US inflation has fallen, but not enough for voters to stop complaining about high prices.

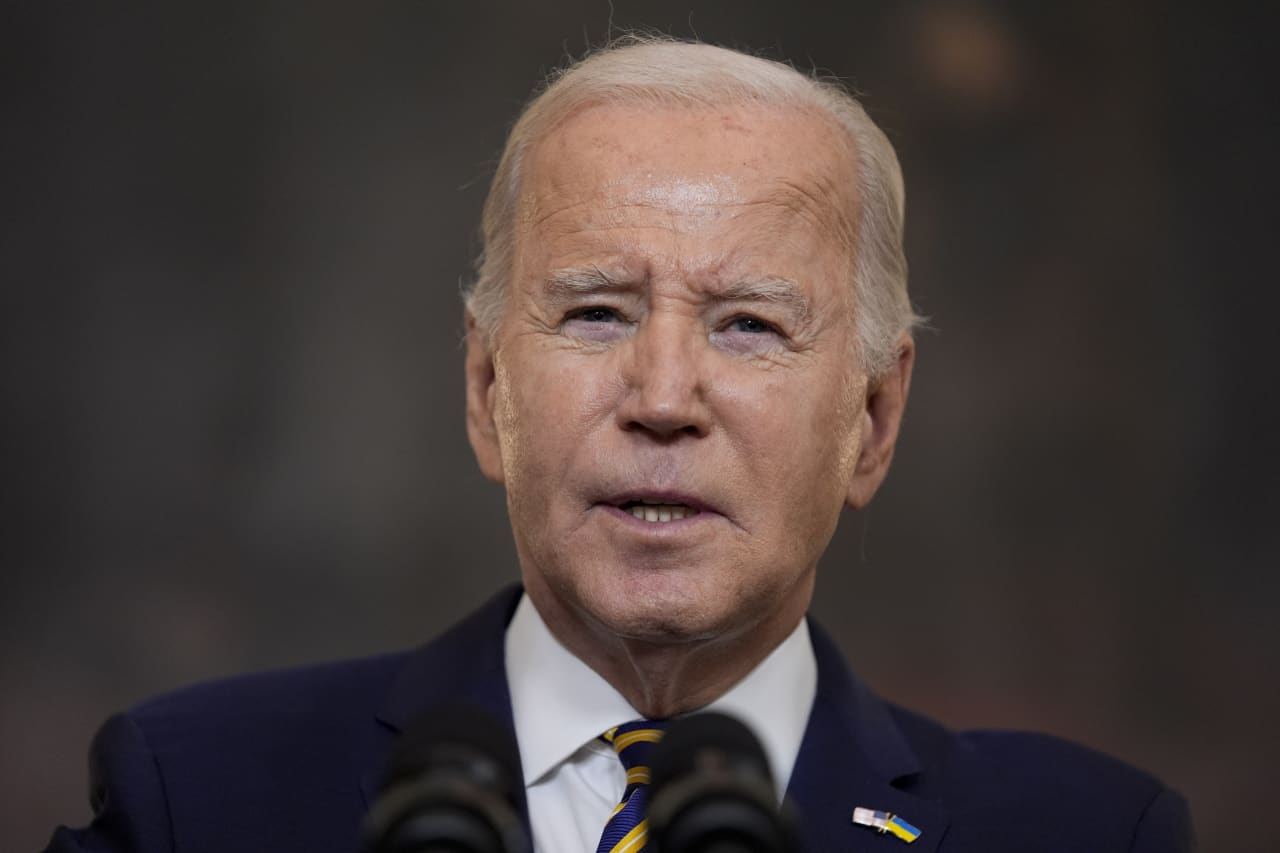

Since US President Joe Biden took office, the economy has recovered from the lockdowns caused by the Covid-19 pandemic and is now progressing, just as economists predicted in 2019 before the pandemic loomed.

The problem is that prices have jumped 18% under Biden, and inflation remains well above 2% per year. During former President Donald Trump's first three years in office, the inflation rate in the United States reached about 2%.

When it comes to inflation, all the blame falls on Biden. This is unconscionable, and reflects the unwillingness of many people to appreciate how markets work and prices are determined.

During the pandemic and early recovery, domestic and global supply chains collapsed, remember shortages of computer chips and support for West Coast ports. Ultimately, lockdowns in China reduced imports of components and finished manufactures.

With more Americans working from home and many service businesses closed, consumers spent more on some goods than on services, resulting in limited supplies.

Studies by the US Federal Reserve suggest that about half of the rise in prices can be attributed to supply constraints, which the Biden administration had little role in creating.

The US government pumped about $4.6 trillion in unemployment benefits, aid to states and local governments, and other stimulus spending. This was enabled by the Fed expanding its balance sheet to monetize a significant portion of the new federal debt generated.

The Fed printed money, but inflation economists predicted it didn't happen right away for good reasons. First, money must go out into markets for goods and services to have an impact. But other than buying more electronics and outfitting home offices and family rooms, Americans have barely spent all of their pandemic relief checks.

Household savings rose above trend by about $2.1 trillion and did not begin to decline significantly until late 2021 and then decline rapidly before early 2022. Likewise, state and local governments have not been able to spend coronavirus aid as quickly as it arrived.

All the savings suggest that the aid distributed by the Trump administration was far beyond what was needed to keep households, small businesses, and state and local governments afloat during the shutdown.

Second, the classical quantity theory of money requires full employment of more money to inevitably create higher prices. Unemployment in the United States rose from 3.5% in February 2020 to 14.8% two months later, and did not return to pre-COVID-19 levels until March 2022.

In the spring of 2022, two forces converged: pandemic money was finally being spent in earnest and labor markets were returning to full employment. The delayed price effects of money printing appeared in April 2022. With the Fed denying guilt and claiming that the price rise was temporary, inflation accelerated to 9.1% in June 2022.

If responsibility must be assigned, consider that Fed Chair Jerome Powell delayed action at the Fed, that Trump administered most of the $4.6 trillion in stimulus, and that Biden was warned that the final $1.9 trillion tranche was irresponsible.

Of the three, Biden is the incumbent, who is running for re-election. Recent polls tracked by RealClearPolitics indicate that 24% more voters disapprove of Biden's handling of inflation than approve. Even if the pace of inflation slows, that would be disturbing, and human nature is no friend to a sitting president at a time like this.

Grocery prices continue to rise but gasoline prices have fallen a lot since May. You would think Biden would get some credit for this, but it's human nature to focus on the bad news and ignore the good. We are equipped to respond more quickly to threats.

It's no surprise then, despite strong US growth, low unemployment and low inflation, that 57% of voters disapprove of Biden's handling of the economy. However, Trump likes big deficits too. If Trump were re-elected in 2020, he would also likely spend too much, and on inflation, I doubt Americans would be much better off.

Peter Morrissey is an economist, business professor emeritus at the University of Maryland, and a national columnist.

more: Real inflation may have peaked in late 2022 – at 18% – and still hover around 8%.

Read also: The last two scenarios when US stocks rose so quickly? During the dot-com bubble and after recessions.