Blockchain technology appears to be losing momentum as more and more institutional traders lose confidence in the technology, a recent survey by JP Morgan showed.

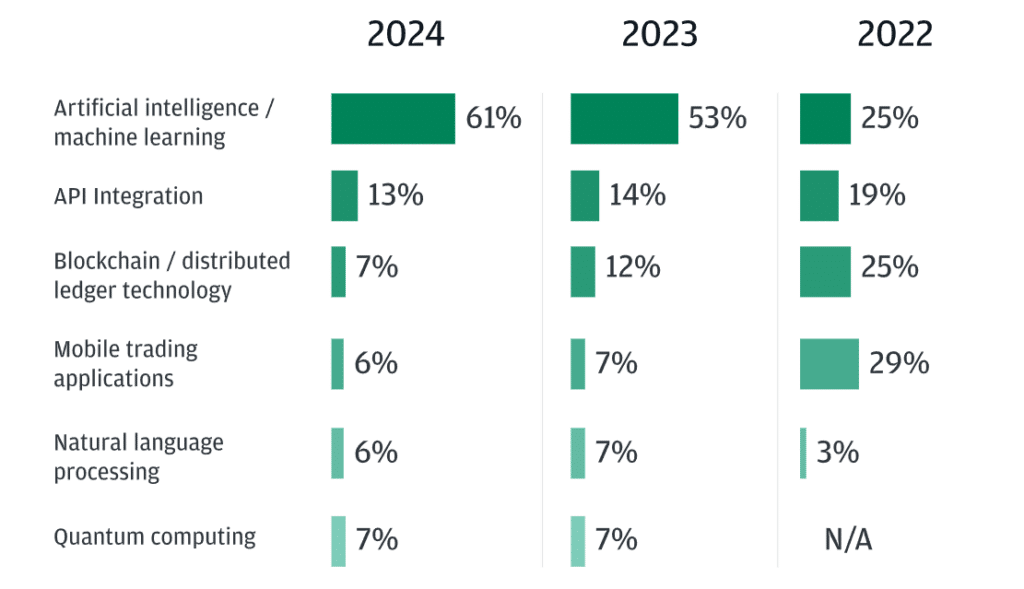

According to a recent survey conducted by JP Morgan among more than 4,000 institutional traders, a worrying shift in trust can be observed, with only 7% of respondents maintaining confidence in blockchain technology as a potential asset over the next three years.

This number represents a significant decrease of 72% from 2022 when 25% of respondents considered blockchain technology to be a promising technology. Despite this decline, blockchain technology still ranks third in terms of prospects, behind API integration (13%) and AI/ML (61%).

Regarding cryptocurrencies, the survey found that 78% of participants had no plans to trade digital assets, while 9% said they were already involved in crypto trading. In addition, 12% of respondents are considering entering the cryptocurrency market within the next five years.

It appears that the bottom is not in sight, as Galaxy Digital reported in the third quarter of 2023. Both the number of completed trades and the total capital invested represent the lowest numbers for blockchain and cryptocurrencies since the fourth quarter of 2020. Analysts at Galaxy Digital noted that and continue to The VC fundraising environment is very challenging, but “it could get better.”

As of Q3 2023, the market saw $1 billion raised by venture capitalists, marking the first rise since the decline began in Q3 2022. Additionally, new fund launches increased to 15 funds from 12 In the second quarter. However, according to the firm's research blog, average fund sizes have declined significantly from their highs during the recent bull run.