Gina Raimondo, US Secretary of Commerce, spoke at Intel's event today and compared the US government's current focus on revitalizing its chip industry to the Space Race of the 1960s. “The fact that we are so overly dependent on some countries in Asia that we need life-saving medical equipment, cars, every piece of technology, has shown us that we have to get back to the business of making more chips,” Raimondo said.

Full disclosure

Intel's new foundry strategy will include disclosing financial data for the new unit to allow investors to see how this part of the business operates. “We don't fix one company; “We are creating two vibrant new organizations,” Gelsinger said.

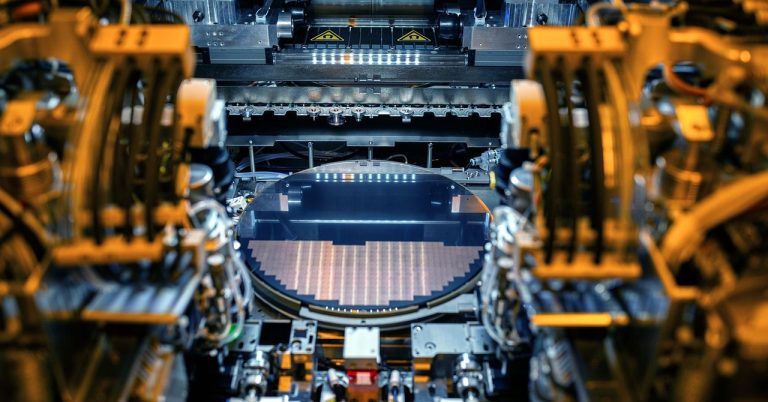

An Intel factory employee holds a chip equipped with Foveros 3D technology at an Intel factory in Hillsboro, Oregon.Image: Intel Corporation

Now all Intel needs is more customers willing to trust it with the future of their businesses. Some chip industry insiders say the company's revamped foundry plans appear more likely to succeed than previous attempts to revive Intel's fortunes.

“Before Pat came on board, they didn't really have an understanding of the foundry market,” says Dan Hutchison, a longtime chip industry analyst at Tech Insights. “This has steadily improved. Messages are more focused, and they are picking up customers, proving they are doing the right thing.”

Gelsinger took over as Intel CEO in 2021 as the company was on a downward trajectory after several high-profile missteps. He has promised a bold comeback plan that includes developing more competitive chips of his own while regaining an engineering advantage in manufacturing and offering that to other companies.

Hutchison says the company's biggest advantage may be its ability to offer advanced packaging for newly carved chips into business components, assured supply lines, and other additional chipmaking solutions that customers see as safer in an uncertain world. “Their biggest point of differentiation seems to be that they are a strategic alternative to TSMC,” he says.

Intel's decline has raised concerns in the US national security establishment because of the importance of computer chips and the extraordinary potential of artificial intelligence. China's technology ambitions and the potentially vulnerable location of most of TSMC's factories in Taiwan have caused concerns that U.S. access to the world's best chips could be cut off. In 2022, the US government passed the CHIPS Act which promised $52 billion to revitalize the domestic chip industry and secure silicon supply lines. According to a Bloomberg report, Intel is on track to receive $10 billion of this money.

Intel seems to think it can benefit from more government money. On stage today, Gelsinger asked Secretary Raimondo whether the US government might need a second potato chip law. “I think there has to be — whether we call it CHIPS Two or something else — continued investment if we want to lead the world,” Raimondo said.