(Bloomberg) — Asian stocks and U.S. stock futures rose Thursday in a sign of new momentum in global stocks after Nvidia Corp. revealed a better-than-expected revenue outlook.

Most read from Bloomberg

Japanese shares rose, supported by a falling yen, with the Nikkei 225 briefly surpassing its record closing high in 1989. South Korean shares rose, while Chinese indexes opened higher and Australian shares erased early losses. These moves raised the region's stock gauge to its highest level in nearly two years.

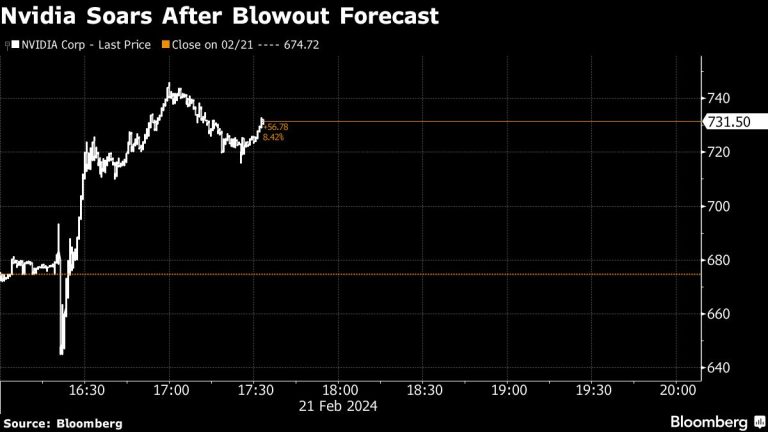

Nvidia's results spurred gains in US contracts during Asian business hours. Shares of the technology company rose as much as 11% in after-market trading after it said first-quarter revenue would likely reach $24 billion, above previous estimates of about $22 billion.

The results were expected to provide a catalyst for global stocks, and they delivered on the promise. Shares of Nvidia's Asia-based companies SK Hynix Inc and Advantest Corp rose, as did the index of semiconductor companies across the region.

“As is the case with Nvidia, so is the market,” said Kim Forrest, chief investment officer at Bokeh Capital Partners LLC. “And the results seem good enough. It confirms the narrative that AI will remain strong for the foreseeable future. This narrative supported the markets last year, so why not do the same this year?”

The gains in mainland China and Hong Kong indices followed new support for financial markets. The country has banned major institutional investors from reducing stock holdings at the open and close of each trading day, said an order from the securities watchdog to asset managers and major brokerage firms, according to people familiar with the matter. The regulatory body also intensified monitoring of short selling.

“Things are still not rosy,” Xiao Jiaqi, chief China economist at Credit Agricole, told Bloomberg Television. “Deflationary pressures are likely to persist for the rest of the year although they will be less pronounced compared to last year.”

The dollar index was slightly weaker on Thursday as the greenback fell against G10 currencies. The yen was largely unchanged at around 150 yen to the dollar. The won strengthened after the Bank of Korea left its key interest rate unchanged.

Treasuries stabilized in Asia after a sell-off on Wednesday that sent the 10-year bond yield up by five basis points. Selling pressure was being felt across the curve, and came on the heels of the sale of $16 billion in 20-year bonds and the release of Federal Reserve meeting minutes that revealed caution about cutting interest rates. Australian and New Zealand bonds tracked the declines.

Richmond Fed President Thomas Barkin highlighted persistent pricing pressures in sectors such as housing despite lower headline inflation. Meanwhile, Fed Governor Michelle Bowman objected to the prospect of imminent cuts.

Elsewhere, Qantas Airways Ltd said first-half profits fell as flight prices eased from their post-Covid high, as it made an underlying profit of A$1.25 billion in the first half before tax, down on the previous year, but lower than analysts had expected. United Overseas Bank Ltd.'s profits expanded. In the fourth quarter, supported by stronger fee income from wealth and credit cards.

Later Thursday, economic data scheduled for release includes euro zone inflation and purchasing managers' indexes, as well as initial US jobless claims and home sales.

WTI rose, extending a 1.1% gain on Wednesday, supported by tightening physical supplies. Gold settled at $2,027 an ounce. Bitcoin stabilized after Wednesday's decline to trade around $51,250.

Main events this week:

-

Eurozone Purchasing Managers' Index (PMI) for global services, S&P Global Manufacturing Index, and Consumer Price Index, Thursday

-

US Initial Jobless Claims and US Existing Home Sales, Thursday

-

The European Central Bank releases its January meeting account, Thursday

-

Fed Governor Lisa Cook and Minneapolis Fed President Neel Kashkari speak Thursday

-

Real estate prices in China today, Friday

-

Germany Ifo Business Climate, GDP, Friday

-

The European Central Bank publishes its one- and three-year inflation expectations survey on Friday

Some key movements in the markets:

Stores

-

S&P 500 futures rose 0.7% as of 10:50 a.m. Tokyo time

-

Nasdaq 100 futures rose 1.4%.

-

Japan's Topix index rose 1%.

-

Australia's S&P/ASX 200 index was little changed

-

The Hang Seng Index in Hong Kong rose 0.2%.

-

The Shanghai Composite Index rose 0.6%.

-

Euro Stoxx 50 futures rose 0.8%.

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

There was little change in the euro at $1.0828

-

There was little change in the Japanese yen at 150.31 to the dollar

-

There was no significant change in the yuan in external transactions at 7.1949 to the dollar

Digital currencies

-

Bitcoin fell 0.2% to $51,300.77

-

Ethereum fell 0.4% to $2,916.25

Bonds

-

The yield on the 10-year Treasury note fell 2 points to 4.30%.

-

The yield on 10-year Japanese bonds settled at 0.720%.

-

The 10-year Australian bond yield rose one basis point to 4.18%.

Goods

-

West Texas Intermediate crude rose 0.2% to $78.07 a barrel

-

Gold in spot transactions rose 0.1 percent to $2,028.39 per ounce

This story was produced with assistance from Bloomberg Automation.

Most read from Bloomberg Businessweek

©2024 Bloomberg L.P