“ This won't end well, but not yet. It's still early in the bubble.“

The technical decline in the US stock market was evident last week, but Nvidia Corp.'s NVDA.

The blowout earnings report saved the day. The tech giant's results beat Wall Street expectations by all measures, and the company also trended higher. There was nothing not to like about the report. As a result, the PHLX Semiconductor Index SOX,

Which is a leader in artificial intelligence related plays, rose strongly.

However, as with the dot-com bubble of the late 1990s, signs of abuse are clear. However, I reiterate my view that the AI bubble has much more room to run before it reaches the stage of “splendid exuberance.”

This is how a bubble forms. Take General Electric, for example,

Which was one of my non-technical darlings in the late 90s. Jack Welch, who was considered the outstanding CEO at the time, demanded that division managers become either No. 1 or No. 2 in their business lines. If it fails to achieve those goals, the division will be closed or sold.

Division managers who couldn't make the numbers tried the old trick of financing: General Electric loaned customers money to buy its products and then rolled the money around to inflate sales. This maneuver worked so well that GE Capital was born. GE Capital, in its effort to achieve the top two spots in its industry, has loaned to anything that moves. It wasn't just aircraft engines, it was emerging market loans and subprime mortgages. GE Capital became larger than the company's industrial divisions and eventually collapsed; GE CEO Jeff Immelt announced a divestment from GE Capital in 2014, eventually selling off its parts over the next two years.

“Today's technology giants are buying shares in companies and transferring money to boost sales. “

It's happening again. Instead of financing sellers, today's tech giants buy stock in companies and move the money around to boost sales. AMZN, a subsidiary of Amazon.com,

The investment in Anthropic and Nvidia's investment in CoreWeave are just two of the clearest examples of the financing. Because today's market is focused on the potential for addressable overall market and sales growth, technology executives, who are mostly paid through stock-based compensation, strive to foster sales growth at all costs.

This won't end well, but not yet. It's still early in the bubble.

There were some concerns raised about the concentration of US market indices as well. These concerns are mitigated by two factors. The concentration peaked in 1931-32, rather than at the time of the October 1929 crash. In addition, the current episode of increasing index concentration has been gentler and less severe than the last two episodes.

Valuations are also more reasonable than in the dot-com bubble experience of the late 1990s. Technology and communications services stocks are still tracking their earnings closely.

However, there are a number of warnings about abuse that are cause for concern. Amazon is about to replace Walgreens Boots Alliance Inc. WBA,

In the Dow Jones Industrial Average (DJIA)..

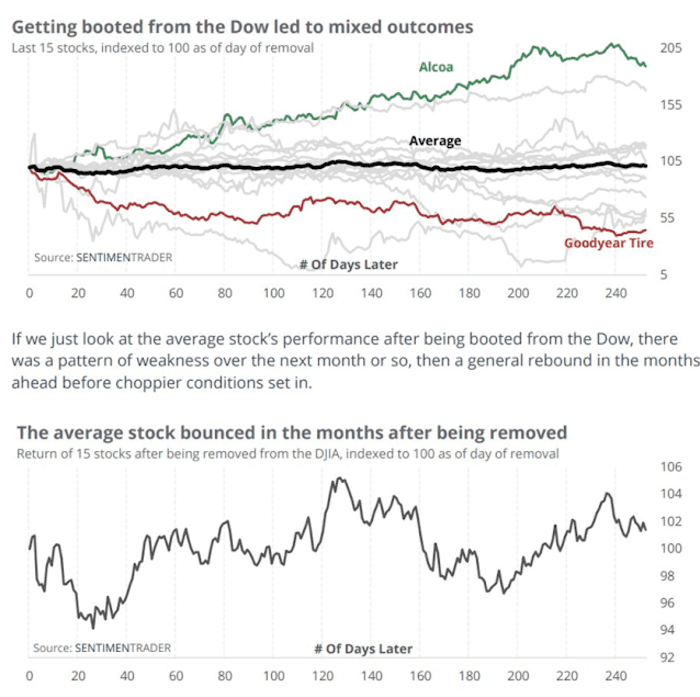

SentimenTrader has been trusted How the deletion of Dow Jones stocks was, on average, a contrarian buy signal and how new additions tended to lag the market.

The last time this happened was in 2020, when Salesforce Inc. CRM,

It replaced ExxonMobil XOM,

Which was great for Exxon shareholders but not for Salesforce investors. So this latest change in the composition of the Dow Jones may be a sign that Amazon, and growth stocks in general, are about to lag behind the market.

is reading: Why would Amazon and Uber investors want these stocks not to join the Dow?

more: After Nvidia's Recent Explosion, Here Are 20 AI Stocks Expected to Rise as Much as 44%

The virtuous artificial intelligence course

“AI-led productivity gains, combined with existing gains, could ignite a virtuous cycle of non-inflationary growth in the US economy. “

There is no doubt that AI will change the way we work over the next decade and boost productivity. Even without the benefits of AI innovation, a study by Tuan Nguyen and Joseph Brusuelas at RSM showed a rise in total factor productivity in the US, which should encourage the Fed to overlook above-inflation wage increases, as they would be offset by productivity gains.

During Nvidia's earnings call, CEO Jensen Huang said the company is seeing a “tipping point” in demand for AI systems. Furthermore, Nvidia's latest results represent the first year of “a 10-year cycle to deploy this technology across every single industry,” he added.

Taken all together, AI-led productivity gains, combined with existing gains, could spark a virtuous cycle of non-inflationary growth in the US economy. Such a scenario could lead to an AI-driven stock bubble of massive proportions over the next few years.

What to watch out for

The market cycle is currently in the early stages of an AI-led boom. Investor sentiment is inconsistent with the extremes seen at major market tops. As a reminder, here are some signs of overreach in the dot-com era:

-

Investors piled into Mannesmann, a German industrial group known primarily as a manufacturer of steel tubes because it included a division that built Germany's first cellular network. Vodafone eventually acquired the company for €190 billion, the largest acquisition price ever paid at the time.

-

Hutchison Whampoa, a holding company, has become a TMT (Technology/Media/Telecoms) darling because of the exposure of one telecoms division.

-

Presentations of companies in industries as diverse as mining and forestry have always included a section titled “Our Broadband Strategy.”

-

The summit was marked by a flood of low-quality IPOs. Remember all the B2B (business to business) and B2C (business to consumer) offerings?

Certainly, some signs of froth are beginning to appear, such as instances of financial engineering to boost sales. The Wall Street Journal also recently published a report on how teens are jumping into the stock market using custodial accounts.

Teen custodial accounts at Charles Schwab totaled nearly 200,000 in 2022, up from about 120,000 in 2019, according to Schwab figures cited by the newspaper. Those numbers rose more than 300,000 in 2023, thanks in part to Schwab's merger with TD Ameritrade. Other brokerages, including Vanguard, Fidelity and Morgan Stanley's E-Trade, have also reported an increase in custodial accounts in recent years.

The latest BofA Global Fund Managers Survey showed that respondents have moved into crowded long positions in technology stocks. Although this may be a contradictory warning, it may be too soon. History shows that such excessive overweight allocations can persist for years, as long as the sector continues to outperform.

If I had to guess, the current AI-driven frenzy looks more like 1997-1998 than 1999 or 2000 in the dot-com era. The investment thesis is real and valid. Prices are just starting to rise. While progress will not be in a straight line, wait for real signs of froth before turning cautious.

Cam Hui writes the investing blog Humble Student of the Markets, where this article first appeared. He is a former equity portfolio manager and sell-side analyst.

Read also: Ed Yardeni: Expect a '2020 Roaring' Market to Keep Stocks High and Inflation Lower

Plus: Tensions between the United States and China over Taiwan threaten to derail Nvidia and other tech giants