A prominent cryptocurrency analysis firm warns that digital asset markets may be about to witness a corrective move.

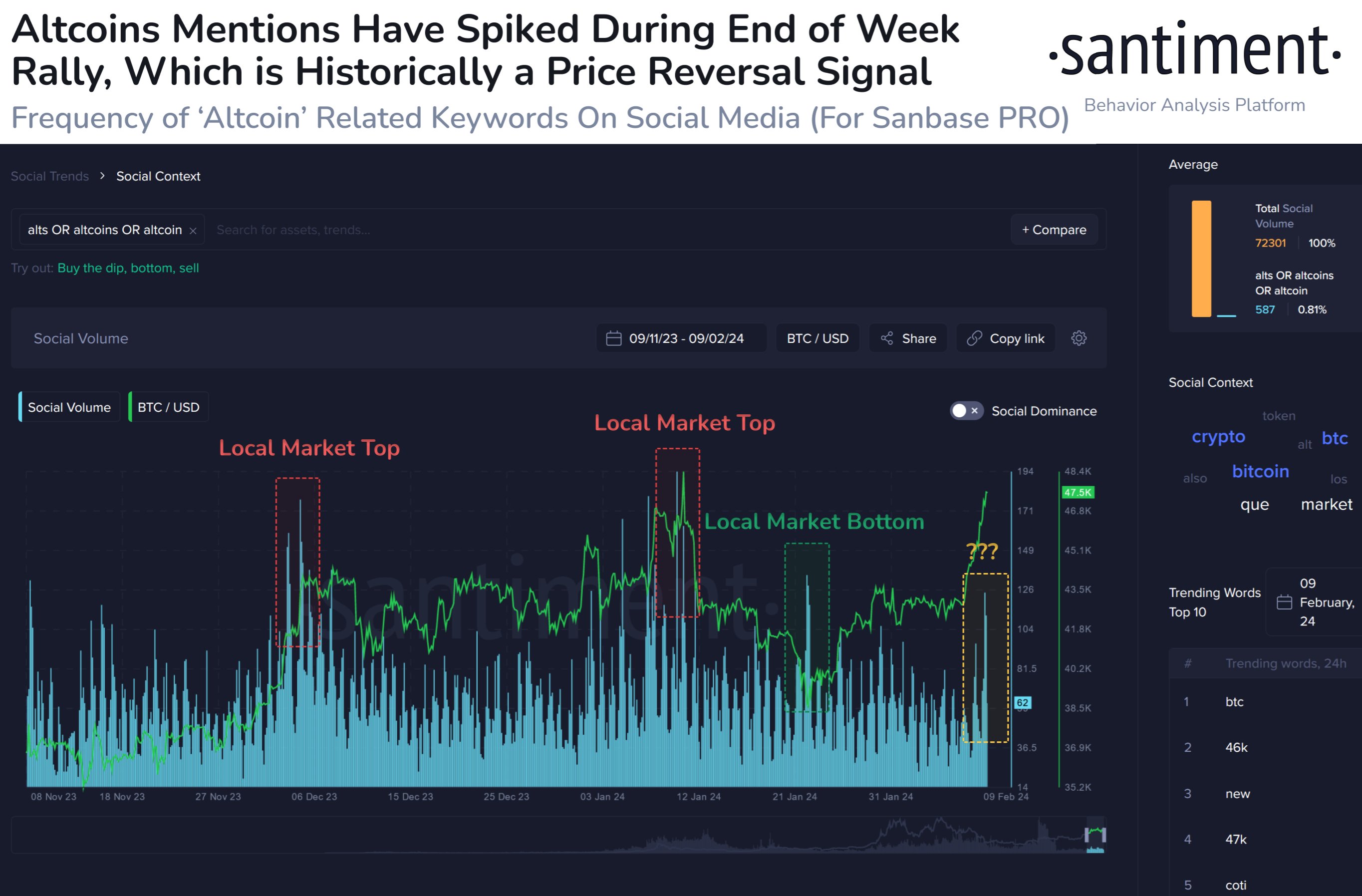

Santiment says on social media platform X that interest in altcoins has increased in the past few days amid a market-wide rally.

According to the analytics firm, mentions of the terms “alt,” “altcoins,” and “altcoin” suddenly spiked in social media chatter by the end of last week, suggesting that traders are showing signs of exuberance.

“With the overall crypto market cap up this week (+5.9%) and volume up (+65.4% vs. the previous week), interest in altcoins has risen. When this happens during a price surge, it can be a sign of greed.

The analytics firm also says that the broader cryptocurrency markets appear to be following an uptrend that began in October — the month in which Bitcoin (BTC) and altcoins began seeing a rally to the upside.

With signs of greed emerging in the markets, Santiment warns that a rebound period could be on the horizon for Bitcoin and altcoins.

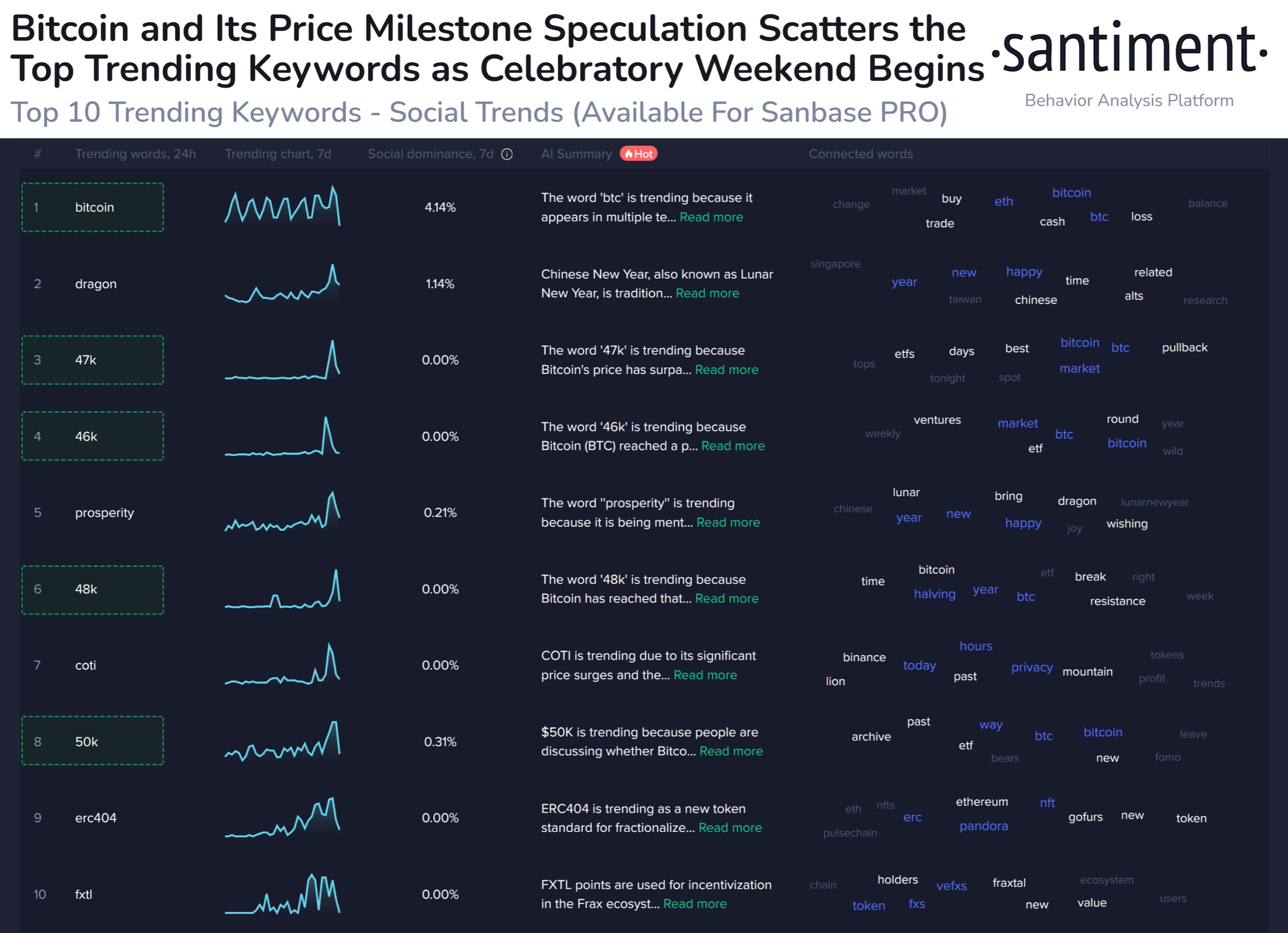

“Bitcoin's +13% price rise last week has traders speculating on several new support and resistance landmarks, with $50,000 widely expected. Ironically, as these price levels were surpassed, altcoins flipped the script in the holiday opening hours The end of the week as the public became overly focused on the BTC price.The trend throughout the bull cycle that started in October has been:

- Bitcoin has an isolated pump, and the crowd is in control of Bitcoin

- Profits are distributed to altcoins, and the public gets greedy

- Bitcoin price declines slightly, and swing season ends more radically.

Watch how the public responds to this second step of the cycle this weekend, and whether open interest levels on speculative alternatives will start to rise. If so, Step 3 will likely come quickly.

At the time of writing, Bitcoin is trading at $48,196, up 1.41% over the past 24 hours.

Never miss an opportunity – sign up to get email alerts delivered directly to your inbox

Check price action

Follow us TwitterAnd Facebook and Telegram

Browse Hodl's daily mix

Disclaimer: The opinions expressed in The Daily Hodl are not investment advice. Investors should conduct due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Long Quattro/Baio Sodekin