-

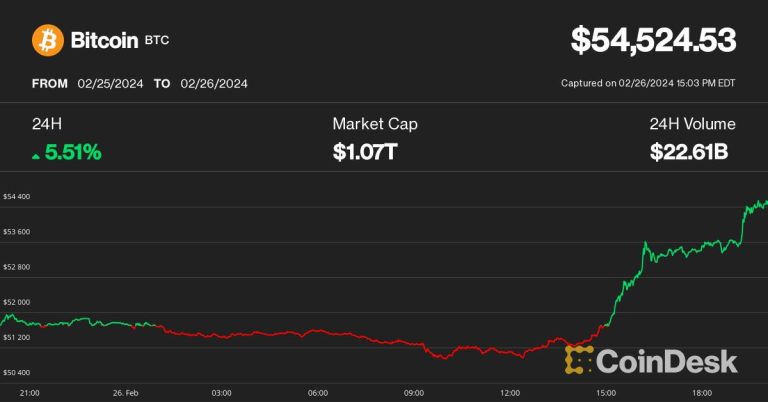

Bitcoin surpassed $54,000 on Monday, breaching a key resistance level that has capped prices since mid-February.

-

SOL, MATIC, and ATOM led altcoin gains, while crypto-focused stocks Coinbase, MicroStrategy, Marathon Holdings, and Riot Platforms posted double-digit advances.

-

Swissblock said the next short-term target for Bitcoin is $57,000-58,000.

Bitcoin {{BTC}} surpassed $54,000 on Monday, surging to its highest price since November 2021, breaking out of its recent sideways range as the cryptocurrency's rally suddenly resumed.

The largest cryptocurrency by market cap broke through the key resistance level at $53,000 during mid-morning trading hours in the US, halting price gains over the past two weeks, and quickly surpassed $55,000 by the afternoon hours before retreating, CoinDesk data showed. a little. At press time, Bitcoin was trading at $54,400, up nearly 5% over the past 24 hours. It outperformed the broad-based CoinDesk20 (CD20) index, which advanced 4%, crossing the 2,000-point level for the first time.

Ethereum {{ETH}}, the second-largest cryptocurrency asset, also rose nearly 4%, reaching a new 22-month high of $3,200.

Read more: Bitcoin's price outperforming Ether is not only due to a potential EIF approval: Bernstein

Solana's native token {{SOL}}, Polygon's MATIC token and Cosmos' ATOM token led the gains among major cryptocurrencies in the CD20 index, with advances of 5%-7%.

The rise in cryptocurrencies has also lifted stocks focused on digital assets. Shares of cryptocurrency exchanges Coinbase (COIN) and MicroStrategy (MSTR), led by Michael Saylor, rose 17% on the day. Big Bitcoin miners Marathon Digital (MARA) and Riot Platforms (RIOT) posted gains of 22% and 15%, respectively.

Bitcoin targets $58,000

While some market watchers had predicted that Bitcoin could correct to $48,000 with a pause, Monday's rebound was a decisive breakout of one of the last historically important resistance levels before record highs.

“BTC now appears to have finally broken out of the range it has been in since February 15,” cryptocurrency analytics firm Swissblock said in a Telegram market update on Monday. “The momentum is strong. All sails are ready.”

Swissblock analysts added that the next level for Bitcoin price target is the $57,000-$58,000 range, with all-time highs seen after that.

The move was also coupled with a slight rise in Bitcoin's price premium on Coinbase compared to other exchanges, indicating upcoming demand from US investors.

US-listed bitcoin exchange-traded funds (ETFs) also saw significant trading interest, with BlackRock's IBIT recording its largest daily trading volume since its debut, according to TradingView data. However, ETF trading volumes do not always translate into flows into the funds, the NYDIG report noted.

Update (February 26, 20:41 UTC): Price updates. Adds altcoin performance, cryptocurrency stocks, and Bitcoin ETF trading volume data.