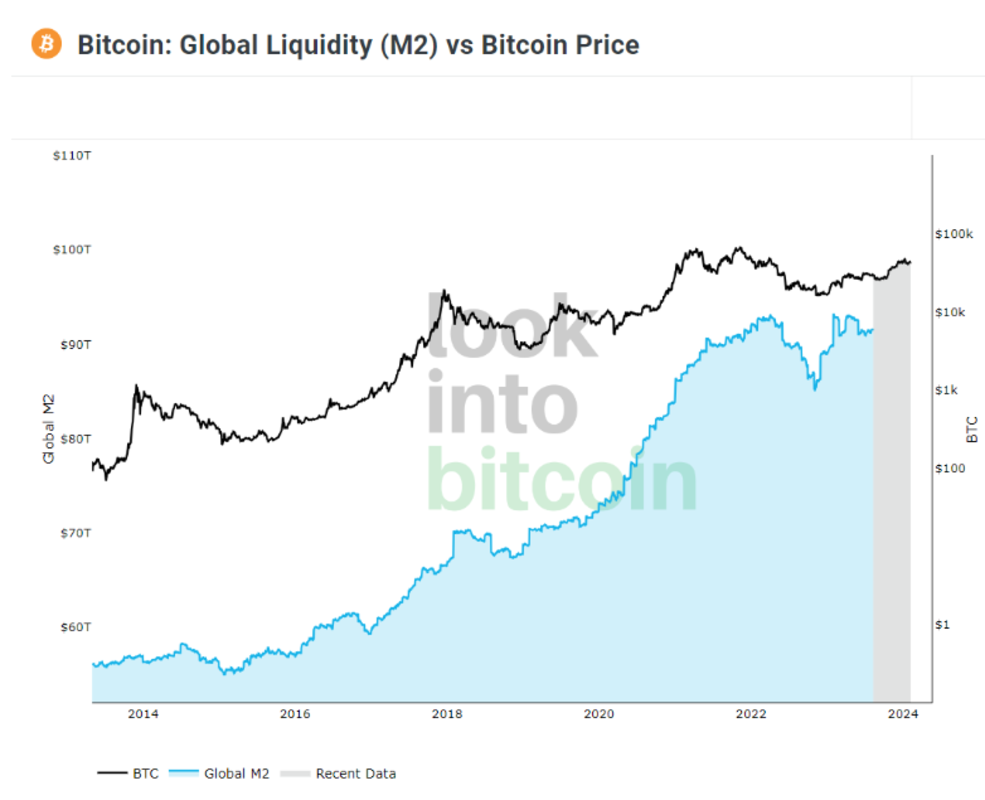

Looking to the future, it is worth noting that the price of Bitcoin depends on global liquidity. After all, it was the Fed's March 2022 rate hike cycle that caused a torrent of cryptocurrency bankruptcies, culminating in the FTX collapse. Current Fed Fund futures forecast the end of that cycle in either May or June.

Moreover, the Fed is unlikely to veer off the path of printing money. On such occasions, Bitcoin prices follow suit.

Given the insurmountable national debt of $34 trillion, while federal spending continues to outstrip revenues, Bitcoin positions itself as a safe-haven asset. One is waiting for capital inflows into the limited supply of 21 million coins.

Historical context and future implications

As a similar safe haven asset, Gold Bullion Securities (GBS) was launched as the first gold ETF in March 2003 on the Australian Securities Exchange (ASX). Next year, SPDR Gold Shares (GLD) were launched on the New York Stock Exchange (NYSE).

Within a week of November 18, 2004, GLD's total net assets increased from $114,920,000 to $1,456,602,906. By the end of December, that amount had dropped to $1,327,960,347. To reach BlackRock's IBIT market capitalization of $3.5 billion, it took GLD until November 22, 2005.

Although not adjusted for inflation, this indicates superior market sentiment for Bitcoin compared to gold. Bitcoin is digital, but it is based on a proof-of-work mining network that extends around the world. Its digital nature translates to portability which cannot be said of gold.

The United States government made this point when President Roosevelt issued Executive Order No. 6102 in 1933 for citizens to sell their gold bullion. Likewise, new gold veins are frequently discovered which weakens the limited supply situation unlike Bitcoin.

In addition to these fundamentals, Bitcoin ETF options are yet to materialize. However, Standard Chartered analysts expect $50 to $100 billion in Bitcoin ETFs by the end of 2024. Moreover, large companies have yet to follow MicroStrategy's lead by effectively converting equity sales into lower-value assets.

Even an allocation of 1% of BTC via mutual funds is expected to see the price of BTC skyrocket. Case in point, Advisors Preferred Trust has allocated a 15% range for indirect exposure to Bitcoin via Bitcoin futures and ETFs.

Conclusion

After 15 years of doubt and skepticism, Bitcoin has reached the pinnacle of credibility. The first wave of believers in sound money ensured that the blockchain version of it did not get lost in the basket of programming history.

On the back of their confidence, so far, Bitcoin investors have formed the second wave. The Bitcoin ETF event represents the main exposure event for the third wave. Central banks around the world continue to erode confidence in money, as governments can't help but indulge in spending.

With so much hype introduced into the exchange of value, Bitcoin represents a return to the roots of sound money. Its saving grace is digital proof, but also physical proof of functioning as energy. Barring extreme actions by the US government to sabotage institutional exposure, Bitcoin could overtake gold as a traditional safe-haven asset.

This is a guest post by Shane Nagle. The opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.