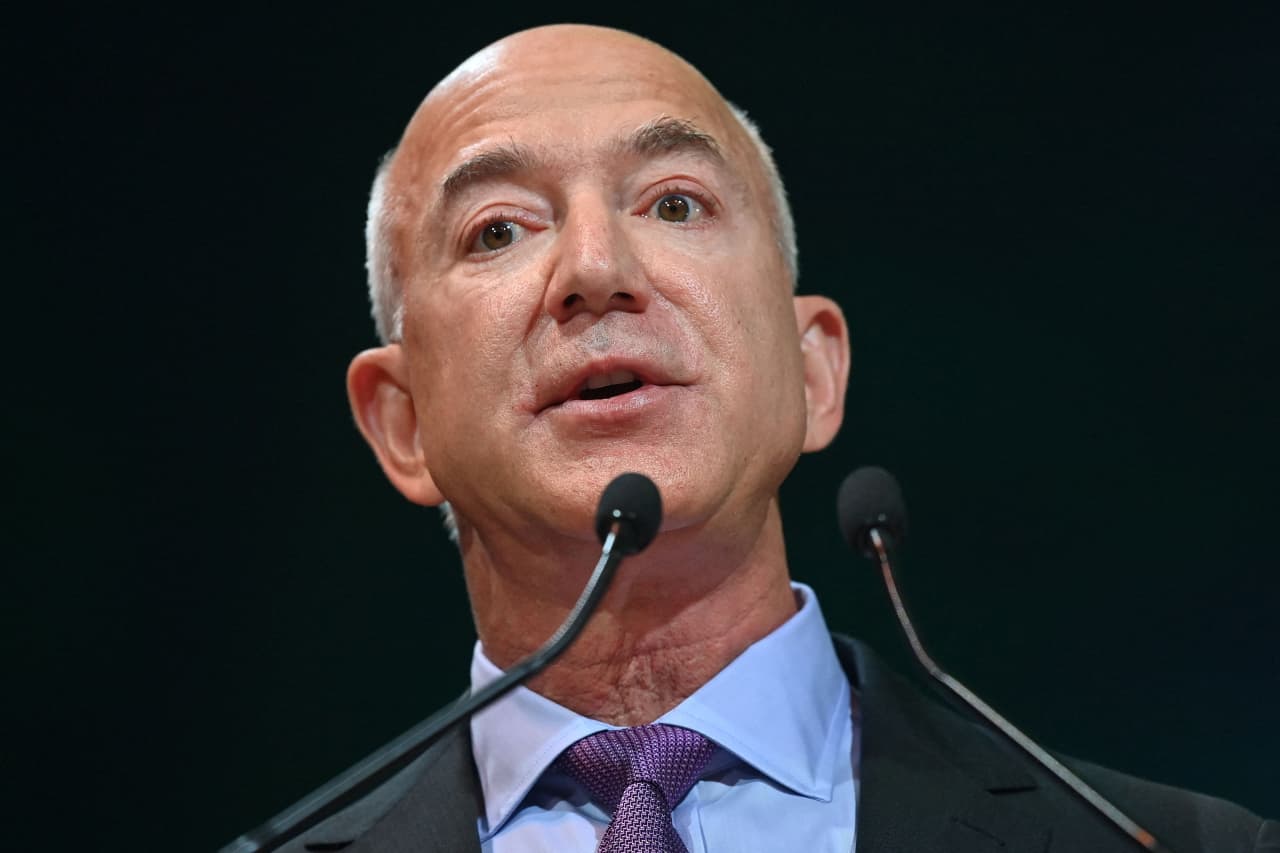

Jeff Bezos, founder and CEO of Amazon.com, continues to sell stock, selling another $2 billion as part of the trading plan.

A new filing with the Securities and Exchange Commission on Tuesday shows that Bezos unloaded an additional 12 million shares of Amazon (AMZN) stock,

Through a series of transactions on Friday and Monday. He disposed of about the same amount in the selling round last Wednesday and Thursday, an earlier Securities and Exchange Commission report noted.

The most recently revealed sales took place at prices between $170.61 and $175.34.

See more: Jeff Bezos just sold $2 billion worth of Amazon stock. This doesn't mean you should sell either.

Bezos' $4 billion in transactions came as part of a 10b5-1 trading plan, which was set up to allow company insiders such as board members and executives to sell stock when predetermined conditions are triggered. It adopted its current plan in November 2023, although Amazon revealed it in its tenth statement earlier this month.

With the current plan, Bezos could sell up to 50 million Amazon shares by the end of January 2025. Ben Silverman, previously vice president of research for VerityData, noted that Bezos would likely focus sales over several days rather than spreading them out over weeks or months. . Based on review of previous selling activity.

Silverman noted that Bezos' February sales were his first since November 2021. He offloaded 60 million shares that year after unloading 80 million in 2020.

See also: Nvidia closes with a higher market cap than Amazon for the first time since 2002

Inside sales, even those conducted through 10b5-1 plans, can sometimes be useful to investors looking for places where executives and board members want to sell. But Silverman said after Bezos' first $2 billion sale this month that past selling activity has not proven to be a good indicator of how Amazon stock will continue to perform.

An Amazon spokesperson did not immediately respond to MarketWatch's request for comment on the latest transactions.