Tuesday's CPI data appears to have beat some expectations on Wall Street and stock futures are seeing a sell-off. The result: An overshoot could dash hopes for a May rate cut and trim the S&P 500 SPX by 5,000 points. Today is a young man.

is reading: Arm's frenzied stock rally continues as AI chase outpaces valuation.

What could eventually cause this market to fall? our Call of the day Russell Clark, a former hedge fund manager, points to Japan, an island nation whose central bank is one of the last bastions of loose monetary policy.

Note that Clark bailed on his RC Global Fund in 2021 after wrongly betting against stocks for a decade. But he has a whole theory about why Japan is so important.

In his sub-article, Clark claims that the real trigger for the bear market will come when the Bank of Japan ends its quantitative easing program. To begin with, he says we are in a “pro-labor world” where a few things are bound to happen: higher wages, lower unemployment levels, and higher-than-expected interest rates. In line with his forecast, real assets began to rise in late 2023 as the Fed began shifting to easy monetary policy, and the yield curve began to steepen.

From that moment on, everything didn't match up so easily. It was thought that rising short-term interest rates would pull money out of speculative assets, but then the money flowed into cryptocurrencies like Tether and the Nasdaq fully recovered from the 2022 rout.

“I've been thinking about the idea that semiconductors are the new oil — and therefore becoming a strategic asset. That explains the rise in the Nasdaq and Nikkei to some extent, but it doesn't explain Tether or Bitcoin very well.”

So, back to Japan and his unpopular explanation for why financial/speculative assets continue to trade so well.

“The Fed had high interest rates throughout the 1990s, and the dot-com bubble developed anyway. But during that period, the Bank of Japan finally raised interest rates in 1999 and then the bubble burst.

He points out that when Japan started tightening interest rates in late 2006, “everything started to go downhill,” adding that the Bank of Japan’s short-lived attempts [to] The 1996 interest rate hike can be blamed for the Asian financial crisis.

In Clarke's view, the markets appear to have moved more with the Japanese banks' balance sheets than with the Fed. He points out that the Bank of Japan “invented” quantitative easing in the early 2000s, and the subprime mortgage crisis began shortly after that liquidity was removed from the market in 2006.

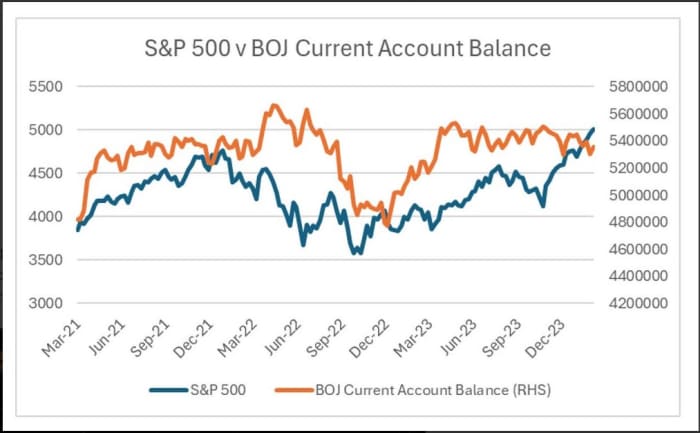

“For long-time investors, Japan's loose monetary policy also explains the bubble economy of the 1980s. “The BOJ's balance sheet and the S&P 500 have a good correlation in my book,” he said, providing the chart below:

Capital Flows and Asset Markets, Russell Clark.

This also helps explain why higher bond yields don't really impact assets, Clark says. “As Japanese government bond yields rose 10%, the Bank of Japan committed to unlimited purchases to keep them below 1%,” he points out.

The big takeaway here? “The Bank of Japan is the only central bank that matters…and we need the US to be bearish when the Bank of Japan raises interest rates. Given the movements in bond markets and food price inflation, this is a question of… Time,” he said, adding that in light of his plans to set up a new fund, “a bear market would be very beneficial for me.” He is watching the Bank of Japan closely.

Markets

US stock futures ES00,

NQ00,

The declines continued as consumer prices rose 0.3% in January and core prices rose 0.4%. The two-year yield on BX:TMUBMUSD02Y rose 14 basis points.

|

Performance of key assets |

last |

5d |

1 m |

YTD |

1y |

|

Standard & Poor's 500 |

5,021.84 |

1.60% |

4.98% |

5.28% |

21.38% |

|

Nasdaq Composite |

15,942.55 |

2.21% |

6.48% |

6.20% |

34.06% |

|

10 year treasury |

4.181 |

7.83 |

11.45 |

30.03 |

42.81 |

|

gold |

2,038.10 |

-0.17% |

-0.75% |

-1.63% |

9.33% |

|

oil |

77.14 |

5.96% |

6.02% |

8.15% |

-2.55% |

|

Data: Market Monitor. The change in Treasury yields expressed in basis points |

|||||

Buzz

beeogen baby,

The stock fell on disappointing results and a slow rollout for Alzheimer's treatment. There is a bug that also affects Krispy Kreme DNUT,

my coca cola,

Revenue is on the rise. Hasbro has stock,

declines due to loss of profits, while Shopify SHOP,

It also decreased after the results.

jetBlue JBL U,

It rises after billionaire activist investor Carl Icahn disclosed a stake of close to 10% and said his company is discussing possible board representation.

stock trip on tripadvisor,

It rose 10% after the travel services platform said it was considering a potential sale.

For the first time, Russia placed the Prime Minister of Estonia on the “most wanted” list. Meanwhile, the US Senate approved aid to Ukraine, Israel and Taiwan.

Best of the web

Why will chocolate lovers pay more this Valentine's Day than they have in years?

A startup wants to harvest lithium from America's largest saltwater lake.

Online gambling transactions reached nearly 15,000 per second during the Super Bowl.

Chart

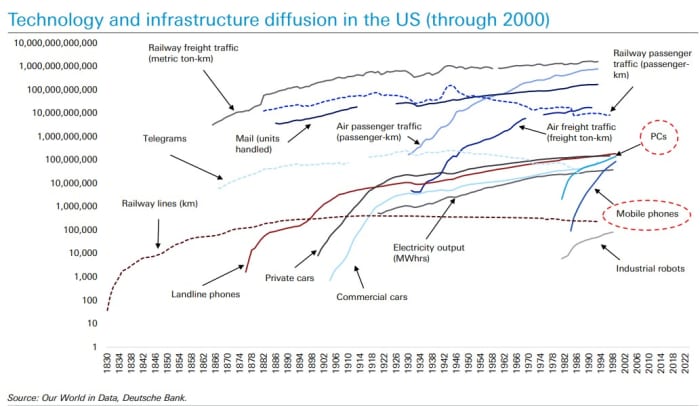

Deutsche Bank has taken a deep dive into the power of the Seven Wonders, and why they will continue to matter to investors. one reason? Nearly 40% of the world's population still does not have access to the Internet, as the bank's graph shows:

Highest indicators

These were the most searched indicators on MarketWatch as of 6 a.m

|

tape |

Security name |

|

TSLA, |

Tesla |

|

ran out, |

Nvidia |

|

arm, |

Holding arm |

|

Belter, |

Palantir Technologies |

|

New, |

New |

|

imc, |

AMC Entertainment |

|

Camel, |

apple |

|

Amzan, |

Amazon.com |

|

Mara, |

Digital Marathon |

|

TSM, |

New |

Random readings

Everyone wants this exotic bag.

Lying on text? Get your free dumplings.

Dog Messi steals the Oscars spotlight.

Love and millions of flowers stop in Miami.

“Need to Know” starts early and is updated until the opening bell, however Register here To be delivered once to your email inbox. The copy will be emailed at approximately 7:30 a.m. ET.

paying off Monitored by MarketWatcha weekly podcast about the financial news we're all watching — and how it affects the economy and your portfolio.