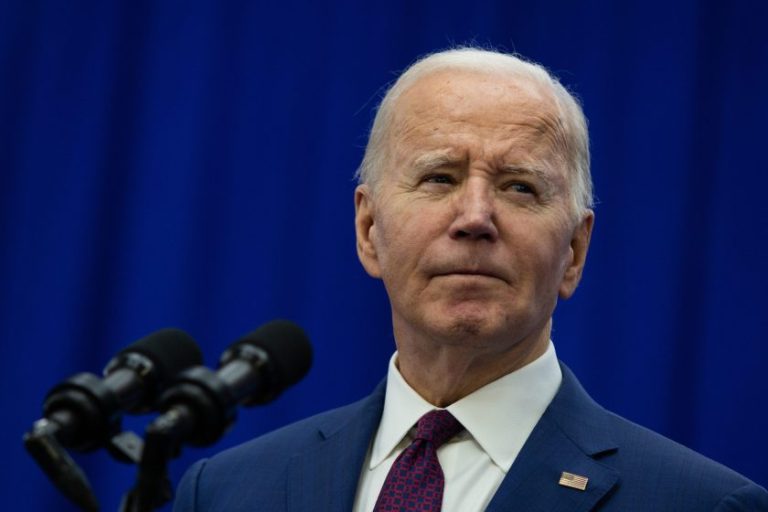

Joe Biden has revealed plans to tax cryptocurrency mining in his 2025 budget proposal. Jason Bergman – Bloomberg/Getty Images

US President Joe Biden has rolled out a variety of taxes and regulations related to cryptocurrencies, which he says could generate nearly $10 billion next year, and more than $42 billion over the next decade, according to his proposed 2025 budget released on Monday. Among the proposals is to impose an indirect tax on Bitcoin mining.

The proposal stipulates that any company that uses computing resources to mine digital assets would be subject to an excise tax equivalent to 30% of the costs of the electricity used. The proposed tax is scheduled to take effect after December 31, 2024, and will be introduced in three stages: 10% in the first year, 20% in the second year, and 30% in the third year.

“The budget saves billions of dollars by closing other tax loopholes that greatly benefit the wealthy and larger, more profitable companies,” the proposal continued, including “closing a loophole that benefits wealthy cryptocurrency investors.”

If implemented, miners would have to report the quantity and quality of electricity they use, as well as how much they paid if they bought it from an outside source. Meanwhile, miners who rent computing power – as is common in so-called mining pools – will be required to report the value of the company's electricity that rented it to them. The value will then serve as the tax base.

The Biden administration is proposing to impose a 30% tax on the electricity he uses #Bitcoin Miners, even if you are off the grid using your own solar and wind generation. All the reasons they give are pretextual, the real reason is that they want to suppress Bitcoin and launch CBDC. pic.twitter.com/juNHvO2NBx

– Pierre Rochard (@BitcoinPierre) March 12, 2024

Critics of the proposals include Republican Senator Cynthia Lummis, who expressed her opposition to the tax proposal On X. While the inclusion of cryptocurrencies in the budget indicates that the administration may be bullish on cryptocurrencies, a 30% tax would destroy the existence of the mining industry in the US, she tweeted.

The 2025 White House budget is incredibly bullish on crypto assets, and some would say they think it will go to the moon.🚀

But the proposed punitive 30% tax on digital asset mining would destroy any foothold the industry has in America.

– Senator Cynthia Lummis (@SenLummis) March 11, 2024

Bitcoin mining has been a growing business in the United States since the Chinese Communist Party banned miners operating in China in May 2021. The industry has taken off in Texas, thanks in part to the state's cheap power. Capitalizing on Bitcoin's tailwinds in this uptrend, shares in eleven publicly traded US mining companies have soared over the past year, with CleanSpark ($CLSK) up 270% over the past six months, according to CoinGecko data.

Meanwhile, Dave Rodman, cryptocurrency lawyer and founder of Rodman Law Group, also expressed his frustration with the proposals. Tell luck via email “I find it really funny that 'wealthy cryptocurrency investors' are included in the laundry list of oligarchs in this statement… The government is aware of the economic power web3 will wield but is focused on suppressing it while extracting it.”

Biden's call for a mining tax came as part of the proposed budget, which many view as merely a wish list or political statement, as new revenue measures must originate in the US House of Representatives, currently controlled by Republicans hostile to his agenda. .

This is not the first time the Biden administration has sought to limit mining operations. Biden introduced the same tax last March in his 2024 budget proposal, and he recently pressured miners to disclose the amount of energy consumed through a mandatory and emergency survey, but was forced to back away from it last month, after a legal backlash.

According to preliminary estimates published by the Department of Energy last month, industry could account for between 0.6% and 2.3% of total annual electricity use in the United States. For context, last year, Utah consumed roughly 0.8%, and Washington state, home to nearly 8 million people, consumed 2.3%. In Texas, Bitcoin mining has raised electricity costs for non-mining Texans by $1.8 billion annually, or 4.7%, according to Wood Mackenzie.

Additional proposals that would impact cryptocurrencies include provisions to apply wash sale rules to digital assets, reporting requirements for financial institutions and digital asset brokers and new foreign exchange account reporting rules, including cryptocurrency market rules.