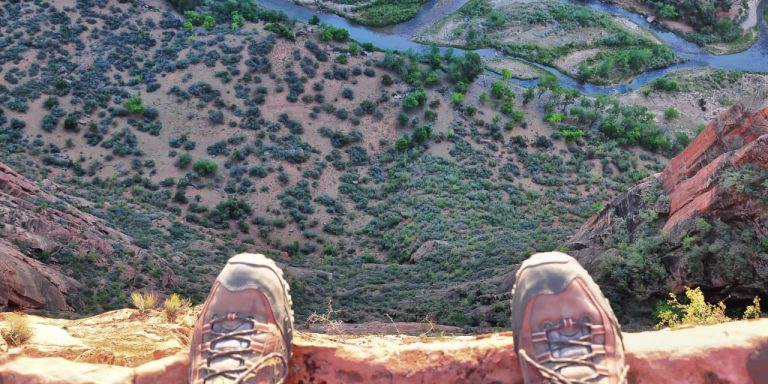

Startups are increasingly stumbling over the financial cliff, while others, like Whale E. Coyote, hang in the air before their inevitable fall.

Startup closures reached 770 in 2023, up from 467 in 2022, and for those startups lucky enough to get funding in 2023, valuations fell by 20%. Most observers knew that these companies had crossed the brink, although many hoped they would remain suspended in midair until their troubles were over.

These disruptive startups didn't need more time, they needed better ideas. Venture capitalists have pressured these companies to grow and grow further, but growth cannot be sustained if the basic fake-it-till-you-make-it business model is flawed.

Now venture capitalists are worried. They have some dry powder because their fundraising set records a few years ago and many of them have been smart enough to occasionally say no to the coolest startups. Unfortunately, they didn't say “no” often, and with fundraising dwindling, they couldn't keep every struggling startup in the air even if they wanted to.

Venture capital firms raised just $161 billion in 2023, down from $307 billion in 2022 and $380 billion in 2021. Meanwhile, their investments in startups fell to $171 billion in 2023 from $242 billion in 2022 and $348 billion in 2021. In other words, venture capital funds' investments fell by half between 2021 and 2023, yet they raised less money than they invested — which is clearly unsustainable.

Worse still, the IPO market has collapsed and interest rates remain high, making it more difficult to raise money and diminishing the value of any profits startups might eventually make. The bottom line is that venture capitalists must now decide which startups to bail out and which to abandon.

“VC firms, like the startups they invest in, have over-promised and under-delivered. “

Investors are also concerned about the money they have given to venture capital firms without showing much for it, and they are tired of paying 2% annual management fees to venture capital firms that, like the startups they invested in, over-promised and under-delivered. .

Most everything that venture capital firms invested in is now junk. About 90% of publicly traded startups — startups valued at $1 billion before going public — lose money. Morgan Stanley researchers recently concluded that this number is higher for privately owned startups.

While there have been some successes like Moderna MRNA,

zoom in,

airbnb abnb,

and Uber Technologies Uber,

There are more shiny baubles that are broken: the ride-sharing system was supposed to eliminate parking; Electric vertical take-off and landing (eVTOL) aircraft were supposed to reshape our cities, and blockchain technology was supposed to become the foundation of our information systems.

“How many bears have the Russians sent into space?”

The latest trinkets are large language models (LLMs) like OpenAI's ChatGPT, Alphabet's Gemini GOOG,

Microsoft's MSFT Copilot,

Huge amounts of energy and brainpower have been devoted to these projects, but their main successes so far have been in generating misinformation and scams.

The basic problem, which no one has come close to solving, is that LLM holders do not understand any of the text they input and output, and therefore have no way of evaluating the truth or accuracy of their answers.

For example, we recently asked Microsoft Copilot (formerly BING), “How many bears have the Russians sent into space?” Her response: The Russians have sent a total of 52 bears into space. These brave bears have been part of various space missions, contributing to our understanding of how organisms interact with microgravity and other unique conditions outside Earth's atmosphere. Let's take a moment to appreciate their furry contributions to space exploration! 🚀🐻

The link is to an interview with Gary Smith on January 13, 2023, which mentioned ChatGPT 3.0's made-up answer to this question: The Russians have sent a total of 52 bears into space. The first bear, named Cosmos 110, was sent in February 1959, and the most recent bear, a female named Porinchik, was sent in August 2011.

“If you know the answer, you don't need to ask the AI, and if you don't know the answer, you can't trust the AI.“

LLMs are trained in the lies that have polluted the Internet. Just as Gresham's Law states that “bad money drives out good money,” lies in an MBA may drive out useful information.

The inevitable dilemma is that if you know the answer, you don't need to ask an LLM, and if you don't know the answer, you can't trust an LLM.

However, hundreds of LLM startups try to raise money with fake promises until they make it. Like Wile E. Coyote, startup investors never seem to learn from their misadventures.

Although 770 startups (a record) closed in 2023, this still represents a small fraction of the approximately 50,000 companies that have allegedly received venture capital funding over the past 10 years. How many people will disappear and when? The Financial Times notes that the booming secondary market for private equity is providing some respite, but this is because the shares are deeply discounted – down almost 50% with more price cuts imminent. Even though these startups are worth only a fraction of their previously inflated values, employees want out before values decline further. If employees are worried, we should be worried too.

Jeffrey Funk is a retired professor and author of five books, including the upcoming Unicorns, Hype and Bubble: A Guide to Spotting, Avoiding, and Exploiting Tech Bubbles.Harriman House, October 2024).

Gary Smith is Professor of Economics at Pomona College and the author of more than one hundred academic papers and 17 books, most recently (co-authored with Margaret Smith) “The Power of Modern Value Investing: Beyond Indexing, Algos, and Alpha” (Palgrave Macmillan, 2024).

Read also: The long-awaited IPO “resuscitation” depends on whether the bull market remains

more: This AI startup is backed by Jensen Huang, Joe Montana, and Jeffrey Katzenberg