Crypto asset manager Grayscale made a strategic move by transferring 3,443.1 bitcoins, equivalent to more than $175 million, to an address linked to the Coinbase exchange.

The final step was carried out in five separate transactions to Coinbase Prime, a platform designed to meet the liquidity needs of institutions.

The transfer has generated significant interest within the financial and cryptocurrency communities, as Grayscale is known to impact market dynamics significantly. The company's decision to transfer such a large amount of Bitcoin to a liquid exchange for potential sale comes at a time when the cryptocurrency market is experiencing a mix of volatility and growth.

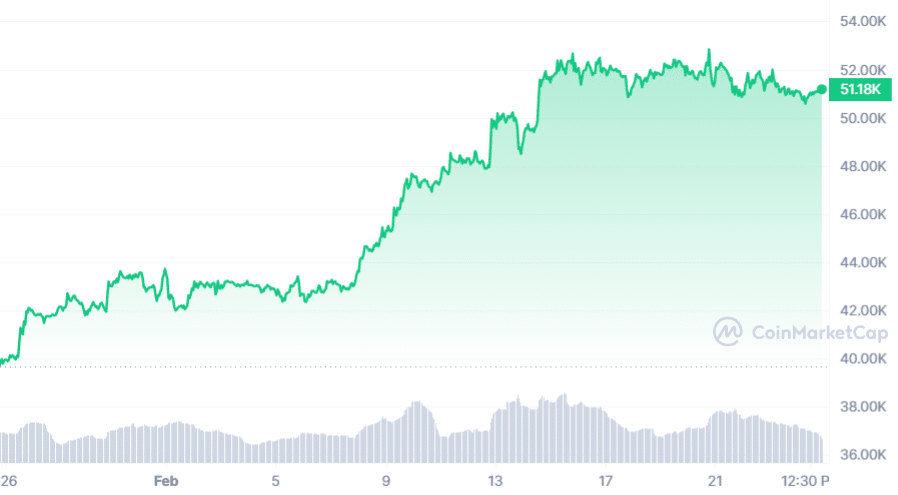

Bitcoin's price recently saw a 20% increase in the month of February, despite a slight 2.65% decline over the past three days, keeping its value above the $50,000 mark.

Speculation abounds regarding the reasons behind Grayscale's recent transactions. Some market watchers suggest that the move may be part of a strategy to capitalize on recent market gains. This theory gains weight given the long period investors have spent their investments in the fund, resulting in the current market rally, especially after there is a tempting opportunity for liquidation.

The timing of Grayscale's actions also coincides with discussions about management fees within the digital asset management sector. Grayscale's Bitcoin Trust (GBTC) is known for its relatively high management fee of 1.5%, in stark contrast to competitors like BlackRock's IBIT, which currently charges 0.12% – although plans are afoot to increase this fee to 0.25% within the next 12 months. next day. Months.

Fee variation plays a crucial role in investors' decisions, as lower fees typically lead to higher net returns over time.

Some commentators have linked the increase in grayscale outflows to Genesis activities, suggestion That the recent sale of GBTC against Bitcoin could affect the market dynamics.

This perspective offers a less bearish view on Grayscale's market impact going forward, suggesting that the effects of these transactions may be balanced out by the nature of sales made in Bitcoin.

Following this significant transfer, Grayscale's holdings now stand at 449,834 BTC, worth over $23 billion. The company's portfolio extends beyond Bitcoin, with Ethereum (ETH) and LivePere (LPT) being its second and third largest holdings, respectively.

Grayscale's total assets under management exceed $31 billion, including other tokens such as Uniswap (UNI), Chainlink (LINK), and Avalanche (AVAX).