It can sometimes seem like investors care more about Jensen Hwang than they do about Federal Reserve Chairman Jerome Powell.

Huang is the longtime CEO of Nvidia Corp. NVDA is a chip maker.

Which stole the show last week by shattering already high earnings expectations and driving stocks to new rounds of all-time highs, even as nagging concerns about renewed inflation continued to linger in the background. Huang announced that the AI industry, of which Nvidia is the main supplier of critical chips, has reached a “tipping point” that will see the technology go “mainstream.”

Deep dive: After Nvidia's Recent Explosion, Here Are 20 AI Stocks Expected to Rise as Much as 44%

This may lead investors to wonder whether they are wasting energy worrying about the economic cycle and the timing of interest rate cuts by the Federal Reserve. Should they instead embrace a rally led by technology stocks that are beginning to expand into other sectors, buoyed by the potential for advances in artificial intelligence to deliver a generational productivity boost that would lift corporate profits and limit inflation pressures?

It's a nice picture, but it's unlikely to come together that smoothly.

“I think investors will obsess over inflation metrics again,” Michael Aron, chief investment strategist at State Street Global Advisors, told MarketWatch in a phone interview.

Coincidentally, the Fed's preferred measure of inflation, the core PCE reading, is scheduled to be released on Thursday morning. The January data comes after markets were previously shaken by higher-than-expected CPI and Producer Price Index readings.

Aroni said investors know — and the Fed emphasized — that one month's data does not constitute a trend, but it will be important for inflation to resume its trend toward the central bank's 2% target. If that starts to look in serious danger, the market volatility will be over.

is reading: Wall Street is preparing for more economic data and strong US inflation data next week

Investors entered 2024 with interest rates cut by six to seven quarters of a percentage point over the course of the year, starting in March. With the data coming in and the Fed backing away from those expectations, markets now see a somewhat better chance of 50% that cuts will begin in June and that the Fed will only make three or four cuts by the end of the year, according to the Chicago Mercantile Exchange. Feedwatch tool.

If inflation proves flat or begins to rise, investors may eventually be forced to endorse no rate cuts in 2024 or even the outside possibility that the Fed will need to raise rates again. That would be a big shock, Arone said, likely sending stocks into a correction and sending Treasury yields skyrocketing.

Other than that, Aaron is optimistic, and sees the prospects for continuing to rise after last week witnessed strength in sectors outside of technology and consumer services. A continued rally would give investors the opportunity to build exposure to small-cap stocks and value stocks.

Stocks continued their climb last week, with the S&P 500 SPX and the Dow Jones Industrial Average (DJIA) hitting new highs. The Nasdaq Composite Index COMP briefly came close to its first record close in more than two years on Thursday and again on Friday before pulling back, but ended the week up 1.4%.

Of course, the megacap-led tech rally is not a new phenomenon. Nvidia and its group of AI heavyweights led a stock market rebound in 2023, which grew increasingly — and alarmingly — growing.

“The most important event in global stock markets last year was none other than Microsoft MSFT.

“The investment is in OpenAI, which makes ChatGPT,” Christopher Wood, global head of equity strategy at Jefferies, said in a note last week.

“This was a catalyst for the topic of AI to start driving market psychology and, more importantly, gave the most important sector of the world’s largest stock market a new narrative that is secular, not cyclical,” he wrote.

This rise has also drawn comparisons to the dot-com bubble of the late 1990s.

Baron: Echo 1995 or 1999?

A look at how big single-day gains have contributed to the stock market's year-to-date rise illustrates the role the strength of the technology sector plays.

The S&P 500 is up 6.7% year-to-date through Thursday, with just five trading days accounting for that gain, Nick Colas, co-founder of DataTrek Research, noted in a note.

That includes a 2.1% rise on Thursday, driven by Nvidia's earnings, and four days with gains ranging from 1% to 1.4%, including the Jan. 8 spike after Nvidia announced new chips; January 19 gains led by chip stocks after earnings guidance from Taiwan's TSM Semiconductor,

; February 1 bounce after Powell-inspired sell-off; The February 2 rally was driven by Meta Platform Inc.'s META.

20% increase.

The lesson, Colas wrote, is that the market is ignoring the possibility that interest rates will remain high for longer to focus on the leverage of Big Tech's earnings. “This is classic mid-cycle market behavior. Investors can live with higher interest rates if (but only if) there is a promising development in an important sector.

At the same time, the degree of this promise remains debatable.

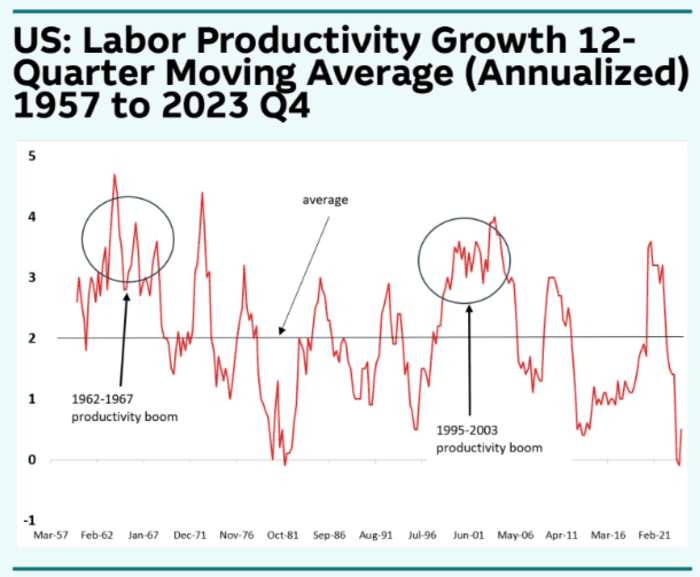

To be sure, many “new models” for US productivity growth have been offered by market experts in the past 125 years. “Not all of these challenges worked, and there were only two episodes (mid-1960s and mid-1990s) in which US productivity growth remained sustainably high,” said Thierry Wiesmann, a global FX and interest rates expert at Macquarie. On a note (see chart below).

Macquarie

“But what matters is not whether this is a new AI-driven model or not

Pans out. It matters whether people believe it will work, if it does

“Change the overall dynamics,” he said.

Such a change can carry a sting.

The danger here is that the new growth model leads the Fed to conclude that the so-called neutral interest rate – the level at which the official interest rate does not promote or support growth – is higher than currently thought, opening the door to further rises.

Meanwhile, investors are focused on whether AI will continue to deliver strong results for leading technology providers and whether it will ultimately allow companies using these products to become more productive and more profitable, said Jose Torres, chief economist at Interactive Brokers. In a note. .

With many companies outside the technology sector offering cautious guidance, the practicalities of AI don't appear to be supporting overall profits yet, he said.

“Only time will tell if Nvidia CEO Jensen's optimism is justified, and while bulls have been energized by his comments and Nvidia's quarterly results, bears are praying that AI will be more trivial than substance,” Torres wrote.