“Junk spreads” are abnormally low right now, and this increases the risk of an impending recession. An unwanted spread is the difference between the yield on high-yield corporate bonds and US Treasury bonds with similar maturities. This spread represents the additional return that investors require to compensate them for the additional risk of investing in junk bonds rather than Treasuries.

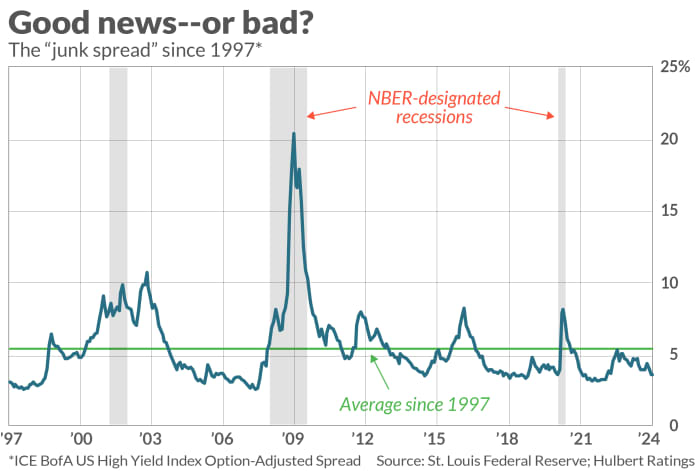

The difference currently stands at 3.5 percentage points, well below its average since 1997 of 5.4 percentage points, as shown in the chart above. This means that investors believe that economic risks are abnormally low at the moment, which is not surprising given the widespread consensus that the US Federal Reserve has executed a soft landing well.

However, as Humphry Neale, the father of paradoxical analysis, reminded us, “When everyone thinks alike, everyone is likely to be wrong.” Contrarians believe that the low current spread represents an overabundance that will correct itself in the coming months.

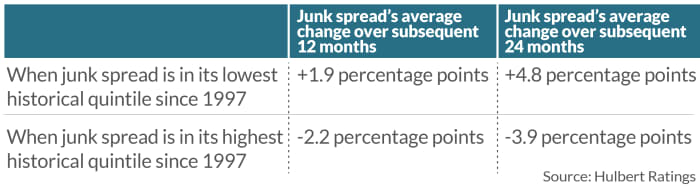

History provides strong support for this contradictory belief, as the table below shows. The reported results are based on one of the market's standard methods for measuring spread, the ICE BofA US Options-Adjusted High Yield Index.

The differences shown in the graph are significant at the 95% confidence level that statisticians often use when determining whether a pattern is real. The spread of junk currencies is currently at a historical low, represented by the first row of the chart, which is why contrarians conclude that there is a high risk of a recession. Increases in the prevalence of unwanted goods of 1.9 to 4.8 percentage points over a one- to two-year period would not only reflect increased economic risks, but would also contribute to this increase.

“The junk bond spread has greater explanatory power over the one- to three-year horizon.“

A contrarian indicator in the long term

Thus, contrarians must add unwanted variance to the set of sentiment indicators they focus on when assessing investors' moods. One advantage this indicator has over most other indicators is that its greatest explanatory power is in the long term. Most other sentiment indicators tell you little about the market beyond a one- to three-month horizon. In contrast, the junk bond spread has greater explanatory power over the one- to three-year horizon.

On the one hand, you may find some solace in this longer explanatory horizon, because it means that the recession does not have to start in the next few months. On the other hand, this analysis suggests that the risk of a growing recession will not go away anytime soon.

This does not guarantee a recession, of course. But it may be entirely consistent with the contrarian theory for a recession to begin just as the market is celebrating a soft landing.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to audit them. It can be reached at mark@hulbertatings.com.

more: “Breadth of a bad stock market” makes even strong bulls nervous

Read also: Here's what to expect from stocks in February after January's big rally