While regional bank stocks continue to fall on the turmoil attacking the Community Bank of New York, their bonds are holding up — suggesting that bondholders view the New York central bank's problems as isolated.

NYCB at NYCB,

The only publicly traded bond fell last week as its shares lost more than 40% of their value after the bank reported a surprise quarterly loss and revealed problems with its commercial real estate loans. The company also reduced its dividend to build capital to meet regulatory requirements.

The stock is now down about 60% for the year to date, and its bonds are trading at about 75 cents on the dollar after Moody's Investors Service downgraded its credit rating to junk status.

On Thursday, DA Davidson downgraded the stock to neutral from buy and said it was trading “unconstrained by fundamentals.”

Analyst Peter Winter cut his price target on the stock to $5 from $8.50 following the rating downgrade and the company's disclosures about rising deposits and its plans to hire a new chief risk officer in the near future.

The bank confirmed that both its chief risk office and chief audit executive had left the bank, triggering unhappy memories of the Silicon Valley bank and its collapse in March 2023. That bank also did not have a chief risk officer when it was hit by a deposit run last year that sent Shock waves through the regional banking sector.

New York Commercial Bank raised its loan loss reserves by 790%, or $490 million, in the fourth quarter, the most of any regional bank — though other banks also made significant increases, MarketWatch's Steve Gelsey reported.

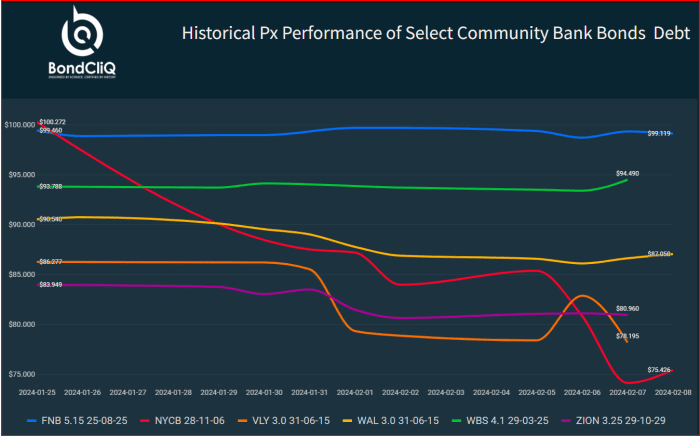

The following chart from data solutions provider BondCliQ Media Services shows how selected community bank bonds have performed over the past two weeks, with variable-rate NYCB bonds due 2028 showing the most dramatic decline.

do not miss: New York Community Bancorp is looking to sell rent-regulated commercial properties after a surprise quarterly loss

Those bonds actually rose by about 5 basis points on Thursday, as the chart indicates.

NYCB is affiliated with Valley National Bancorp's VLY subsidiary,

The 3.0% bond, due June 2031, fell to 78 cents on the dollar. The bank, which operates as Valley Bank, is a regional lender headquartered in Morristown, New Jersey, with assets of approximately $61 billion.

Historical price performance of selected community bank bonds.

Bond Click Media Services

As the chart shows, other junior lenders' bonds remained steady as New York Mercantile Bank bond selling rose. These companies include Western Alliance Bancorp.

The Phoenix-based bank had assets of $70.9 billion as of December 31. Zion Bancorp Na Zion,

a Salt Lake City-based bank with assets of $87.2 billion; First National Bank of Pennsylvania FNB,

and a Pittsburgh-based bank trading under the name FNB Corp. With assets of $34.74 billion; Webster Financial Corporation WBS,

It is a bank headquartered in Stamford, Connecticut, with assets of $74.95 billion.

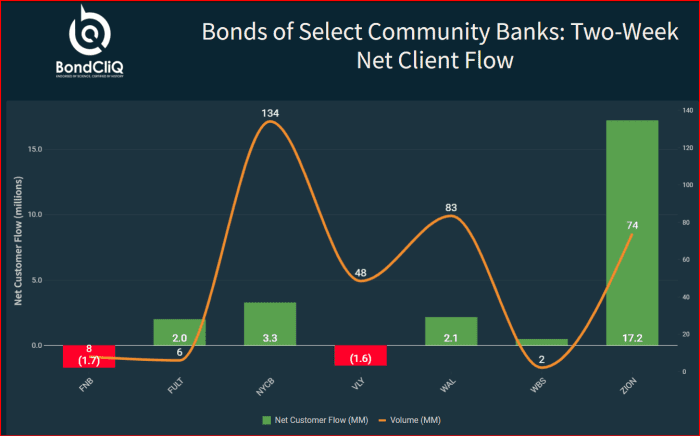

Bonds have also seen net buying over the past two weeks, even as drama unfolds at the Bank of New York.

Two-week net customer flows bonds from selected community banks.

Bond Click Media Services

“The bond market seems to think this is an isolated problem and there is no contagion,” one market source told MarketWatch.

SPDR S&P Regional Banking ETF KRE,

The ETF tracking the sector fell 0.3% on Thursday and is down 11% year to date, while the S&P 500 SPX is up 4.6%.