With the price of Bitcoin now above $49,000 and other crypto assets surging, traders have entered a period of “extreme greed,” according to one expert. Known indicator Measure market sentiment.

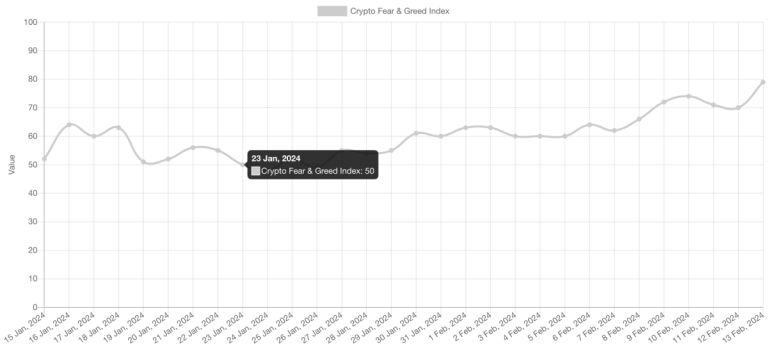

The Fear and Greed Index, published by data source Alternative.me, measures the market's enthusiasm for Bitcoin and other prominent digital assets. The last time the index reached a score of 79 out of 100 was when Bitcoin reached an all-time high of around $69,000 in November 2021.

“When investors become too greedy, it means the market is on its way to a correction,” Alternative.me said on its website.

It is a market axiom that smart traders prefer to buy when the indicator shows extreme fear, and that they become more cautious when greed is highest. But, of course, this may not be the case.

The index has been routinely above 70 (the “greed” threshold) since October last year. It fell to the 50 level following the approval of Bitcoin ETFs in January, which initially turned out to be a “news selling” event.

The price of Bitcoin has doubled in the past 12 months. On this day last year, one coin was worth US$21,000, and yesterday its price briefly rose above US$50,000. The price fell slightly to $49,400 at press time.