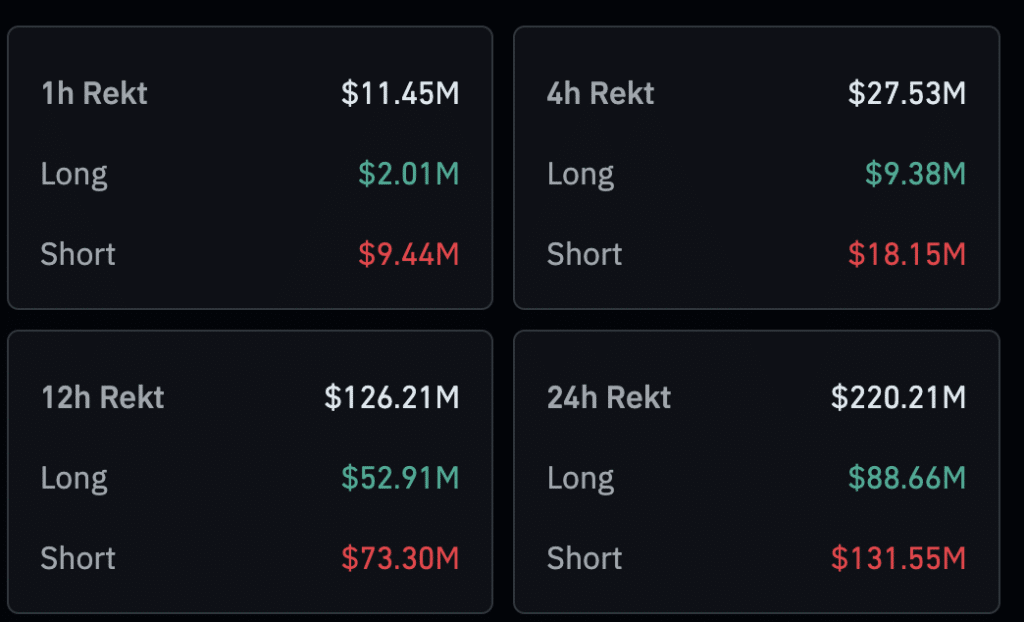

Liquidations of traders' positions on major cryptocurrency exchanges due to jumps in cryptocurrency prices over the past 24 hours exceeded $220 million.

According to Coinglass, on March 4, most liquidations were in Bitcoin (BTC), amounting to approximately $60 million. Traders also liquidated positions in Ethereum (ETH) worth $26.84 million. It is worth noting that traders actively closed their positions in memecoins, including Dogecoin (DOGE), Pepe (PEPE), Memecoin (MEME), and Shiba Inu (SHIB). DOGE and PEPE accounted for the most liquidations in this category – $18.12 million and $12.27 million, respectively.

The most significant liquidations occurred on the Binance cryptocurrency exchange worth $88.72 million, followed by OKX which saw liquidations worth $82.59 million.

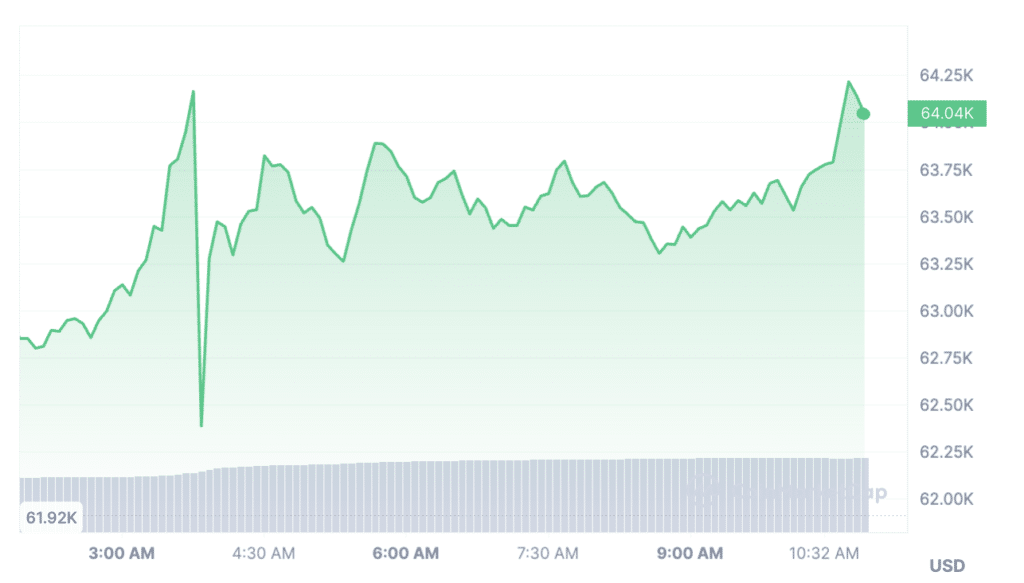

On March 4, Bitcoin surpassed $64,000. At the time of writing, Bitcoin is trading at $64,050, having risen almost 4% over the past 24 hours. Bitcoin (BTC) has increased its price by more than 24% in just one week.

Matrixport analysts confirm that the institutional aspect is now intertwined with physical demand. The imbalance between supply and demand continues to push BTC prices higher.

K33 experts also point out in their report that exchange-traded funds (ETFs) have emerged as an important topic, particularly with regard to their ability to boost the price of BTC past its previous all-time high (ATH) of around $70,000. Another growth driver will be the upcoming halving in spring 2024.