Today in my series titled “Things that people who have been following Bitcoin for the past 13 years have discovered but I present as a brand new revelation“, I wanted to write about the unfolding, consolidation, and normalization of Bitcoin adoption last week. While thinking about what it would take for Bitcoin to receive a significant boost of adoption in the US, I was able to think of one scenario that might not be so far-fetched.

And contrary to what you might think, it has nothing to do with regulation, taxes, accounting standards, or any of the things that are wrongly talked about as the ebb and flow of Bitcoin adoption on a daily basis. As I learned firsthand while doing some research on Bitcoin over the past month, none of these things really matter. The decentralized nature of the network requires that it does not need any of these things to thrive. I mentioned this in my article last week titled “Why I Use Bitcoin.”

But what I also pointed out in the same article is that Bitcoin will survive If the people want to survive. For those who understand the network, they realize that nearly 20,000 global nodes mean that the network will remain resilient no matter what politician, jurisdiction, or regulatory agency around the world tries to stand in its way. This is part of the elegance of the network.

And still, after realizing this, I think to myself: “What will accelerate this adoption to the point that we can move from now – period barely No going back to Bitcoin — to A An important point for dangerous escape speed?” And the answer was right under my nose.

When I wrote the title of my article last week, “Why I Use Bitcoin,” it was just one of those titles that came to mind instinctively. Sometimes I spend hours trying to figure out what title will be the most catchy, and other times, as with this article, I have a pre-determined title because it's so clear what I want to say.

But I was walking around over the weekend wondering where I'd heard that phrase before.

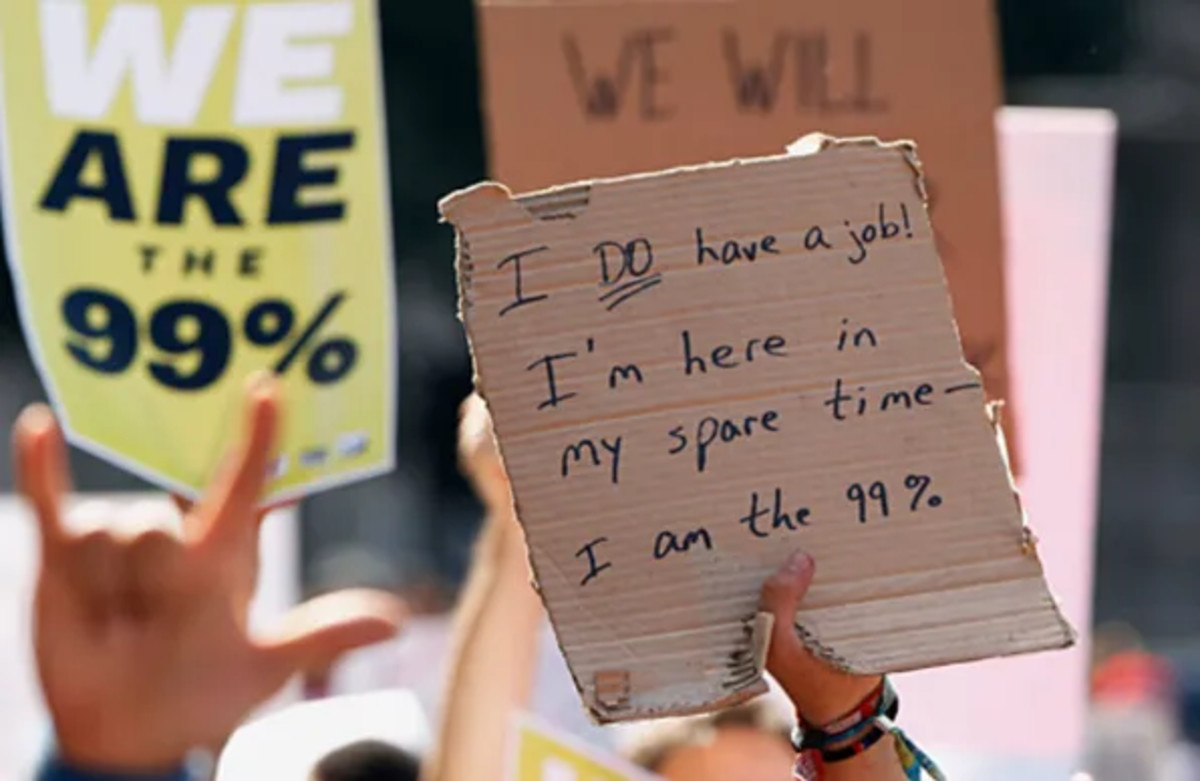

Suddenly it came to me. In one of my favorite skits, a group of stand-up comedians from Philadelphia went to the Occupy protests that occurred as a result of the economic collapse of 2008. In more than one place there were signs saying “Why Occupy.” In fact, this was essentially the same name for part of the Occupy movement. I remember WhyIOccupy.org was a source of a large angry population at the time; They believed that any ideology found on this site was their solution to the financial crisis.

Only after I remembered that did I think that in the next major financial crisis, people would really have a legitimate exit route out of the system. Bitcoin is an exit ramp. It's the thing that the people involved in the GameStop craze were desperately looking for, whether they knew it or not, but couldn't find.

While the GameStop fiasco was happening, I remember thinking to myself that there were a lot of people who were angry but had no idea why they were angry. In chat rooms and on social media, everyone was to blame but Federal Reserve. These people were angry because they felt cheated: they were reacting, whether they knew it or not, to widening inequality while struggling to make ends meet.

But what they didn't know was that this wasn't the fault of Ken Griffin, the Citadel, or the short sellers; It was the Fed's fault.

Nowadays, it has become even more evident with the Federal Reserve highlighting widening inequality. It's more clear because inflation is a prevalent story and a phenomenon that people can understand. Even if they don't know Why When inflation occurs, most people have some semblance of an understanding that it is about the Fed overextending the money supply over the past four years and then, to make matters worse, lying to the public about inflation being temporary.

And those who had hoped to replicate GameStop's success with names like AMC now know that toxic management and a money-losing business can easily suck the air out of any momentum in any type of short selling, or FOMO, squeeze on any single stock. They also know that brokerage firms and regulators can prevent them from dealing in it anytime they want for good.

During the next major financial crisis, which I believe is not that far away, hopefully the same angry group of “have-nots” will direct more blame where it belongs: monetary policy. After all, inflation is a brutal tax on people who can't afford it, and it's meaningless for the super-rich. The super-rich are getting richer as a result of quantitative easing and money printing, which funnels a disproportionate amount of the relief into stocks, bonds, and the housing market: assets that the rich have that low-income people don't.

I've been asking a lot while printing the Fed's Covid money, that if the Fed wants to print $5 trillion, why don't they divide it equally among all the people in the US and cut us all a check? After all, $5 trillion divided by 300 million people amounts to about $16,500 per person. Methodological logic aside, this is a fairly simple and straightforward question. If you want to stimulate the economy by spraying money everywhere, why not do it equally among all its citizens, rather than preferentially?

But that's not what happened in 2008, and that's not what will happen during the next financial crisis.

However, I think what will happen is that a new group of “have-nots” and economic renegades will be significantly more informed about how the monetary police work, not only as a result of the GameStop failure, but also as a new, younger generation. They recognized the ideological case for Bitcoin. Before I moved to Bitcoin, one of the things I liked about it was the idea that it forced the younger generation to understand Austrian economics in a world where we have overused the privileges of MMT and beaten it to death. Armed with this new knowledge, a whole new generation of angry ordinary people will once again bear the cost of the social toll caused by evil, toxic corporations that have privatized their profits. This will be part of an inflationary crisis that is still fresh in their minds. This time there will be no doubt about who is eroding the purchasing power and wealth they worked to obtain through taxes and inflation.

Which brings me to my point: Bitcoin could be the exit ramp that millions of angry people look forward to in such a situation.

Unlike GameStop, Bitcoin actually He has the opportunity to influence big change Because the network's success is linked to its growth. This means that with each person who decides to own Bitcoin or educate themselves about it, they become part of a self-fulfilling prophecy for the network's success. Of course, the ideology behind the network's success is rooted in empowering people just like them: people who are tired of having the little they earn silently whisked away by the dark inflationary financial machine in the night.

Many people who participated in the GameStop frenzy, including the “monkeys” at Reddit's Wall Street Bets and millions of other retail traders, will have to realize that Bitcoin has all the positives they sought in the past without the negativess. There is no administration to screw it up, no counterparty to dilute it, no one to turn off the buy button, and basically no governing or regulatory body to prevent the network from succeeding if people wanted to be one. It's the digital freedom that all these people sought during the recent financial crisis but had no effective way to demonstrate.

The year 2008 was another echo of what has become commonplace on Wall Street: Every time things get disastrous, the public bears the cost, gets angry, and waves torches. But then it eventually ends and people go about their business.

“I'm starting to feel a little better about this whole thing,” John Told says at the end of the book. Margin callwhich shows that the more things change, the more they stay the same.

Bankers and politicians have relied on this pattern to play the way they have in the past so that they can continue to perpetuate the same scheme they have been part of for decades. In essence, it is what enables miscarriages of justice on the part of ordinary Americans who bear the cost of the failures of the super-rich.

So, the next time this happens, the investing public can do so We have a legitimate opportunity to break that cycle For the first time in half a century through the adoption of Bitcoin. They have the opportunity to opt out of the system they objected to. Capital flows into Bitcoin and out of traditional financial assets will send a message to major financial institutions that only respond to the opportunity to charge fees (see their new obsession with Bitcoin now that there are ETFs for reference). At the same time, these flows can add to the network's prophecy of success, due to their redundancy essentially serving as a measure of the network's health.

It's by no means foolproof, but if the system collapses again, and the average person is looking for a real weapon to fight the system — one that's literally programmed to be the technological Braille of the phrases “There's Safety in Numbers” and “Power to the People,” Bitcoin could It shines and opens an era for itself that can be viewed in the future as a renaissance of its adoption.

This is a guest post by Quoth the Raven. The opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.