New York Community Bancorp Inc. is “on its own devices” to resolve its accounting and other issues, as it faces new losses in its stock price and prepares to update its financial statements in the coming weeks.

This is according to Citigroup analyst Keith Horowitz, who commented after regional bank NYCB,

It revealed “material weaknesses” in its accounting and other financial reporting issues — news that sent its shares down 28% early Friday.

“We expect more questions about whether New York Commercial Bank will sell, but we don't see a lot of potential buyers here even at this price due to the uncertainty,” Horowitz wrote in a note to clients.

While the material weakness “adds more fuel” to the fire surrounding the bank, no additional financial impact beyond the $2.4 billion goodwill impairment charge it took in the fourth quarter is expected, Horowitz said.

New York Community Bancorp stock fell to $3.56 a share on Friday after the bank said late Thursday it found a material weakness related to loan reviews in an assessment of its internal financial controls. The stock last traded at its current level in 1996.

On Friday, the bank appointed George F. Buchanan III as vice president and chief risk officer, a position that was vacant before the bank's turmoil this year. Buchanan comes to the bank with more than 30 years of experience, including that of First Union, now part of Wells Fargo & Co. WFC,

and at AmSouth Bancorporation, American Bank and Regions Bank.

The bank also said it has appointed Colin McCollum as chief audit executive. McCollum has nearly 20 years of experience in the industry.

Late Thursday, the bank said its internal control deficiencies were the result of “ineffective oversight, risk assessment and monitoring activities.”

A spokesman for the Federal Deposit Insurance Corporation declined to comment.

Wall Street analysts were quick to point out that the problems appear to be isolated around New York Community Bancorp, the holding company for Flagstar Bank.

The bank's position “does not represent the pressure/uncertainty on regional banks more broadly,” said Stephen Alexopoulos, an analyst at JP Morgan.

Despite these assurances, regional bank shares fell in early trading on Friday.

Horowitz, the Citigroup analyst, said “significant changes” are needed in New York Bancorp’s credit risk oversight, “which we expect will lead them to be more proactive in recognizing issues moving forward.”

Horowitz said the bank's disclosure that it does not expect to disclose materially different operations is important.

“A material impairment does not necessarily always mean an impact on the financials,” Horowitz said. “In our view, the delay in the 10-K is likely intended to give auditors sufficient time to ensure there is no financial impact from a material weakness in the control environment, which would mean plenty of time to test individual loans.”

Wedbush analyst David Chiaverini reiterated an underperform rating — equivalent to a sell — on New York Community Bancorp and lowered his price target on the stock to $3.50 from $5.

“Our underperform rating is based on high exposure to New York Commercial Bank [New York City] Rent-regulated multifamily loans, which we believe are under pressure, represent 25% of New York Commercial Bank's total loans, the highest in our region.

“Coverage,” Chiaverini said.

JPMorgan's Alexopoulos said the bank still poses risks and investors should stay on the sidelines.

“Although it does not appear that the identified weakness in controls would impose restrictions on the Company's business/lending activities or result in a material increase in costs beyond what has already been identified along with [fourth-quarter 2023] “Findings, this new information increases the uncertainty surrounding the company,” Alexopoulos said.

Piper Sandler analyst Mark Fitzgibbon downgraded New York Community Bancorp to neutral from overweight, saying the “New York community knockout continues.”

Fitzgibbon said the bank's latest disclosure raises concerns “that there may be further issues involving the company”.

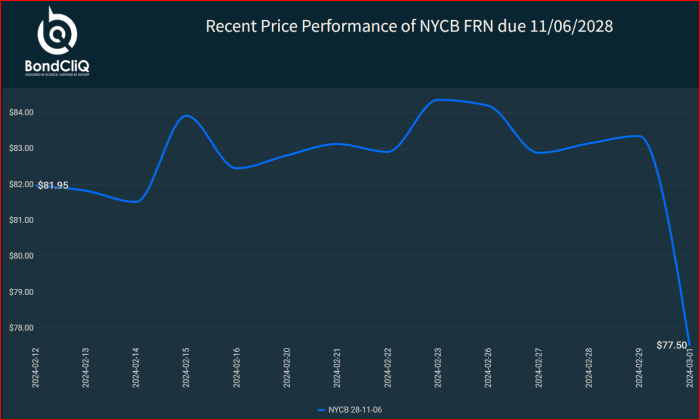

New York Community Bancorp's only bond offering — a $300 million bond it issued in 2018 — also traded sharply lower.

The price of New York Commercial Bank bonds fell sharply after revelations of the company's financial weakness.

Bond Click Media Services

New York Community Bancorp said it has appointed Alessandro Dinello as its new president and CEO effective immediately, following Thomas Cangemi's resignation from the roles after 27 years with the company. DiNello, the former CEO of Flagstar, was appointed CEO of the bank earlier this month, after previously serving as non-executive chairman of the bank's board. Cangemi will remain on board.

The developments mark the latest turn in the bank's rollercoaster ride since it acquired troubled Signature Bank, a former S&P 500 component, in a deal brokered by the Federal Deposit Insurance Corporation (FDIC) in the wake of Silicon Valley Bank's collapse one year ago.

Last summer, the bank reported a nearly 150% increase in second-quarter earnings, sending its shares soaring.

The stock then lost a third of its value on January 31, in the biggest one-day decline in its history, when the bank reported a surprise loss in the fourth quarter, cut profits and costs related to two loans, one of them on an annual basis. An office property and the other is a multifamily real estate deal.

That led to selling at other regional banks in early February as New York Community Bancorp's stock price fell to levels not seen since the 1990s. Insiders then acquired shares at discounted prices, and the stock has been fighting its way back over the past two weeks. Among the buyers was billionaire George Soros, who bought about one million shares.

New York Community Bancorp boosted its loan loss reserves by 790%, or $490 million, in the fourth quarter from the previous quarter, more than any other bank in its category, as it faced potential challenges in its office and multifamily loan portfolio.

When the bank purchased Signature Bank, it reached a size that triggered increased capital requirements by regulators. This has led to the bank allocating more money to its balance sheet.

Read also: New York Community Bancorp stock was crushed by a surprise loss, a dividend cut and the cost of two loans

Philip Van Dorn and Bill Peters contributed.