Nvidia shares rose in premarket trading on Friday. End of message.

It seems that the job of a macro market analyst has never been easier. As is the case with Nvidia's fortunes, so is the S&P 500 SPX.

AI mind control is already here.

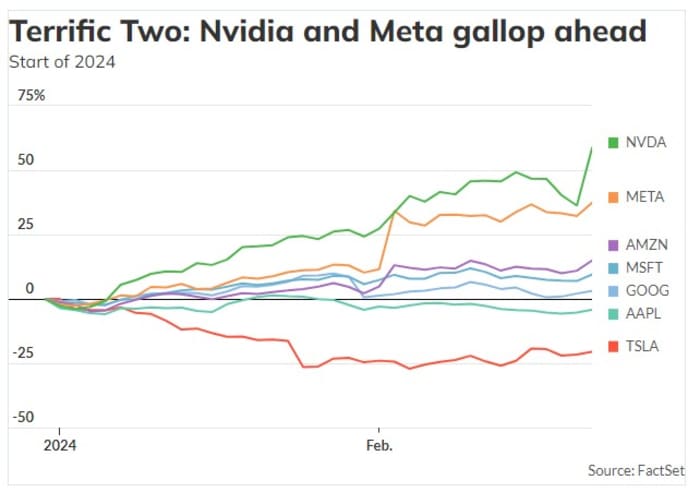

It wasn't long until it was the Seven Great Ones who rallied and then led the emotions. But that force is no longer a cohesive force.

“RIP Magnificent Seven Era” is the title of a new note from Mike O’Rourke, chief market strategist at Jones Trading, who says he has come up with the big tech moniker in the spring of 2023.

Here we must point out that some believe that Michael Hartnett of Bank of America was the first to use the Mag 7 description for Alphabet GOOG,

Amazon.com Amzn,

apple apple,

meta meta platforms,

microsoft MSFT,

nvidia out of stock,

And Tesla TSLA,

Regardless, O'Rourke's new logic is apt. Simply put, he believes Nvidia and Meta should go their separate ways in light of recent events. Maybe the adorable two? …….Well, sure, we can work on that.

“It was last April when we coined the term 'The Great Seven' to encapsulate the seven largest stocks in the S&P 500 as they led 88% of the index's gains in the first four months of 2023,” he wrote in the note published late Thursday. . “Today’s events, along with others that have occurred so far in February 2024, have planted the seeds for the end of this remarkable run.”

O'Rourke says the $277 billion market cap Nvidia added Thursday is a record high that surpasses the previous mark of $196 billion set by Meta earlier this month.

He adds: “These two companies, in addition to these moves, play a prominent role in eliminating the Magnificent Seven as we know them.” The main reason, he says, is that this results season has shown a clear discrepancy in Mag 7's earnings performance.

For example, Nvidia stock now trades at 33 times easily achievable future earnings expectations. “Historically, semiconductors are a cyclical business whose multiples should shrink as they rise, but this market is enthusiastically giving away 35x multiples to trillion-dollar enterprises,” O'Rourke says.

As for Meta, Mark Zuckerberg's flirtation with mutant beings has been curbed, costs have been cut, and the highly profitable company is generally well positioned to exploit artificial intelligence, O'Rourke believes. The forward earnings multiple is 24.4, with only Google in Mag 7 having a lower multiple.

“This earnings season has shown that Nvidia and Meta Platforms have lower multiples and significantly faster growth than the other Magnificent Seven names, which is why the other members will be viewed as less attractive given their multiple and expensive megacap status,” O'Rourke says.

As for Google's parent company, the stock offers “a respectable mix of value and growth for this group, but it won't be as appetizing unless it delivers on AI.” Amazon trades at more than 40 times forward earnings with 11% revenue growth and 44% earnings per share growth, but “neither metric tells us the true picture of the company and the actual numbers are likely to be vastly different,” O'Rourke says. .

Then there's Microsoft, a $3 trillion company that trades at more than 35 times forward earnings and which is expected to grow just 9.5% over the next four quarters.

O'Rourke says Apple and Tesla are particularly ready to be kicked out of the Mag 7. Apple shares have fallen since reporting earnings earlier this month, but they still trade at a multiple of 28 times forward earnings that are expected to grow just 1% this year . “This is not something that would attract a giant company of this size,” he says.

Tesla is facing a slowdown in the electric vehicle sector, and its earnings are expected to decline slightly while shares are still trading at 65 times forward earnings. The company has maintained its position in Mag 7 only because of the stock's impressive past performance, O'Rourke believes.

Thus, says O'Rourke: “As valuation and growth expectations become distorted among the leading names, investors will begin to rotate towards the winners and perhaps look elsewhere for new opportunities.”

The era in which the Great Seven “led the gains of the entire S&P 500” is coming to an end.

Markets

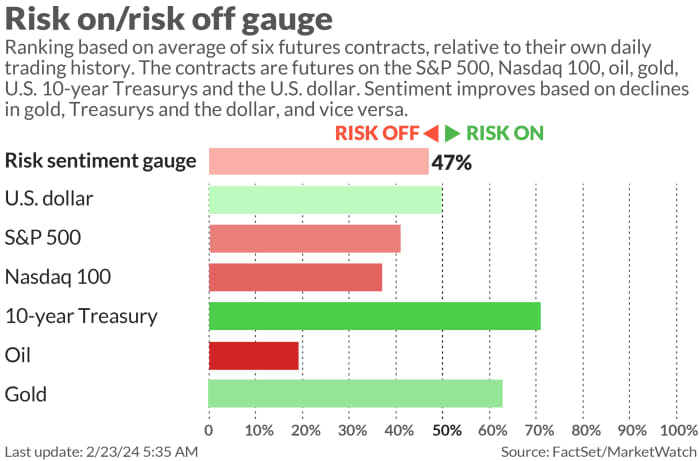

US stock index futures ES00,

YM00,

NQ00,

High as benchmark Treasury bond yields BX:TMUBMUSD10Y fell slightly. The DXY dollar is slightly weaker, while oil prices are CL.1,

autumn and gold GC00,

It trades at around $2,025 an ounce.

|

Performance of key assets |

last |

5d |

1 m |

YTD |

1y |

|

Standard & Poor's 500 |

5,087.03 |

1.14% |

3.94% |

6.65% |

26.79% |

|

Nasdaq Composite |

16,041.62 |

0.85% |

3.42% |

6.86% |

38.40% |

|

10 year treasury |

4.349 |

6.45 |

20.55 |

46.77 |

39.56 |

|

gold |

2,027.80 |

0.12% |

0.48% |

-2.12% |

11.54% |

|

oil |

77.55 |

-0.88% |

-0.87% |

8.72% |

1.44% |

|

Data: Market Monitor. The change in Treasury yields expressed in basis points |

|||||

For more market updates as well as actionable trading ideas for stocks, options and cryptocurrencies, Subscribe to MarketDiem by Investor's Business Daily.

Buzz

warner Bros Discovery WBD,

Shares fell 9% after the media company reported a larger-than-expected fourth-quarter loss and revenue that fell short of estimates, hurt by weak advertising revenue and the impact of recent writers and actors strikes.

intuitive machines LUNR,

Stock rises 30% in pre-sale after space exploration company's Odysseus spacecraft becomes first commercial lander to successfully reach the moon.

block square,

It posted a surprise profit after the market closed on Thursday and shares of parent company Square jumped 13%. Booking Holdings BKNG,

The results were not well received and the stock fell 9%.

There were no notable US economic data points released on Friday. Even Fed officials appear to be taking a vacation from the chatter.

Best of the web

How German soccer fans took on investors and won.

As the penny stock trading frenzy takes hold, criticism of the Nasdaq is mounting.

How Wall Street banks struggled to maintain control of a lucrative but secret business.

Chart

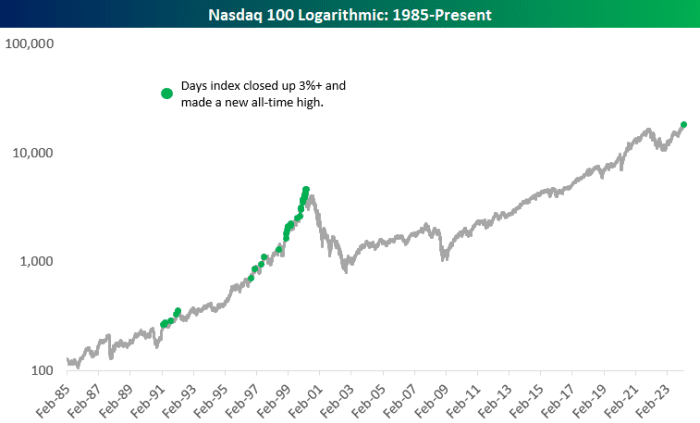

The Nasdaq 100 NDX jumped 3% to a new high on Thursday. The chart below from Bespoke Investment has green dots showing all the times it happened — the last time being 2/3/2000.

Source: Detailed Investment Group

“March 2000 was certainly not a good day for the Nasdaq to suddenly turn bullish,” says Besbock.

Highest indicators

Here are the most active stock market tickers on MarketWatch as of 6 a.m. ET.

|

tape |

Security name |

|

ran out, |

Nvidia |

|

TSLA, |

Tesla |

|

SMCI, |

Super micro computer |

|

Loner, |

Intuitive machines |

|

AMD, |

Advanced micro devices |

|

Camel, |

apple |

|

Amzan, |

Amazon.com |

|

New, |

New ADR |

|

Enough, |

Convoy |

|

Belter, |

Palantir Technologies |

Random readings

Predictable problems. MLB sheer pants.

It's a dog's life (not a very long one).

I love the smell of productivity in the morning.

“Need to Know” starts early and is updated until the opening bell, however Register here To be delivered once to your email inbox. The copy will be emailed at approximately 7:30 a.m. ET.