Diverse photography

Introduction and thesis of investing

Cloudflare (New York Stock Exchange: net) is a provider of cloud services that secure Internet properties. The company delivered stellar results in its latest Q4FY23 earnings report, beating top and bottom line expectations. Company It has a proven track record of achieving a 46% compound annual growth rate (CAGR) in revenue since FY18 and has recently seen tremendous success in driving market penetration among enterprise customers who contribute at least $100,000 in annual revenue.

At the same time, management continued to demonstrate its commitment to improving profitability as it became more efficient, led to deeper product adoption, and streamlined operating expenses.

While the company's long-term growth thesis remains sound given TAM's large scale with an innovative product portfolio and improving margins, the company's current valuation suggests that the stock is priced To perfection, which leaves little room for error in implementation for the company's management. As a result, I would rate the stock a “hold” for now.

About Cloudflare

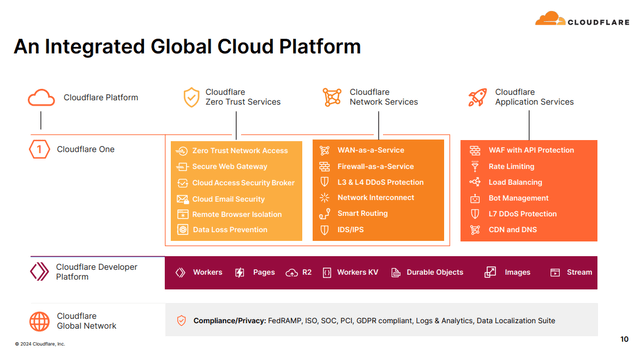

Cloudflare is a web security and network protection services company whose products are designed to keep Internet properties such as websites and Internet applications free from cyber attacks and other online threats. The company also provides network security services without having to purchase any hardware that its competitors, such as Fortinet (FTNT) and Palo Alto Networks (PANW), may need to secure networks.

Additionally, the company bundles its offerings into a network-as-a-service cloud subscription package, which it sells to its customers. The company runs a combination of a freemium model and direct sales to attract and acquire customers in its sales funnel.

Last year, the company also restructured its sales team to target enterprise customers, which began to boost Cloudflare's performance, which will be discussed in the next section. The company generates revenue from a combination of recurring subscriptions and usage-based consumption models from its customers.

Q4FY23 Earnings Slides: Cloudflare's integrated product suite for web applications and network security

The good: Cloudflare outperformed on all fronts in its fourth-quarter earnings

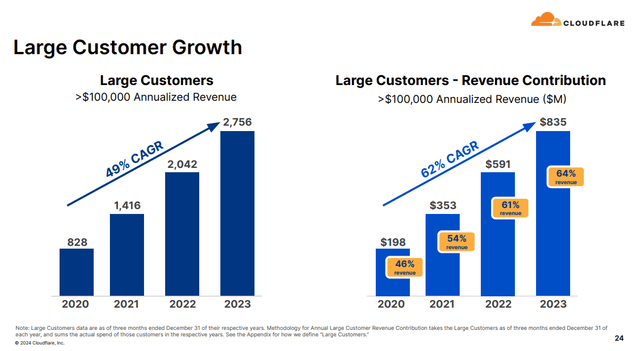

Cloudflare's total revenue rose 33% year-over-year to $1,296.7 million, beating their previous forecast while slightly exceeding consensus revenue estimates of $1,290 million. The number of paying customers increased by 17% compared to the same period last year. But the strength of Cloudflare's go-to-market strategy was on full display among its large customer group ($100,000 or more in annual revenue) that grew 35% year-over-year and contributed 64% to overall revenue, compared to 61% the year before.

Q4FY23 Earnings Slides: Cloudflare Market Penetration Among Enterprise Customers

These were some very strong numbers to show that Cloudflare is having great success in penetrating the large enterprise market segment with increasing deal volume. In addition, management also credited the success of its Zero Trust Architecture (ZTA) cybersecurity products, which have gained significant traction among new Cloudflare customers. Furthermore, Cloudflare's net retention rate continues to hold steady at the 115% mark. I believe this confluence of factors is a very encouraging development in Cloudflare's prospects for consistently outperforming in the future, as management expects FY24 revenue to grow 27% to $1.65 billion.

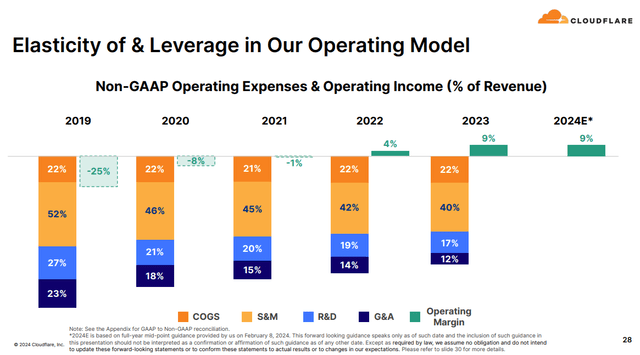

For the full fiscal year '23, Cloudflare's non-GAAP earnings were 49 cents per diluted share, up 277% from 13 cents per diluted share the year before. While full-year gross margins were slightly better at 78.3%, the company's non-GAAP operating margins saw some significant expansion, from 3.7% in FY22 to 9.4% in FY23, as the company streamlined its expenses operational on all fronts. The company continues to expect margins to normalize during 2024 and has guided non-GAAP operating margins to be flat year over year.

Q4FY23 Earnings Slides: Cloudflare's margins expanded year over year

The bad: The competitive landscape could dampen Cloudflare's growth prospects

Despite the company's outperformance and guidance for FY24 beyond consensus expectations, management sought to temper optimism by warning of a highly uncertain macro environment. Cloudflare had already read the tea leaves earlier and took measures early last year to move up the market by targeting large companies in its target market. This approach seems to be paying off, in my view, with the strong growth Cloudflare has seen in the enterprise segment.

Additionally, Cloudflare saw success in demand for its Access ZTA product, which was discussed during the Q4 call. But its past success may not always translate into future achievements, as the ZTA market is an emerging technology in cybersecurity and is hotly contested by other industry players. While large companies like Google and Amazon offer unique ZTA solutions for their private cloud platforms, Cloudflare competes directly with highly successful cybersecurity players like Zscaler (ZS) and Palo Alto Networks. Since ZTA is an emerging technology, Cloudflare may have to invest more heavily in its sales and marketing spend lines to continue penetrating the enterprise market for cybersecurity solutions.

Tying it all together: Cloudflare is priced to perfection

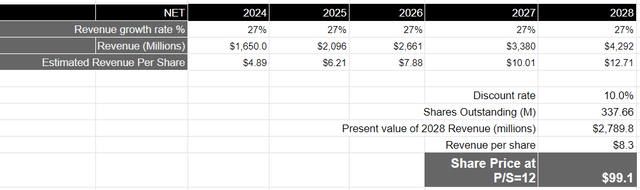

Cloudflare trades at a forward price-to-sales ratio of 25 based on management's FY24 revenue forecast. Management also presented a long-term operating model in which it expects the company to significantly improve its non-GAAP operating margin from 9.5% to 20%. This means we'll see Cloudflare's profits outpace its revenue growth over the coming years as the company streamlines its sales and marketing spending to 28% of total revenue over the coming years. However, since management has not specifically identified the fiscal year in which it realizes this amount of operating leverage, I will base my assessment on my revenue growth estimate over a 5-year investment horizon.

In this case, if you assume that Cloudflare grows its revenue in the high 20s over the next five years, as it penetrates deeper into the large enterprise customer pool along with stronger customer adoption of its product suite, it should be able to produce roughly 4.3 billion dollars in revenue by fiscal year 28.

This translates to a present value of $2.8 billion in revenue, when discounted at 10%, or earnings per share of $8.3. If we take the S&P 500 as a proxy, whose companies grew their revenue at an average rate of 4.8% with a price-to-sales ratio of 2.19 over a 10-year period, I assume Cloudflare should trade at 5-6 times the forward price-to-sales multiple of the S&P 500.

This means that the stock should be trading at around $99, which means that the stock price is currently at par. In my opinion, it does not provide an attractive entry point for long-term investors, given the risk reward of the company.

Author evaluation form

Conclusion

Cloudflare has performed exceptionally well so far, and this has led to a lot of investor optimism about the current stock price. There is undoubtedly a lot of tailwinds for the company at the moment, given its continued success in driving growth of new acquisitions in the enterprise client segment while deepening adoption among existing clients. Company management also believes Cloudflare should be able to see a strong expansion in operating margins, although the time frame is unknown. However, competitive forces remain a threat despite the company's strong pipeline of product innovation. Given the above, I believe the company's long-term growth prospects are currently factored into the valuation, leaving no room for upside at the moment.