US stocks have just accomplished something that hasn't been done since President Richard Nixon was still occupying the White House.

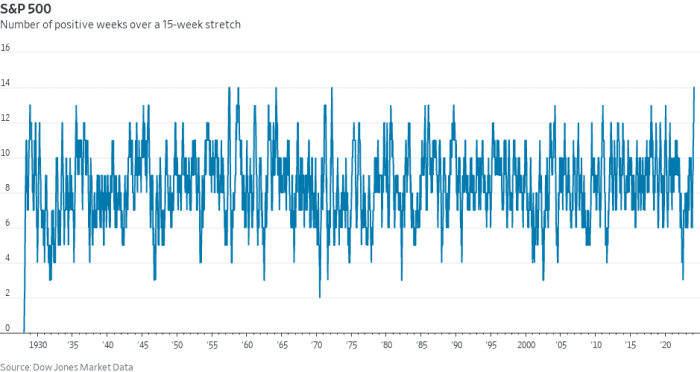

The S&P 500 SPX has risen for the 14th week out of 15 on Friday. According to Dow Jones Market Data, the last time the large-cap index recorded a comparable stretch of weekly gains was March 10, 1972. This marks the 13th time it has happened since the index's inception in 1957.

DOW JONES MARKET DATA

However, investors don't need to look far back to find a precedent for the magnitude of the index's rise over this period. The S&P 500 has risen 22.1% over the past 15 weeks as of Friday's close, the largest 15-week advance since a 22.5% gain during the period that ended Aug. 28, 2020, Dow Jones data show.

See: S&P 500 reaches 5,000 for the first time. Here's what it means for the market.

The index closed above 5,000 for the first time on Friday, its 10th record close of the year, according to Dow Jones data.

To be sure, the S&P 500 isn't the only major US equity index to score a historic winning streak on Friday. The Nasdaq Composite COMP also climbed for the 14th week out of 15 as well.

In the case of the Nasdaq, investors don't need to look quite as far back for precedent: the last time the tech-heavy index landed a winning streak of this magnitude was a 15-week stretch that ended on Aug. 8, 1997.

For the Dow Jones Industrial Average DJIA,

which barely managed to eke out a gain for the week on Friday, it marked the first time this has happened since May 12, 1995. Winning streaks like this one have only occurred 14 times since the index was created in the late 19th century.

For the Nasdaq, it was only the sixth time since its inception that it reached such a milestone. One example was a 15-week winning streak that ended on March 10, 1972.

US stocks have seen a powerful rally since hitting their most recent near-term bottom in late October, when the S&P 500 touched what was then its weakest level in five months.

The No. 1 factor that has driven markets higher during this period has been the Federal Reserve pivoting away from hiking interest rates, and toward holding them steady, or possibly cutting them later this year, according to Chris Zaccarelli, chief investment officer at Independent Advisors Alliance.

“The main reason the market has gone higher over the past 15 weeks has been the Fed pivot, the idea that the Fed is done raising interest rates to be on pause or cutting them. I think that's a big catalyst for the rally that we have seen,” Zaccarelli said.

Zaccarelli also cited the surprising strength of the US economy as another factor contributing to stocks' success over the past year.

“A recession never happened last year, and it doesn't appear that it will be happening any time soon. I think that's one of the big reasons we've had a rally over the last 14 months, let alone the last 15 weeks,” he added.

US stocks finished mostly higher on Friday, with the exception of the Dow. But all three major indexes finished with weekly gains. Even the Russell 2000 RUT,

Which has struggled in the new year, finished the week in the green. The S&P 500 closed 28.70 points, or 0.6%, higher at 5,026.61, according to FactSet data, bringing its weekly advance to 1.4%.

The Nasdaq Composite closed 196.95 points, or 1.3%, higher at 15,990.66, clocking a 2.3% advance for the week. Meanwhile, the Dow Jones Industrial Average finished down 54.64 points, or 0.1%, at 38671.69, leaving it with a weekly gain of less than 0.1%.

The Russell 2000 gained 30.29 points, or 1.5%, at 2,009.99, finishing 2.4% higher on the week.