introduction

We live in a highly digital world, but most of humanity still uses physical goods to store value. The most widely used store of value in the world is real estate. It is estimated that approximately 67% of global wealth is in real estate. But more recently, macroeconomic and geopolitical headwinds have highlighted the vulnerabilities of real estate as a physical store of value. What to do if war breaks out? What happens if a house that was used as a store of value is destroyed?

In German, the word “estate” translates to “Immobilie”, which literally means “to be immobile”. Owning property creates local dependency that can be a problem in a world of increasing conflict and extremism. In the event of war, you cannot take property with you and it can be easily destroyed.

This may seem like a harsh reality, but I think if you are serious about long-term wealth management, you should consider the worst-case scenario and the potential global impact.

War and destruction of wealth

Since the beginning of the twenty-first century, war has not cost humanity so much money. More than 238,000 people were killed in the conflict last year. Syria, Sudan, Ukraine, Palestine, Israel, Lebanon – global sources of conflict are growing. Some of these areas have already suffered massive destruction. There are no more properties there, and the value stored in them has literally disappeared It evaporated. It is difficult to imagine the financial setbacks people had to endure, apart from the suffering and grief that war brings.

Real estate is used as a store of value all over the world, although there are some exceptions, such as Japan. As the threat of destruction increases, the fruits of the labor of millions, perhaps billions, of people are at stake. Along with inflation and taxes, the destruction of material wealth has historically been one of the greatest threats to overall prosperity. Already in ancient times, armies mercilessly plundered cities and destroyed the inhabitants' property.

Physical store versus digital store of value

Fortunately, with Bitcoin there is a solution to the threat of destroying wealth stored in physical assets. As a near-perfect mobile digital store of value, it is difficult to destroy and easy to move.

The introduction of Bitcoin in 2009 challenged the role of real estate as humanity's preferred store of value, as it represented a better alternative that allowed people around the world to protect their wealth with relative ease.

You can buy very small denominations of Bitcoin, the smallest being 1 satoshi (1/100,000,000 of a Bitcoin) for as little as ≈ $0.0002616 (as of 12/2/2024). All you need to store it securely is a basic offline computer and a BIP39 key generator — or just buy a hardware wallet for $50. In case you need to move, you can save 12 words, the backup (seed phrase) to your wallet, and “take” your bitcoin with you.

Digitization

Digitization improves almost all value preservation functions. Bitcoin is rarer, more accessible, cheaper to maintain, more liquid, and most importantly allows you to move your wealth in times of crisis.

Bitcoin is wealth that truly belongs to you. With the threat of war looming around the world, I believe it is better to keep wealth in digital assets like Bitcoin rather than physical assets like real estate, gold, or works of art, which can easily be taxed, destroyed, or confiscated.

Confiscation of property

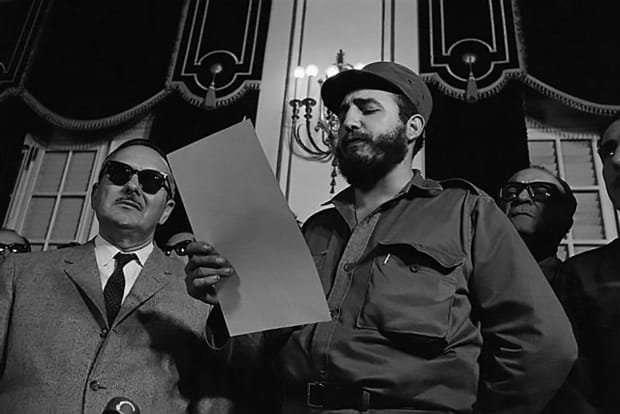

If we look at history, it is clear that physical stores of value have made people vulnerable to government abuse. A historical example of this is the expropriation of Jewish property in Nazi Germany. Unfortunately, these repressions were not an isolated case in history. It happens all the time. Many lost their property in Cuba when Fidel Castro took power, as Michael Saylor likes to point out.

These painful lessons of history underscore the importance of protecting wealth in digital assets like bitcoin, which are difficult to confiscate, tax or destroy and easy to transfer.

Macroeconomic changes

Additionally, shifts in the macroeconomic landscape can cause real estate values to decline rapidly. Usually, real estate is purchased through a loan. Therefore, higher interest rates translate into lower affordability of financing, which leads to lower demand and consequently lower real estate prices. We can see this scenario playing out globally right now, as the combination of increasing interest rates and falling demand is contributing to a decline in property values around the world.

Bitcoin vs real estate

Bitcoin is less affected by problems in the traditional financial system than real estate. Because it works independently of the system. Variables such as interest rates, central bank decisions, and arbitrary government actions have a limited impact on Bitcoin. The price is mostly determined by supply, release schedule, and adoption rate.

Bitcoin follows a deflationary model that involves a gradual decrease in supply over time until a maximum is reached in 2140. About every four years, the Bitcoin awarded to miners for successfully requesting transactions (every 10 minutes) is halved.

The upcoming halving, scheduled for Friday, April 19, 2024, is expected to halve the block reward from 6.25 BTC to 3.125, which translates to a daily issuance of 450 BTC instead of 900.

Currently, Bitcoin's annual inflation rate is around 1.8%, and is expected to decline to 0.9% after the next halving. After that, the inflation rate will be almost negligible. In addition, a large number of Bitcoins have been lost and we can expect to lose many more in the future. The continued decline in finite supply increases deflationary pressure on the Bitcoin network. As more people (and machines) use Bitcoin, increasing demand is met by decreasing supply.

This very strong deflationary movement cannot be observed in the real estate sector. Although real estate is also scarce due to the limited supply of construction land, there is no fixed maximum. New building land can be developed and zoning laws can, for example, enable higher floors to be built.

Absolute scarcity

For most people, it is difficult to imagine the impact of a fixed supply on the price of an asset. Before Bitcoin, there was no concept of an inherently scarce commodity. Even gold has elastic supply. Increased demand leads to more intensive mining efforts, a flexibility that does not apply to Bitcoin.

Thus, with every halving event, which indicates a decrease in supply, the price of Bitcoin rises and continues to do so permanently. This permanent increase continues as long as there is corresponding demand, a possibility attributed to Bitcoin's exceptional monetary properties.

This dynamic is expected to continue even in the midst of the global economic crisis. The supply of Bitcoin will continue to decline and the price will likely continue to rise. Due to the ongoing demand expected in times of crisis, he explained. Even inflation can have a positive impact on the price of Bitcoin because it leads to an increased availability of fiat currencies that can be invested in Bitcoin.

Conclusion

In a world of increasing extremism and a financial system in deep crisis, Bitcoin is emerging as a better option for storing value, especially during periods of macroeconomic volatility. Bitcoin is expected to rise in importance during these turbulent times, potentially overtaking real estate as humanity's preferred store of value far into the future.

The ambition is for an increasing number of individuals to recognize the benefits of Bitcoin, not only to preserve wealth, but, in extreme circumstances, to secure their livelihoods.

0A79 E94F A590 C7C3 3769 3689 ACC0 14EF 663C C80B

This is a guest post by Leon Wankom. The opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.