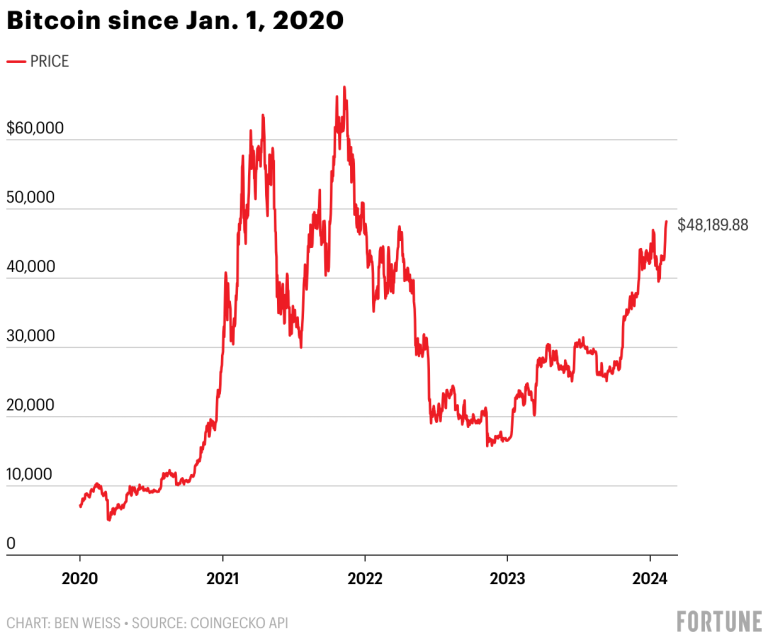

Bitcoin surpassed $50,000 on Monday for the first time since December 2021, according to CoinGecko data, suggesting that confidence in the digital currency is growing after two turbulent years of scandals and bankruptcies.

Thanks to inflows into exchange-traded funds, speculation about future monetary easing, and the upcoming halving, “the tailwinds for digital assets are the strongest they have been in some time,” said Christopher Newhouse, a decentralized finance analyst at Cumberland Labs. luck.

Bitcoin fell 64% in 2022, hitting lows of $16,000, partly due to the FTX collapse. But over the past 12 months, it's up about 129% — although the price is still below the all-time high of around $69,000 reached in November 2021.

When the Securities and Exchange Commission approved 10 Bitcoin ETFs on January 11, individual and institutional investors gained exposure to Bitcoin without having to hold the underlying asset. The merging of traditional finance with digital assets, with companies like BlackRock and Fidelity launching funds, has been hailed as a watershed moment for cryptocurrencies.

But despite expectations that new retail and institutional investors would fuel the bull market, Bitcoin initially looked volatile.

The disappointing impact of the SEC's approval on Bitcoin prices was largely caused by outflows of more than $6 billion from the decade-old Grayscale Bitcoin Trust, which operated as a closed-end trust and had previously locked up investors who… They are now free to liquidate, according to Bloomberg. The GBTC exodus helped push prices to $39,505, with BTC down nearly 15% since the approval date.

But it is now clear that outflows are slowing, and prices are rising again. In the first few weeks of trading, daily outflows averaged $500 million, but have been declining steadily since January 26. On Friday, outflows totaled just $51.8 million, according to Bloomberg data, the lowest level since the approvals.

Meanwhile, flows into the other nine ETFs have accelerated: Last week, cumulative net inflow was about $1.2 billion — nearly half of the total so far.

“This strong pressure in the buy zone is driving prices higher, and this is the main driver of recent growth,” said Matteo Greco, research analyst at investment firm Fineqia International. luck.

If ETF inflows continue at this pace, gaining nearly $1 billion weekly, “bitcoin will go higher every day,” said Jeff Kendrick, head of digital assets research at Standard Chartered Bank.

Moreover, the Fed has indicated that interest rates will be cut in the spring, which “provides another tailwind for Bitcoin prices,” said Markus Thelen of 10X Research. luck. During periods of rising interest rates, riskier assets such as Bitcoin, which are highly liquid and more volatile, tend to be less attractive.

Meanwhile, Dave Nadig, a recent financial futurist at VettaFi, attributes the growth to inherent optimism ahead of the April halving, where miners take the financial rewards by halving, thus reducing supply, while forcing smaller miners out of the market.

“The halving gives everyone a reason to care about bitcoin,” he said. luck. “There is a mechanical reason why we expect the number to be higher, which is that supplies are disconnected.”

In fact, a bull market followed each of the previous four halving events. When the first happened in November 2012, the price of Bitcoin was around $12. One year later, it had risen to more than $1,000. BTC was at $8,755 at the time of the last halving in May 2020 before making a mad dash toward $69,000 the following year.