Technology stocks rose after Nvidia Corp.'s latest earnings report, which helped push the Nasdaq-100 and S&P 500 to new highs last week.

But looking beyond index-level performance, there are signs that the momentum that propelled the sector higher over the past year is beginning to fade.

Unprofitable technology companies are starting to decline. Popular momentum metrics show a slowing pace in which the average technology stocks are outperforming the average S&P 500 stocks. The share of technology stocks that are trading above their medium-term averages has also declined from their recent highs, although they are still well above 50%.

Meanwhile, valuations for average technology stocks have returned to their peak as of November 2021, according to JC O'Hara, chief market technician at Roth MKM.

be seen: More stocks are joining the market rally — although big tech companies are still getting the most attention

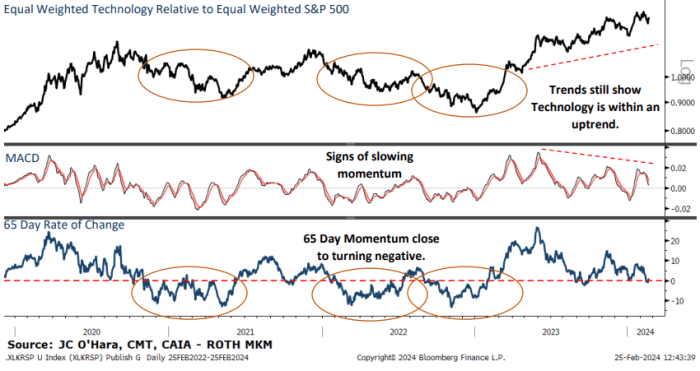

The relative momentum of mid-cap technology stocks has begun to slow

While technology stocks remain steady in an uptrend, their outperformance compared to the average S&P 500 stock SPX is beginning to slow.

This is demonstrated by a measure of the average outperformance of technology stocks compared to the average S&P 500 stock over the past 65 days, as shown in the chart below.

Such a shift has heralded periods of underperformance for tech stocks in the past, not just in 2022, but in 2020 as well.

M. K. M. Roth

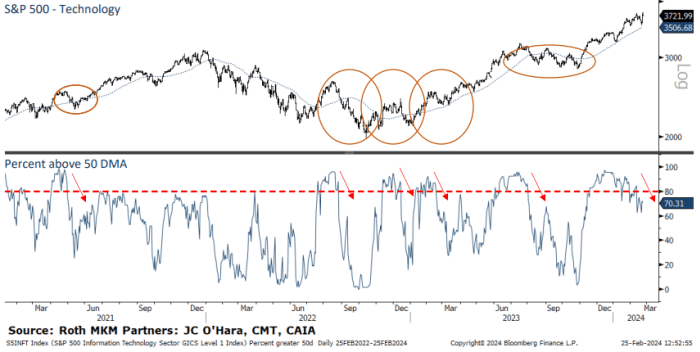

The share of technology stocks that are trading above their moving average is declining

Taken together, the S&P 500 technology sector is still trading well above its medium-term average. But more individual technology stocks are starting to lag behind.

Nearly 70% of the technology sector's 64 components are trading above their 50-day moving average as of Friday, according to O'Hara's count. By comparison, late last year, that number was 90%.

M. K. M. Roth

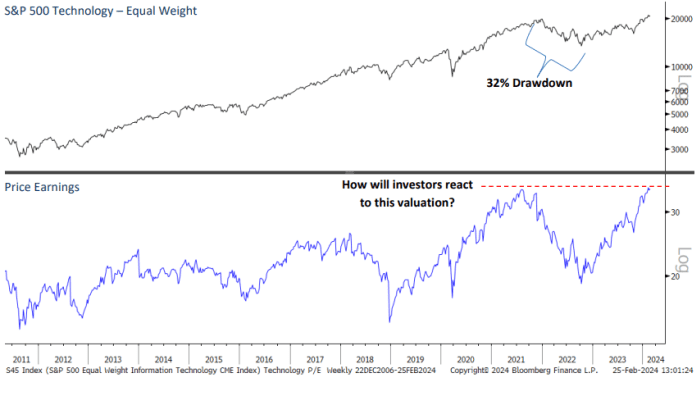

Ratings appear stretched

Investors pay a significant premium for the average technology stock, as evidenced by the trailing 12-month price-to-earnings ratio.

The ratio recently reached 35 times, the level that preceded the market peak in late 2021.

There is a version of the technology sector in the S&P 500 that assigns equal weighting to each component stock, and it has only just managed to achieve these highs after more than two years. During this period, the metric saw a decline of more than 30%, according to O'Hara.

M. K. M. Roth

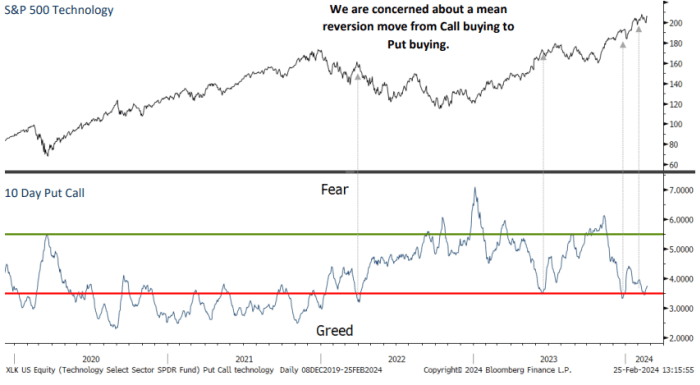

Options traders are getting greedy

Traders piled into bullish options ahead of NVDA Corp.

Last week's earnings report. This has pushed the 10-day put-call ratio, which measures demand for bullish options compared to demand for bearish options, firmly into greed territory.

However, history shows that demand for options tends to mean a return, according to O'Hara. As of Friday, there is still plenty of room for options traders to move from one side of the boat to the other.

M. K. M. Roth

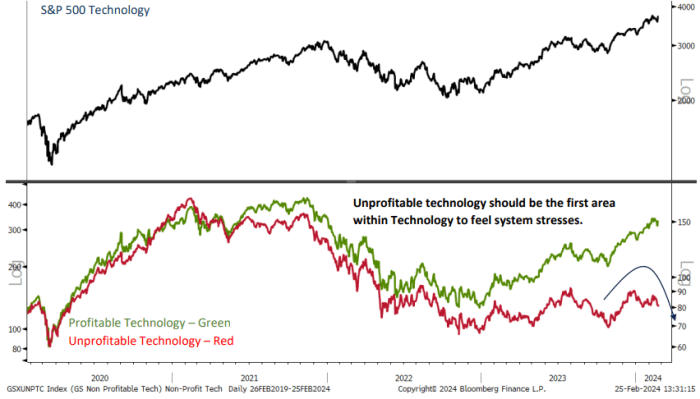

Unprofitable technology stocks are fading fast

Even technology companies that didn't generate consistent profits saw their stocks surge as the broader market rose strongly in November and December. Some analysts described it as a “dash into the garbage.”

But since the start of 2024, many of these companies that have struggled to deliver consistent profits have seen their shares decline. Case in point: ARK Innovation ETF ARKK,

It is seen as a proxy for unprofitable technology companies, and has fallen 5.3% since the beginning of the year after gains of more than 48% between November 1 and January 1, FactSet data shows.

In the past, these companies were the canary in the coal mine, O'Hara said.

“When market pressures start to develop, unprofitable companies are usually sold first, because they are farther back from the risk curve and have the greatest potential for a downturn,” he added.

M. K. M. Roth

To be clear, O'Hara doesn't recommend his clients rush out of their technology stocks.

“We continue to place high importance on technology in our sector rankings,” O'Hara said.

But a recent surge in inquiries from clients seeking investment ideas outside of technology piqued his curiosity.

He now expects a modest pullback that could take the sector back below the 50-day moving average. This equates to a decline of more than 4% for XLK, according to FactSet data. The ETF most recently traded at $206.35 per share on Monday.

With that in mind, investors may want to consider buying some downside protection for their portfolios, he said. The unbalanced put ratio means that investors can buy portfolio insurance relatively cheaply.

The technology-heavy Nasdaq-100 NDX,

Which has the largest weighting toward the largest giant technology stocks such as Nvidia Corp., reached its latest record close of the year on Thursday, while the Nasdaq Composite COMP came close to its first record close since November 19, 2021.

Meanwhile, the S&P 500 and the Dow Jones Industrial Average (DJIA) ended last week at their 13th and 14th record closing levels for the year, respectively.

All three major indexes — the S&P 500, Dow and Nasdaq Composite — were trading in the red early Monday afternoon.