Wendy's shares continued a post-earnings selloff on Wednesday, after a longtime bullish analyst recommended investors hold off on buying, citing concerns that price competition will intensify.

Fast food chain WEN stock,

Its shares fell 1.2%, posting a fourth straight loss in pre-opening trading, putting it on track to open at a 20-month low. The stock has fallen 6.8% in the three sessions since Wendy's reported fourth-quarter results, closing Tuesday at the lowest price since June 22, 2022.

JPMorgan analyst John Evanko lowered his rating on Wendy's stock to neutral, after being overweight for at least the past three years.

He also cut his price target to $19 from $22, saying the stock is “likely to remain range-bound” with competitive pricing and capital intensity.

Many of the fast-food industry's core consumer base is increasingly focused on value, with grocery prices now more than 4.5 percentage points cheaper than prices at limited-service restaurants (LSRs) like Wendy's, Evanko said.

Keep in mind that Walmart Inc.WMT,

Food prices have declined in areas such as eggs, apples and snacks, it said Tuesday in its fiscal fourth-quarter earnings report.

As a result, Wendy's and its competitors, such as McDonald's and MCD,

and Yum, a subsidiary of Yum Brands Inc.

Taco Bell has reverted back to pre-coronavirus strategies, including meal deals or individual menu items.

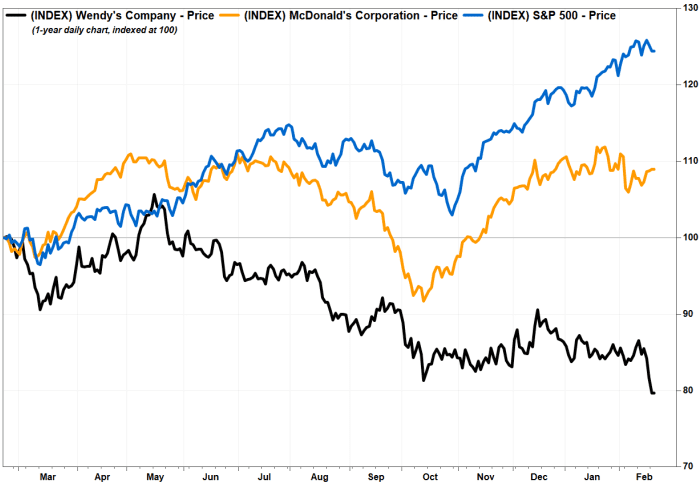

Wendy's stock continues to decline after earnings, and continues to underperform.

FactSet, Market Watch

Another concern is that the idea of a “calorie peak” may be sound after decades of expansion, with “COVID-era indulgence” matching the effects of anti-obesity drugs on caloric restriction.

Although Wendy's has sought to offer all-breakfast offerings, Evanko noted that it has not been able to “increase frequency” of breakfasts with its core customers. He thinks Wendy's goal of increasing day sales by 50% by spending $55 million on breakfast advertising seems “aggressive.”

is reading: Wendy's goes all in on its breakfast ads, believing that if you try it, you'll come back.

On the bright side, Ivanco spoke favorably of Wendy's stock's dividend yield, which stood at 5.56% as of Tuesday's closing prices.

This compares to McDonald's stock returns of 2.28%, Yum Brands' 2.00%, and Restaurant Brands International Inc.'s 2.00%.

of 3.04% and the implied return of the S&P 500 SPX of 1.44%.

With the downgrade, Ivanco is now part of the majority on Wall Street. Of the 28 analysts surveyed by FactSet who cover Wendy's, 20 were neutral, while seven were bullish and one was bearish.