“Let him cook” has been the expression used by all young people lately when describing someone or something that should not be interrupted, because it is in a state of success.

I know this article will be upsetting to some, especially because I've been bullish on Bitcoin with some enthusiasm over the past couple of months (although I first pointed it out to readers in December 2022), but as a new affiliate… church Bitcoin community, I would be remiss if I didn't try out my voice a little.

I apologize in advance for expressing my opinions on things that many members of Planet Bitcoin have talked about and discussed ad nauseam over the past decade. But, one way or another, I have to get myself up to speed, and I do that best through writing. As a result, you, the reader, are left here to suffer. So, you know, don't forget to renew your paid subscriptions Marginal financing.

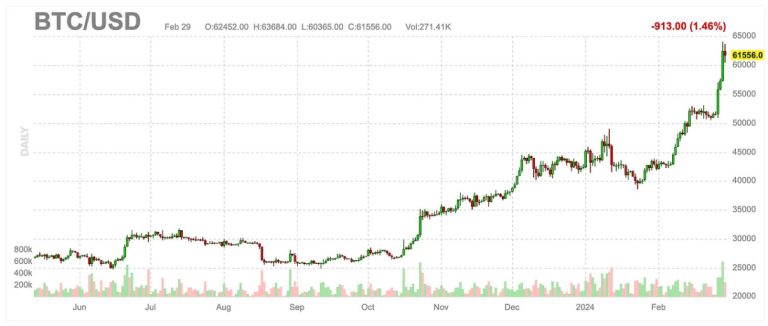

Enough of the introduction – we all know it's been a great week for Bitcoin, which has risen more than 20% in just a matter of days.

These moves have succeeded in increasing interest in the cryptocurrency even more than it had over the past month with the launch of ETFs. Hell, even Morgan Stanley came out this week and said they were considering getting in the ring and launching their own Bitcoin fund.

I've received a number of phone calls and text messages about Bitcoin, and I'm not even a prominent member of the community, nor am I a known bull. And so I can't even imagine the extent of the outbreak that long-time extremists and defenders have seen this week.

It's undoubtedly exciting, and I can't even imagine how long people have waited to savor this moment, after years of abuse from family members and uninformed assholes like me, as well as general skepticism around the asset class. But if there's one small lesson I've learned from decades in capital markets that I think can translate across asset classes, it's this Celebrate modestly and prepare for the worst.

This may seem the furthest thing from people's minds this week, but for me, it has always been the best way to taste success. Many people who listened to the podcast I did a couple of weeks ago with Peter McCormack know that it was arrogance and arrogance that initially turned me away from Bitcoin. Maybe this was my fault because I didn't have an open enough mind and didn't do enough of my work – a mistake that caused me to miss out on significant gains. But today I speak as one of the people who can envision Bitcoin as a long-term success and is really excited about getting the rest of the world on board.

Over the past week, my Twitter feed has been full of people celebrating victory, bragging, and lashing out at those who doubted prices might rise again. Here's one example from my brother James Lavish, whom I know well enough to know that he wouldn't mind me using him as an example because he knows I respect him. Look at Exhibit A: James is talking nonsense to Vanguard.

Does James have a point? Yes he does. Could it be true 50 years from now too? Yes he can. But is it right to make fun of the $7.7 trillion bear? For me, not really. I'd rather just enjoy the satisfaction of quietly temporary dubbing.

Everyone has the right to celebrate this short-term event in any way they want, but what I am suggesting today is that from both a karmic and psychological perspective, The less you force the issue and the more humility you show, the more balanced and stable Bitcoin will be across the rest of the world.

Think about this: celebrating making an exorbitant amount of money or tweeting angrily about your success will do two things: (1) it will turn off people like me who think this behavior is generally synonymous with fraud and (2) it will interest investors with less than average experience. And who will be looking for quick riches and will not be the steady hands that Bitcoin needs for lasting success.

Instead, what I'm proposing is to let the news media do what they do (generally be useless and chase stories long after they happen) and let people come to a realization about Bitcoin in the same way I did: mine, sOnce I felt as if I wasn't choking on the thought From external sources anymore.

My interest in looking at Bitcoin this round in early 2024 was completely organic: news coverage of it had died down, and I had blocked or unfollowed enough people who were promoting it, that I could get some clarity and some peace of mind about it. That's when I sat down to think about how it worked, seriously, for the first time ever. It was that quiet, comfortable, blank canvas that allowed me to understand the relatively complex concepts of how it works and believe in them the way I do now.

I think that given the astrological week we've just had, it's best to “act like we've been here before” and remember that sometimes the more you push an idea, the more people tend to resist rather than bark like it. Hyenas mock people. If Bitcoin had a market cap of $50 trillion, that would be a different story. But we're still in the early stages of this relationship with the rest of the world, and like any good relationship or friendship in your life, there has to be a real organic interest in “showing up” to the idea of this happening. All those who have been suffocated by a partner or friend in the past know that all it does is create distortions and unhealthy dynamics. Such delicate things cannot be forced, but rather deliberately accepted like a deep, slow, purposeful breath outside on a winter's day.

That doesn't mean I don't think this week is the beginning of a much greater adoption that will likely send the price of Bitcoin higher. As I said in the What Bitcoin Did podcast, I believe there is at least one country, if not several, looking to put Bitcoin on their sovereign balance sheets, and that this will start a period of game theory digital asset revolution the likes of which we have not yet seen. And just days after I said that, Edward Snowden came out yesterday and assumed the same thing.

Try to keep up with me, Eddie.

But in all seriousness, we know what will happen if the price continues to rise. The hype will continue to rise, as will interest and adoption. People will have the same realization that it took me a decade to discover: This thing simply isn't going anywhere anytime soon. But if you ask me, especially in light of the fact that we all know how quickly price action can return to the downside in the short term, I think it would be beneficial for the community to focus less on raising the bar here and more on how to get there. He will be able to clearly explain and convey the transformation unfolding before our eyes in a calm, thoughtful and comprehensive manner.

After all, who do you want to deal with in the next 20% of overnight declines: unsophisticated lunatics or thoughtful investors who already know and expect volatility that is considered certain.

The more time we spend making reasonable expectations that Bitcoin can easily exceed, rather than overpromising and underdelivering, the less time we have to brag about being right. The journey is the reward. Or as the Bible says:

“With pride comes humiliation, and with humility comes wisdom.”

—Proverbs 11:2

But I think if Jesus were around today, he would simply tell us to “let Bitcoin cook.”

QTR Disclaimer: I'm a fool and I often get things wrong and lose money. I may own or deal with any names mentioned in this piece at any time without notice. I haven't double-checked any figures or numbers in this piece and I'm generally lazy in my research. Contributor posts and aggregated posts have not been verified and are the opinions of their authors. Contributor posts and curated content are published either with the author's permission or under a Creative Commons license. This is not a recommendation or solicitation to buy or sell any stocks or securities, just my opinions. I often lose money on the positions I trade/invest in. Sometimes I lose money by misplacing it. I'm generally irresponsible. I may add any name mentioned in this article and sell any name mentioned in this article at any time, without further warning. These positions may change immediately once this is posted, with or without notice. are you alone. Don't make decisions based on my blog. Search elsewhere. I exist on the sidelines. The publisher does not guarantee the accuracy or completeness of the information provided on this page. These are not the opinions of any of my employers, partners or colleagues. I have done my best to be honest about my disclosures but I cannot guarantee that I am right; I write these posts after a couple of beers sometimes. Also, I just make mistakes a lot. Mention it several times because it is important to you.

This piece was originally published on Quoth the Raven's Substack here.

This is a guest post by Quoth the Raven. The opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.